Volume growth drives improvement in revenues

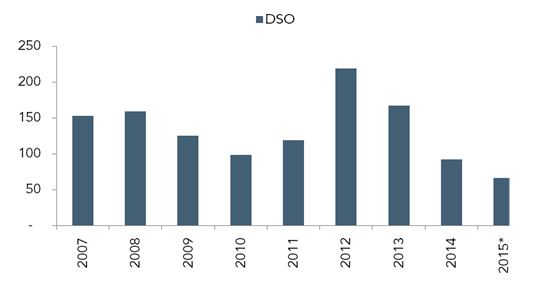

- Dangote Flour Mills Plc (DFM) released unaudited results for 3 months ended December 2014 wherein revenues rose 28% YoY to N10.67 billion, 7% higher than our forecasts, marking the second consecutive quarterly rise in revenues. DFM links the sustained improvement to volumes, which given the subdued pricing environment and declines in receivable days outstanding (-28% YoY to 67days) points to increasing geographical diversification of revenues away from the North. On this wise, we note previous DFM management guidance which hinted at the prospect of flour sales to other Nigerian subsidiaries of parent company Tiger Brands (UAC foods and Deli biscuits), which possibly explains the continued expansion in top-line.

Figure 1: Days of Sales Outstanding

Source: Company’s financials, ARM Research *Annualised FQ1 15 figure

Softer wheat prices underpin gross margin expansion

- FQ1 15 COGS tracked slower than revenues (+20.2% YoY to N9.5 billion), leading to gross profits more than doubling to N1.2 billion. Improvement reflects tamer input costs with mean wheat prices contracting 16% YoY during the quarter and helped drive a 5.5pps YoY expansion in gross margins to 10.9%.

Naira devaluation drives wider operating loss

- In line with the declining pattern over FY 14, opex contracted 20.5% YoY to N2.2 billion with a corresponding 12pps YoY decline in opex-to-sales at 19.8%. Aided by other operating income (FQ1 15: N6.4 million; FQ1 14: nil), pro-forma operating loss contracted 57.3% YoY to –N935 million. Adjusting for the impact of USDNGN devaluation which DFM estimates at N1.29 billion, operating losses are 1.5% higher YoY at N2.23 billion.

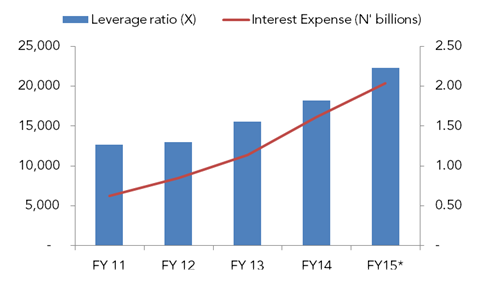

Figure 2: Opex-Sales ratio

Source: Company’s financials, ARM Research

- FQ1 15 finance costs rose 10.2% YoY to N762 million largely driven by 48.5% YoY surge in ST borrowings to N31.77 billion amid 56% YoY decline in LT borrowings to N3.76 billion. Consequently, FQ1 15 pre-tax loss and post-tax loss widened, rising 10.3% and 12% YoY to N2.99 billion and N2.92 billion respectively.

- Given subdued consumer income and tight competition in the milling industry, trends in volumes should continue to underpin revenue trajectory. The sustained improvement in top-line suggests new management is making inroads in its re-structuring program for DFM which has seen the moth-balling of some plants. Whilst commodity price outlook remains benign, risk of further devaluation remain a key source of earnings compression over the rest of FY 15.

- DFM trades at a current P/B of 2.36x vs. a mean of 2.89x for its Bloomberg African peers. Our rating for DFM is currently under review.

Source: ARM