Access Bank rights issue in the offing?

We met with management of Access Bank last week and below are our key takeaways

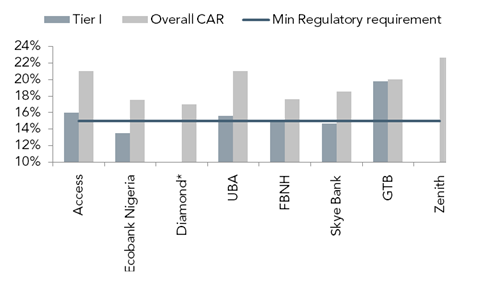

- Tier 1 capital ratio at 16% is testing regulatory limits as Access Bank is classified as a Systemically Important Financial Institution (SIFI)

- Thus, Access is looking to approach the market for Tier I capital possibly by Q4 14

- Estimated size is between ~N60 – N70Billion (mechanics still in the works)

- This would bring CAR to ~22% CAR (Tier 1), supporting -20 to 25% YoY – loan growth over the next 3 years.

- Management guided to no moderation in dividend payout policy.

Beaming the searchlight on our coverage suggests further capital raising possibly along Tier I lines. This follows a raft of Tier II capital raisings which saw some of our coverage banks (Zenith, FBNH, Access, Ecobank and Diamond) collectively raise $1.8billion thus far in 2014.

Figure 1: SIFI

Source: Various Bank Presentations, ARM Research

Figure 2: Non-SIFI

Source: Various Bank Presentations, ARM Research

Following Diamond’s N50billion rights issues and current moves by Access focus shifts to UBA, FBNH and Skye (with GTB and Zenith being well capitalized). For Ecobank, a likely equity injection from Nedbank appears to be driving tamer scope for tapping domestic equity markets.

In contrast to equity raising by top-tier banks, with most second tier banks in our coverage above regulatory CAR requirements, a theme across conference calls was the likely raising of Tier II capital possibly spurred by the August 2013 circular on Exclusion of Non-Distributable Regulatory Reserve and Other Reserves in the Computation of Regulatory Capital of Banks and Discount Houses which sees:

- Exclusion of regulatory risk reserve from regulatory capital for the assessment of capital adequacy.

- The exclusion of collective impairment on loans and receivables, and other financial assets from tier II capital,

- The recognition of audited other comprehensive income reserve as tier II capital and the restriction of tier II capital to 33.33% of total tier I capital.

This has resulted in local currency debt raising announcements by Stanbic (N30billion) and FCMB (N12-20billion) for H2 2014.

Near-term, we expect sector performance to stay largely flat for the rest of the year as banks seek to meet capital adequacy requirements for Basel II which should see capital raising activity over H2 14.

Author: Wole Layeni, ARM Securities Ltd