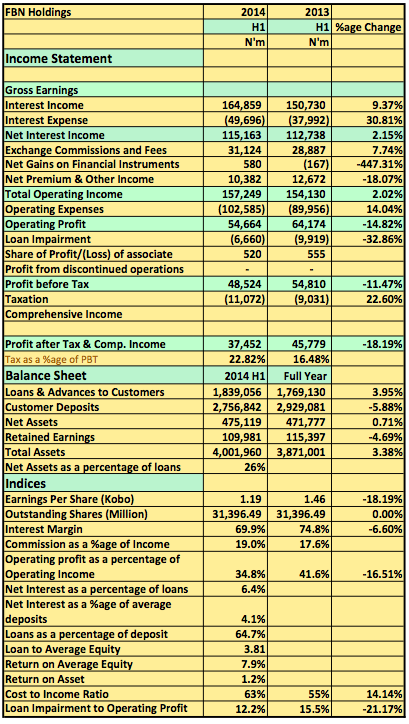

FBNH released its 2014 half year results last week and not too many will be happy with the outcome. The share price soon dropped to N14.4 having opened the week at N15.7. Whatever you make of this announcement, one thing is for sure, FBNH is till posting profits and billions of them for that matter. At N48.5billion in profits in the last two quarters of the year combined, you have to admit that is quite significant. What then is the problem? FBNH is not making as much money as it used to do and hasn’t posted a profitability growth well, since the second half of 2013 if you look at it on a year and year basis.

Ironically, pre-tax profits have seen a haphazard growth in the last 6 quarters hitting a high of N31billion in Q1 2013 and a low of N15.2billion in Q3 of the same year. This last two quarters they recorded N24.7billion and N23.7billion in pre-tax profits. So what then should I look out for with this contraption of a HoldCo Bank? A few things come to mind for me which I will always take a closer look at.

- Gross Interest Income – The bank’s ability to stay above 70% in Net interest margin on a quarter on quarter basis is very key to its ability to grow margins and post profits. Banks have suffered in this area lately due to regulatory infractions as such I expect it will take time for them to consolidate their models to suit the new reality. Surely though, FBNH can’t afford to fall below 70% for too long.

- Income from commissions & other sources – This is a key area for the bank and one that I have also watched closely for other banks. In fact, some banks have had to rely on this to boost profits as operating expenses often engulf net interest income. Growth here is a key indicator and FBNH did post N23billion this quarter compared to N19billion in Q1. Income from C.O.Ts are down year on year to N7.9b (2013 h1:N8.6billion) but it’s still growing in this area probably due to its FBN Capital business. It has to keep growing in this area.

- Loan losses – Every bank has them and it’s almost as if banks have resided to losing money to defaulters. The way bad loans are written off has been more punitive lately so this is one line I have to watch closely too especially with how much they are able to recover. FBNH lost a staggering N20.3 billion last year alone in bad loans and 18% of its adjusted operating profits. This year it has written of N6.6billion, though lower than the N9.9billion posted a year earlier. This was mainly because it recovered about N2billion in past written off loans which is great.

- Operating expenses – last year, FBNH averaged N46billion in operating expenses per quarter and a cost income ratio (by my calculation) of about 59% (Zenith is 53% and GTB 49%). This year operating cost has averaged N51billion a quarter and a cost to income ratio of 63%. This just can’t continue going forward.

- Subsidiaries – those who are not happy with FBNH lately have often complained about the ‘baggage’ it’s carrying all because it wants to remain a HoldCo. Whilst the worry is often over bloated it is one aspect of the business to watch closely. I get the feeling a huge part of their high operating cost is from subsidiaries who are either non performing or at their growth stages.

Finally, for FBNH to continue to retain my faith I need to see key improvements in these areas. It just has to keep striving even if the market takes its time to reward it with market value. As mentioned in the beginning of this post, a N48billion a quarter business is still a huge value creation that can’t be undermined for sake of growth only. After all, we bank profits not growth rates.

UgoDre, Would you recommend FBNH as a BUY now especially with the likely drops in stock price? I understand that we may not learn more about the trend of the indices you highlighted for another few months.

Thanks for the great work and showing another way of looking at the numbers in detail

It’s a buy for me. But I feel the price will still go down a bit more. So you should watch out for that.

Your Observations are very convincing, indeed you have an eagle eyes.