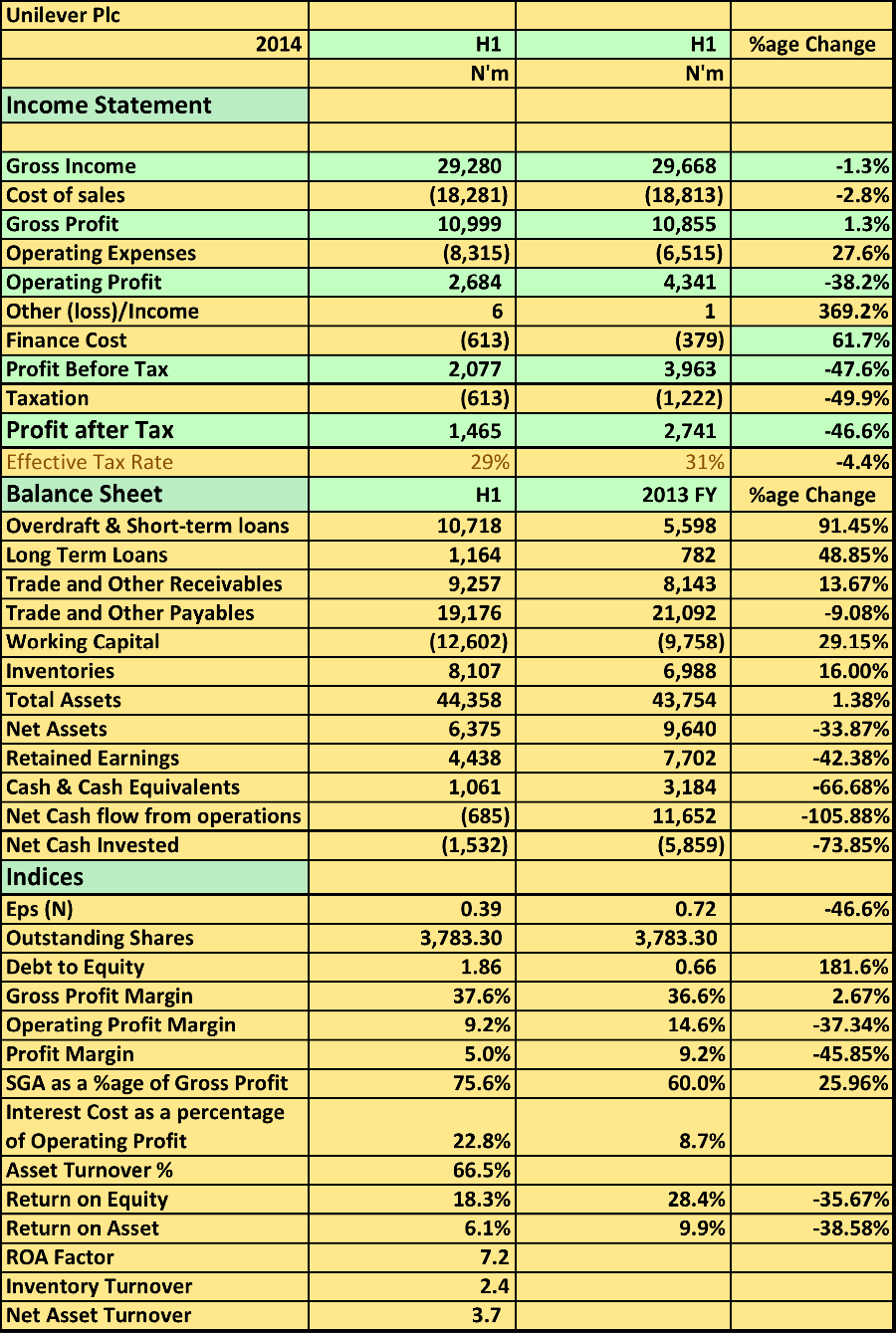

If you are a shareholder of Unilever Plc at the moment then you should be worried about their latest results. The company released its 2014 half year results showing a revenue of N29.2billion (above) . Operating profit was N2.6billion, 38% lower than the N4.3billion posted in the same period in 2013. Pre-tax profits was N2billion for the period and 47% lower than the N3.9billion it posted in the same period 2013.

