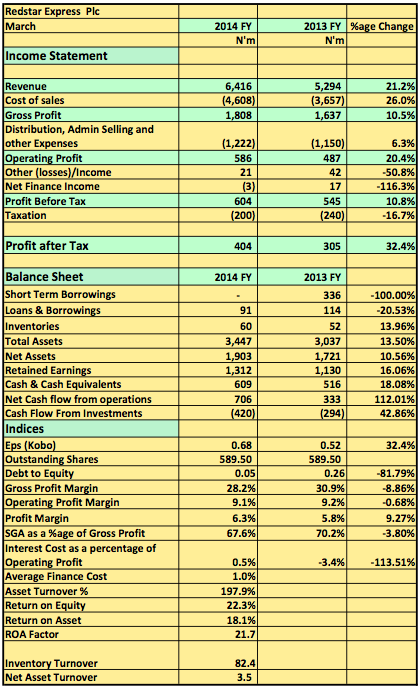

Red Star Express Plc released its 2014 FY results showing a 21% rise in revenue to N6.4billion (2013 FY: N5.3b). Gross profit rose 10.5% t0 N1.8billion compared to N1.6billion posted a year earlier. Profit after tax rose 32% to N404million compared to N305million a year earlier.

Key Highlights

- The increase in revenue is a 21% increase compared to a 5% increase the year before. The group has 3 major business segments, Courier, Freight, Logistics and Support Services. The four segments posted significant rise in revenue for the year with each posting 12%, 42%, 8.4% and 42% respectively. The parent company does courier and posted N3.9billion of the total whilst the remaining four posted a combined N2.5billion

- Despite a 5% rise YoY, Operating expenses as a percentage of Gross Profit was 67% compared to 70% the year before.

- Red Star Express has also refunded a huge chunk of its loans to N91million. The loan balance of N91million is the balance of a N114million loan obtained from Fidelity bank to finance plants

- Operating profit margin was flat at 9.1% in line with prior year trends. Profit margin was 6.3% suggesting a low margin business

- Return on Equity was great at 22% compared to 18% the year before.

- Return on Assets was 18% up from 16% the year earlier. The double figures in return on assets figures well with the business model that depends very little on assets to provide service.

You can view the full results here