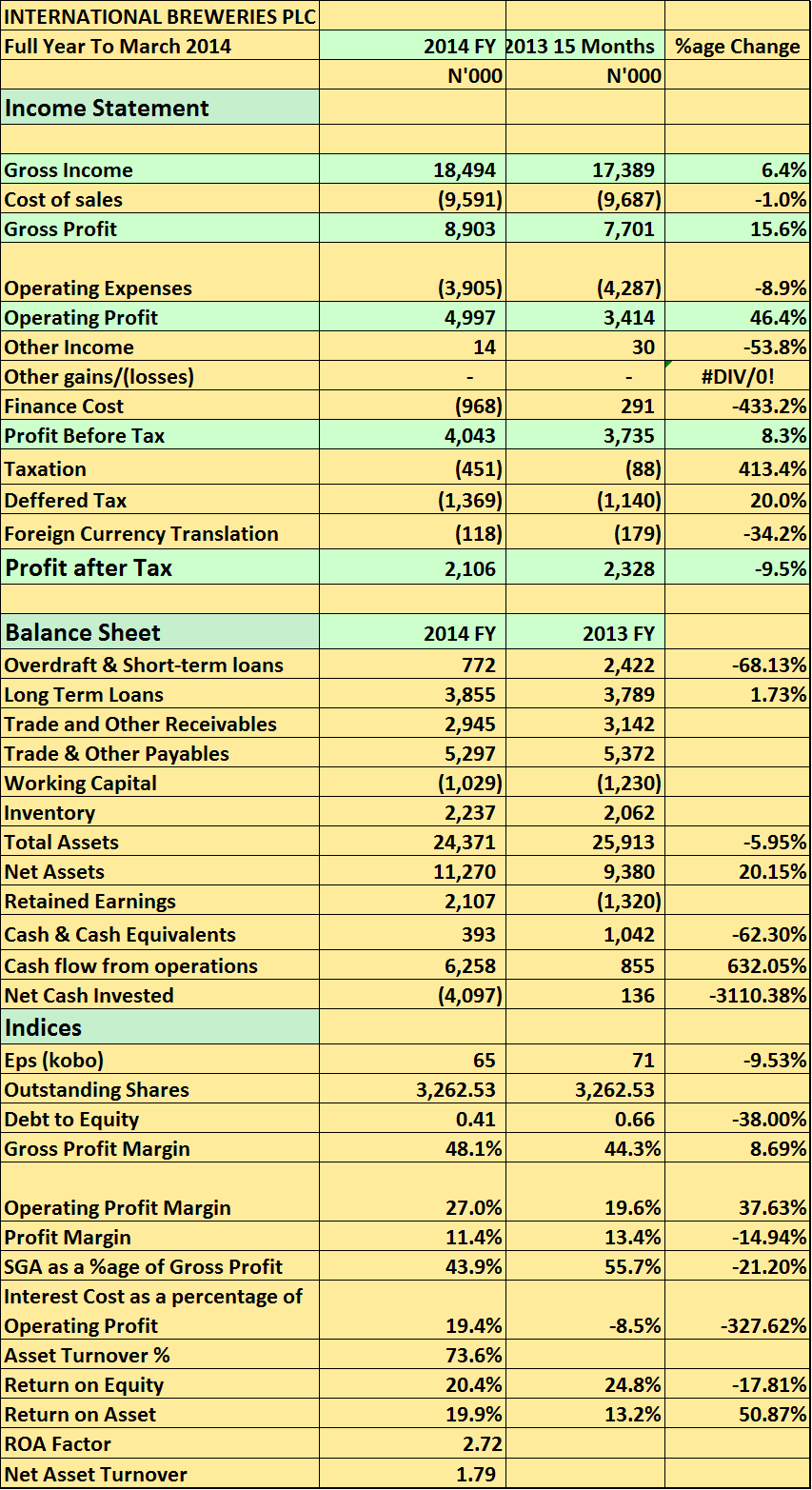

International Breweries Full year results indicate a 6% rise in Revenue to N18.5billion compared to N17.3billion reported in 2013. Profit after tax dropped 9.5% to N2.1billion.

Key Highlights for me

- You have to understand that this result is for 12 months and is been compared to 2013 which was for 15 months.

- Despite this, revenue for 2014 still topped that of 2013 by 6 months

- Operating profit also rose 46% a direct impact of the stable cost of sales and operating expenses. I just love this.

- Finance cost did increase but debt to equity is dropping similarly

- The reason for the drop in profit was the company’s deferred tax payments. International Breweries I guess carried deferred tax assets that it could not utilize and the accounting rule stipulates that you write them off if that is the case. As such, the gradual right offs that began in 2013.

- Return on Equity of 20% and Return of Asset of 19% demonstrates how sound the company’s balance sheet is looking.

- Profit margins are a bit low but I’d blame that on taxes and finance cost

- Over all the results is a morale booster (considering the competitive market) If I was a shareholder.

- Share price is currently N29.5 50 kobo shy of its year high of N30.

- Unfortunately, the current EPS growth rate does not justify the Price Earnings Ratio of 45x. Though, the operating profit growth rate might just be a pointer.

- But then, I just can’t buy this stock at this price for now.

…

Its a bad result to me

Why is it bad to you?