Sometime in August I received a message from one of my readers informing me that he was thinking of liquidating his portfolio. He opined that with the impending elections, the stock market will probably be bad for investors and as such will be a bad time to hold equities. In September another friend and reader sent me a message that he had instructed his stockbrokers to sell his shares. The market was on a free fall he warned and advised me to exit as soon as possible. By then, oil prices were beginning to fall and investors were becoming agitated about the repercussions. The Nigerian All Share Index retreated for week before bouncing back as the earnings season approached.

By October, most banks finalized plans to meet the capital adequacy requirements imposed by the CBN either via equity raise or mergers. Results also started trickling in as investors watched in earnest for an indication of how the financial year will end for most companies. And then came November! Oil price will dip to under $85 and the US announced it was stopping bond buying. Crisis in the North Eastern part of Nigeria will take a dangerously new dimension and the crisis in Eastern Europe and the middle east reached a new height. The Nigerian president will announce his reelection plans shortly after his potentially biggest opponents announced theirs.

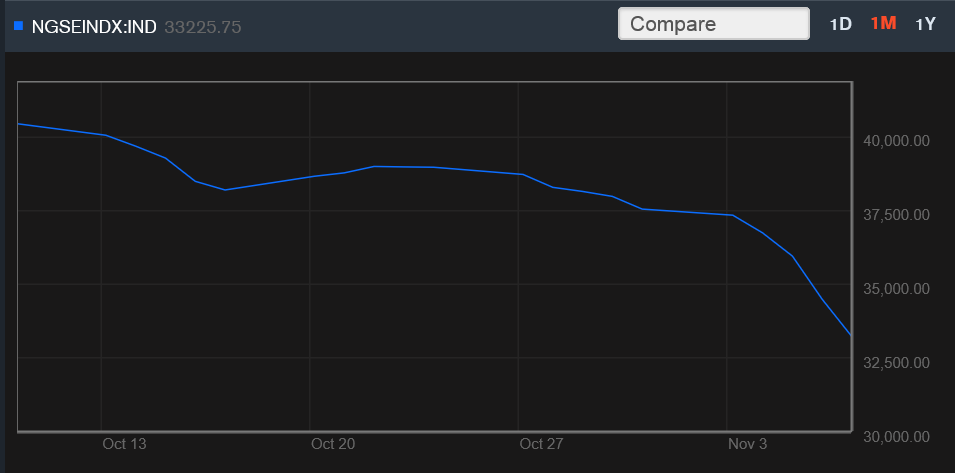

What will follow is the beginning of a sudden decline in the stock market prices of immense proportions and one that is unlikely to end anytime soon. Foreign investors, institutional investors, retail investors are all selling in droves driving the all share index down 3.7% in 12 days to November to 33,225.75, the longest losing streak since 2009. The Nigerian stock exchange has now lost 23% from its year high of July 9 making it the largest retreat of value in the world this year according to Bloomberg. And this many feel is just the beginning.

I looked at my portfolio and my personal loss was staggering for a week. I was down about 17% at a frightening pace. I instinctively sent an email to my stockbroker to sell stocks that still had gains and those I felt were a bit overvalued. And then I paused to ask myself a question every long-term value investor must ask in times like these. Why is the stock market crashing. I came to the following conclusions.

Fall in Oil Prices

It’s no nuclear physics how the price of oil is directly related to the Nigerian economy. The Nigerian Government depends on Oil for about 80% of its revenues. As such, with Oil price crashing to a four-year low this month and its lowest weekly decline in 13 years, the negative effects on government revenue next year is telling. If the prices continue to trend downwards as most predict, Nigeria will have no choice than to lower its benchmark crude oil price from $78 to probably $60. This could mean the government may have to borrow more to finance its projects thus widening the deficits or impose steep cuts which will cause massive pain to an economy that is struggling to survive already. Investors believe this is a bad sign for Nigeria and if oil prices continue to drop many industries will suffer and lose money leading to loss of value for investors.

