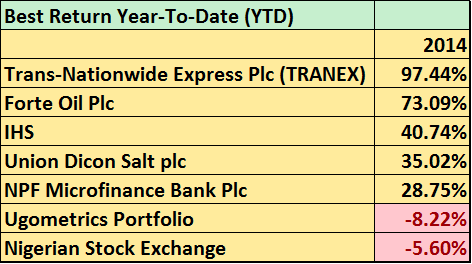

This year hasn’t been a very rewarding one for the all share index and even for Ugometrics Portfolio. YTD the NSEAI has returned about -5.6% and Ugometrics Portfolio -8.2%. However, despite the negativity these stocks have outperformed the market in the most remarkable way. Here are the returns in the table below;

If you don’t have these stocks in your portfolio by now, I am sure you are be reeling. But I am not exactly reeling if you are seeking my opinion. Let’s examine each of them and see if you feel better.

IHS has basically stopped trading and has had major running’s with losses. In fact the owners of the company want to delist. It opened at N2.65 and currently has a suspended trading price of N3.8. NO DIVIDEND YET

NPF Microfinance Bank has actually returned 6.3% in the last one year, indicating a w shaped market return over the last year. It opened the year at 86kobo and currently trades at N1.12 (gained 8% today). DIVIDEND OF 10KOBO PER SHARE

Union Dicon Salt, my friend Tunji Andrews recommended sometime last year as a buy for him, hasn’t really backed its bullish run by fundamentals. It opened the year at N12.08 and currently trades at N14.11. The share price has been flat since March with no apparent news to drive it up or even down. As it stands, owners of the stock may find difficulty selling it. NO DIVIDEND YET

Tranex opened the year at N1.17 and reached a high of N3.02 back in February. Today it closed at N2.31. They returned back into profit this year posting N77.4million (2012: (34million). DIVIDEND OF 10KOBO PER SHARE

Forte Oil’s bullish run has continued from where it stopped last year breaking records. It opened this year at N92.87 and currently trades at N186. DIVIDEND OF N4 PER SHARE

So do you feel better or worse?