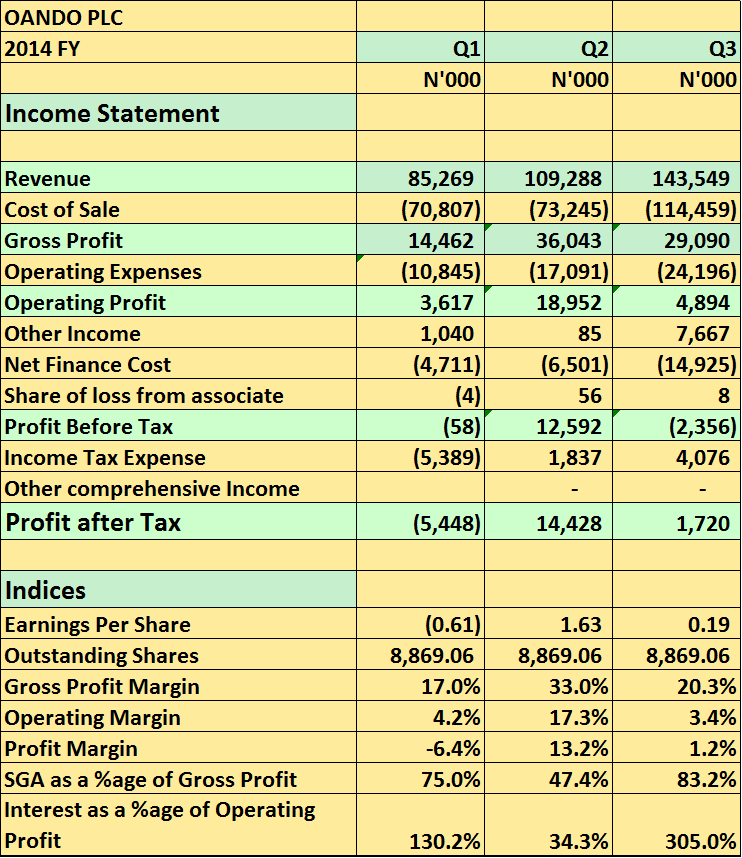

Oando Plc released its 2014 9 Months results showing profit after tax rose on a year on year basis by 75% to N10.7billion. This increase was propelled by a massive cut in cost of sales which dropped 24% to N258.5billion year on year. Even though revenue dropped year on year this period the cut in cost of sales was strong enough to boost margins. Despite this seemingly impressive year on year results, looking at it from a quarter on quarter (qoq) basis reveals a more dire situation for the company. The company it will seem posted a pre-tax loss for the quarter making astonishing the year on year somewhat paradoxical.

key highlights (Third Quarter)

- Revenue rose this quarter to N143billion about 31% higher than Q2 and 68% higher than Q1 results

- Cost of sales however ballooned to N114billlion topping Q1 and Q2 figures. It is currently unclear why they will incur such a huge cost this quarter except offcourse it is a one off item which is unlikely. With their planned exit from the downstream sector, one expected this cost to remain below N80billion a quarter. The last time Oando did over N100billion in cost of sales was in Q2 of 2013 when it posted about N142billion. However, one could understand that it was a major downstream player at the time.

- Operating expenses also rose by N7billion quarter on quarter to N24billion. Whilst I didn’t see a break down of this cost I suspect the company is taking in huge amortization cost such as depreciation and other write offs arising from the COP deal.

- Other income rose by over N7.5billion to help boost the company’s bottom line even though it did little to stop Oando from posting a third quarter loss before tax. The third quarter loss falls squarely on the back of rising cost of sale, operating expenses as well as finance cost all of which topped prior quarter figures. At N14.9billion Oando incurred in finance cost more than what it incurred in Q1 and Q2 of the same year combined. Finance cost is now over 200% higher year on year and just a few millions shy of the N15billion it posted in the whole of 2013

- Oando’s Balance sheet also ballooned to N995billion up 68% from a December 2013 and 51% from the first 6 months of this year. That aroused interest and a look at the results showed about N344.7billion was recorded as Intangible Asset by the company. I suspect the Intangible Asset arose out of the acquisition of COP asset and will constitute mostly goodwill.

- The problem however is that goodwill can easily be impaired under IFRS considering the continuous fall in oil price which surely would have impacted on the future earnings and value capacity of the COP asset.

- 2014 9 Months will probably have Q3 N4billion tax write backs to thank for ensuring they ended the quarter in profits and also help profits surge over 75% higher than 2013 9 months. Without the taxes year on year growth would have been just 4% and this quarter would have been an outright loss for the company.

- Oando shares dropped 0.23% to N21.88 at the end of the trading Monday November 17th 2014

Oando 2014 Q1 to Q3 Results