Exchange Rate

With Oil prices dropping further, it also means that Nigeria will earn far fewer dollars that it would have had oil prices remained above $100. As such, the reserves which the CBN uses to defend the Naira will be under pressure until they have no choice than to depreciate the naira. If this happens foreign portfolio investors will lose money so rather than wait they prefer to cut their losses early leading to a massive sell off. Ironically, as they sell shares and convert the proceeds to dollars there is more pressure on the naira helping it to depreciate further. The naira hit its 3 year low last week as well to N172.5 at the interbank before rallying back after the CBN intervened.

2015 Elections

The 2015 elections is set to become the most important and closely fought election in Nigerian history. With insurgency increasing , defection increasing and rhetoric getting more vile, uncertainty has become the order of the day. The market hates uncertainty and will always place a high premium when it appears. Being a riskier form of investment, many investors are fleeing the stock market for a relatively safer treasury bills and bonds, sending margins further down.

Weak results

As results trickled in this month, many companies reported lower year on year earnings per share. Consumer goods companies saw margins drop as rising insurgency in the north and in cohesive competition bit harder on profits. The financial sector groaned amidst tighter CBN regulations seeing many earn less than what they potentially could. Typically, weaker earnings result in short-term sell-offs as investors strive to seek alpha as much as they could.

Liquidity in some stocks

A closer look at the stocks that have lost the most sell off in this round of sell offs is liquidity. Despite some of the company still having sound fundamentals and cheap valuations, the market seem undeterred in their desire to throw the baby and the bath water away. Right now, even the cheapest of all stock is not immune so far as there are willing buyers. The more liquid a stock is the easier for it to be flogged. A chunk of the NSE 30 (most capitalized) stock is liquid due to their large traceable floats and so a sizeable dip in the index will affect the wider market.

Is this 2009 Market crash again?

I have also wondered if this crash bears any similarity to 2009 which from records is still the biggest ever loss of value in the Nigerian stock exchange. From about 50,000 points the all share index dropped to about 20,000. History will point fingers at too much cash fuelled by margin lending (from newly consolidated banks) and a massively overvalued market. In 2009, stocks had an average P.E ratio of 25x even though most of their earnings were questionable and backed up by weak corporate governance, overseen by careless regulators and patronized by greedy investors.

2014 in my opinion is a different proposition. This sell of is driven by FEAR. Regulations are stronger, company profits are better scrutinized and margin lending is next to none. The reasons I mentioned above, if history serves as a guide points to fear which could be realised or unrealized.

Is this an opportunity?

Fellow long-term investors who I frequently share ideas with in a Whatsapp group for retail investors see this as a once in a life time generational shift in wealth. With N1billion one can acquire significant equity stakes in many quoted companies. When I say many, I mean companies that have sound fundamentals and post billions in profits. In fact, at this rate most stock will have an earnings yield of over 15% and gross dividend yields averaging 10%. To put this into better perspective, if you bought Guinness shares in 2013 when the price was N280 your dividend yield was 2%. A dividend yield of 5% will raise many large cap share prices to the roof. Today Guinness is trading at below N160. This is an incredibly huge opportunity, not just for those with N1billion but for retail investors with a long-term value seeking approach to stocks. Even short-term growth investors seeking huge returns within 1 to 2 years also have an opportunity to make money.

All of this off course depends on FEAR and your ability to conquer it. Nigeria survives 2015 (which I think it would) and you sit on a pile of value. The opposite happens and you stand to lose all your investments. It also depends on timing and your ability to determine whether to buy now or wait in the hope that the prices will fall further, n the hope that whichever decision he takes is correct.

Like Warren Buffet will say, he is greedy when the market is fearful and fearful when the market is greedy. If your greed pays off amidst this fear your reward will wait for you on the other side of 2015 when the market will be waiting to buy from you.

Well write up. Every thing you said about the stock market is correct.

I am still thinking of 3 fundamental stock to invest in, despite the recent happenings.

Doc.Ugo I love your site so much,i am intoxicated with your site because it is rich and give you great insight into the Nigeria Stock Exchange.

very valid