Many who have looked at the Nigerian Budget over the last decade will usually point to the disproportionate allocation of funds between recurrent expenditure and capital expenditure. It typically gives the impression that the main problem with Nigeria is how we spend. The presidential and legislative arms of the government always appears to be wasteful and poor at optimally allocating scarce resources. Whilst that is true, I do believe that the main problem with Nigeria is revenue. We just do not have the financial muscle other countries have. For a country as big as Nigeria, we have not been able to cross the N5trillion mark in Federally allocated revenue and have remained stuck in N10trillion as Federally Collected Revenue. I thought the best way to put this into better perspective will be to compare our fiscal expenditure to that of other MINT (Mexico, Indonesia, Nigeria and Turkey) countries. I also included South Africa for a more closer comparison to an African country.

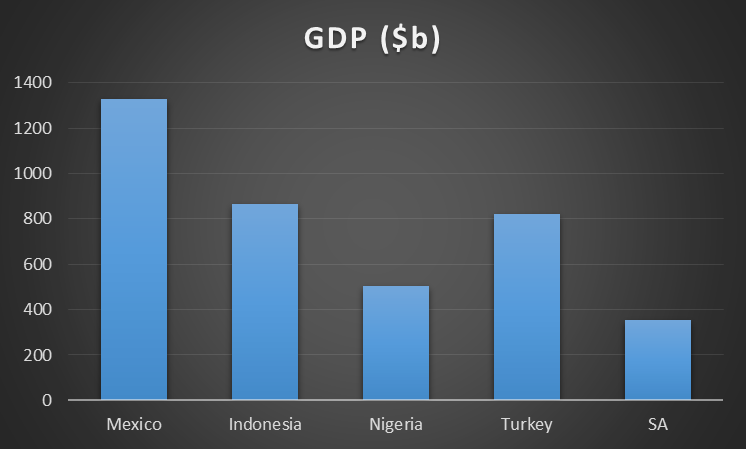

First off is to look at the GDP of MINT countries

Nigeria has the lowest GDP of the MINT countries and is higher than South Africa

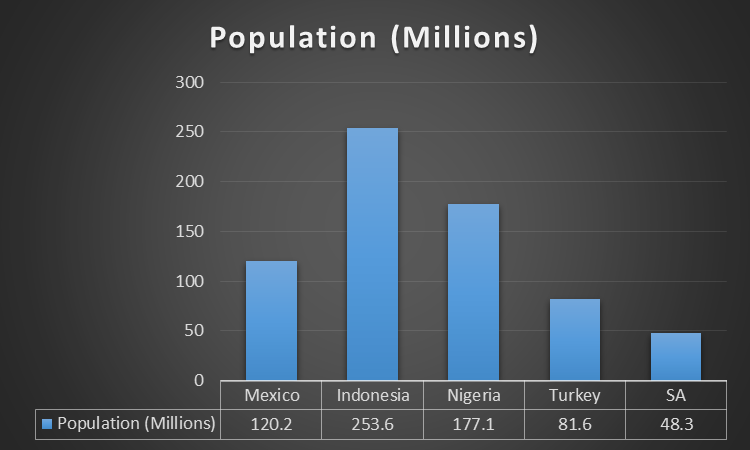

GDP Per Capita

Nigeria ranks very low in GDP per capita as our relative population size to economic output shows just how poor we are as a nation compared to the rest including South Africa.