This result by all counts should be a source of worry for the company and its shareholders. A 47% drop in pre-tax profits suggest the company is either loosing market share, facing rising operational cost or both. The result tells me both is the case here. So here are my problems with the results.

Margins

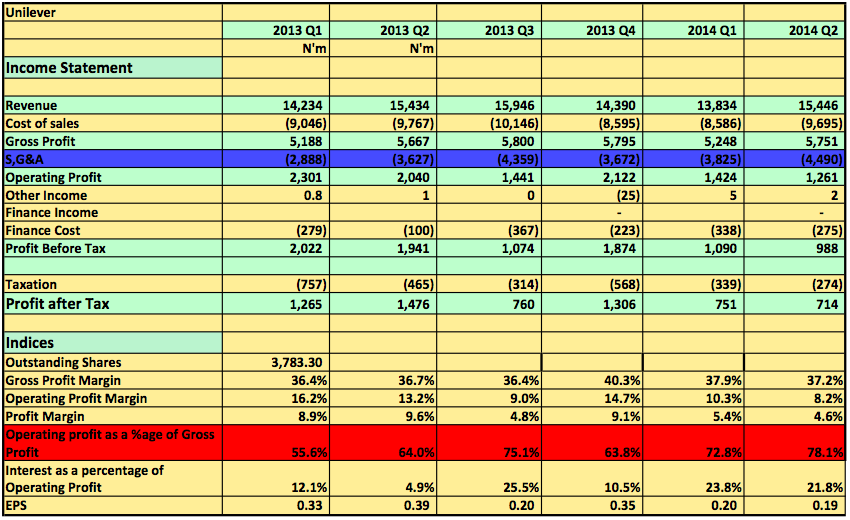

A closer look at Unilever’s margins in the last 6 quarters gives one an insight into what could be wrong. Gross Profit margins is always between 36% to 40% yearly. But operating expenses as a percentage of Gross Profit is a different story. I created a 6 months comparison for you to see

The blue highlighted row above shows how selling & general expenses (S,G&A) otherwise known as operating expenses has been rising over the last 6 quarters. From N2.8billion in 2013 Q1 to N4.5billion in the three months leading to June 2014. Whilst operating expense has been rising revenue growth has remained rather tepid. As such, operating expenses as a percentage of Gross profit which was 56% in 2013 Q1rose to 78% in the latest result. The rise has been pretty much consistent over the successive quarters (red row) and fast eating into profits.

What does this mean for a shareholder

Early this year, Thisday carried an article suggesting the FMCG industry which Unilever belongs too will have a torrid time in the stock market. It quoted Renaissance Capital as valuing Unilever at about N57 for the year. Unilever was N52.77 last friday (July 18) and the highest it has achieved this year is N55. I don’t get fixated on market price all the time but when a stock is trading at 41x its trailing earnings per share at the current price and still posting 47% earnings drop then you ought to be worried. At this rate the company may end up with an earnings per share of 80kobo compared to N1.27 which it posted in 2013. Earnings per share was N1.48 in 2012.

For the market to place Unilever at a 41x P.E ratio you wonder where the growth justifying that valuation is supposed to come from. Meanwhile, the company still has N11billion in debt nearly twice its equity and faces an increasing finance cost further eroding shareholder value. The only silver lining here is the company’s high return on equity (even that one too is dropping). What’s the point of a company posting an ROE of 40% if it’s dividend yield is 3% anyway?

In my opinion, this stock is a red flag and I would probably hold if I bought the shares sometime in 2012. Would I buy now? Certainly not!!!