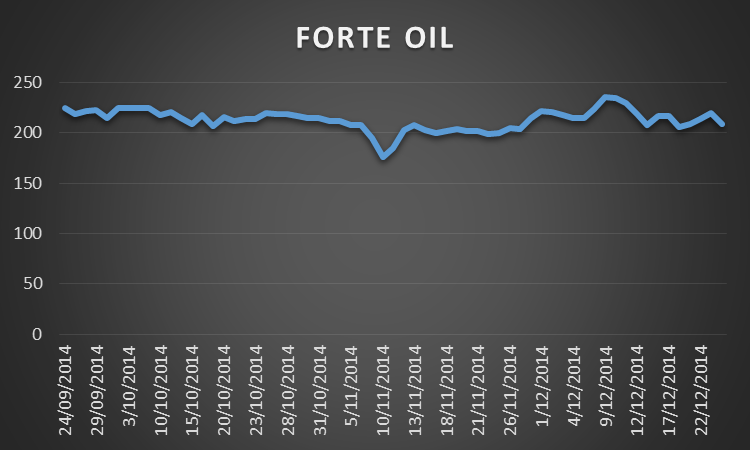

Nigerian stocks have had a volatile last 8 weeks as it rides on a wave of boom and bust that has seen the All Share Index drop to under N10trillion in market cap between Dec 16th and 18th and rising above N13tr again in 5days. All of these have taken place in December alone. Despite this fact, one stock to a large extent remains resilient to the bear trap. Forte Oil has remained on a straight line refusing to tank territories not seen since 2013. Here is the chart;

Whilst most stocks hit their multiple one year lows this month FO at worst dipped below N200. Forte Oil has a year low of N82.4 which it touched back in January. Whist most NSE 30 stocks took a pounding, FO only dropped to N175 on November 10 before roaring past N200 again. So what is the reason for this considering that the company hasn’t really dazzled that much fundamentally?

Many guys I have spoken to believe its the ‘Otedola Effect’. The belief is majority owners of the stock will not allow it free fall like maybe the likes of FBNH or Seplat would. Otedola owns directly and indirectly 6% and 19% of the equity of the company respectively as at December 2013. That is a combined 25% plus holding. Nevertheless, it is not enough for the stock to be immune to a massive sell offs, considering that Dangote Cement which is 95% owned by Aliko Dangote hit multiple year lows this period. Could this then be some of manipulation of the stock or just perhaps a strong technical resistance that somehow shields the stock from sliding uncontrolled. Whatever the case, it’s still the Otedola Effect.

Hello Boss, pls how come Dangote owns 95% of Dangote Cement when the rule for publicly listed companies is that at least 25% of the company should be offered to the public but he offered only 5% in his case and was still allowed to list? Pls reply. Thanks. Ur doing a fine job here Boss. I read ur blog everyday and I appreciate u a lot. I also fflw u on twitter. Cheers!

Hi,

I believe Dangote has an exception to that rule that should expire this year. It has been one controversy that has overshadowed the company for a while now. Lets hope things change from next year. Cheers

Ok thanks. It also seems Dangote’s listing of DangCem on London stock exchange has been paused cos of his reluctance to relinquinsh @ least 25% equity to d public and also d structure of d board of directors unlike seplat who just came yesterday and did a dual listing on nse and lse without time wasting cos d board is balanced and ova 25% of equity is publicly offered??