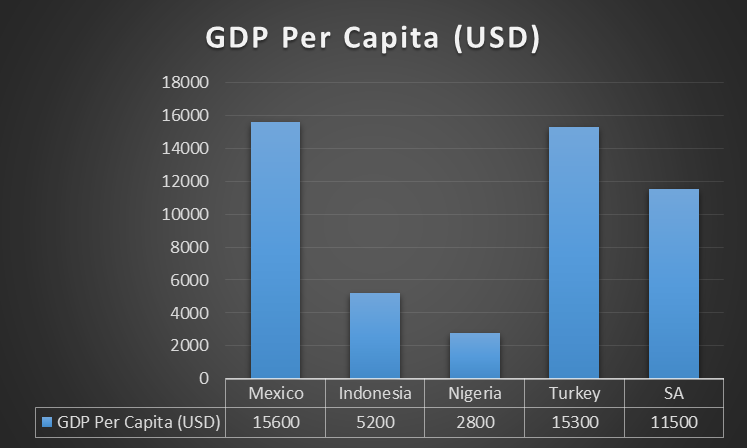

MINT Budget

As mentioned, Nigerian budget is very small relative to our size as a country. Our revenue base is pretty small because we rely solely on oil to fund governance and infrastructural developments. Nigeria can never ever develop at this level of income. The MINT economies including South Africa by far surpasses Nigeria in terms of revenue and expenses.

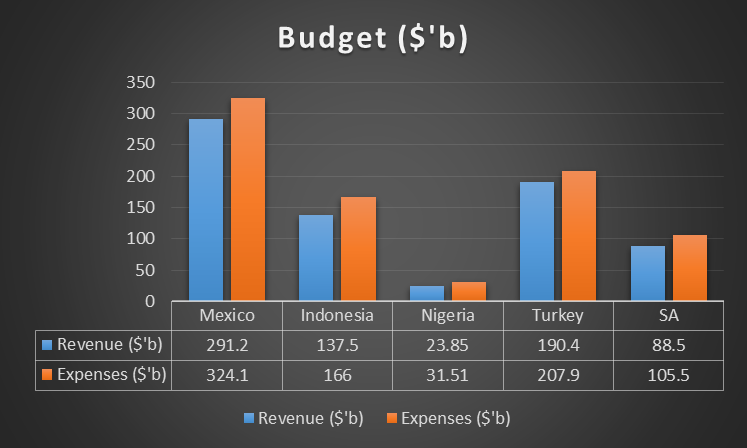

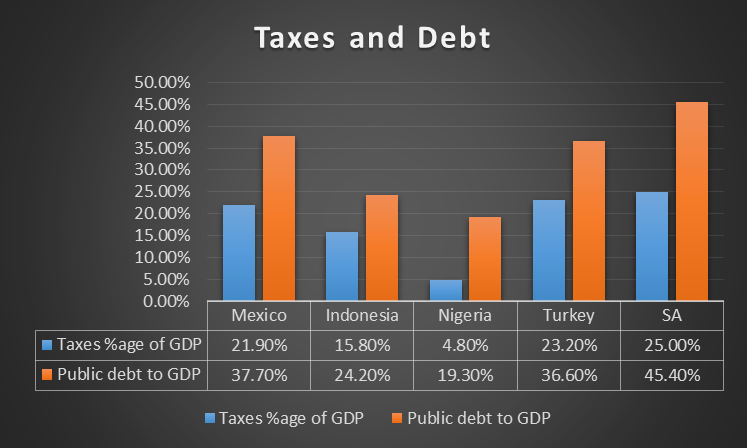

Tax to GDP

Tax as a percentage of GDP emphasizes the need to rely on taxes as a major source of funding government programs. Nigeria generates very little from non-oil taxes. By our estimates, Company income taxes, VAT and Custom Duties contributes about 25% of actual Fiscal revenues of the Federal Government. This is a very small contribution and is nowhere close to the potential of the country. Taxes at 4.8% of GDP is dwarfed heavily by other MINT countries which are in the double digits. Whilst we are poor with revenue collection we are also very fiscal conservative in the debt markets at least compared to other MINT countries. Nigeria’s public debt is still at 19% of GDP giving us ample room to borrow more.

If Nigeria is to achieve its infrastructural and industrialization goals then the numbers above will have to improve. It should also rely less on oil but on taxes to fund the government expenditure. It should start by privatizing NNPC and giving states more control over their resources.

If we compair our revenues as a percentage of debt, Nigeria is in pretty bad shape

Compare…..