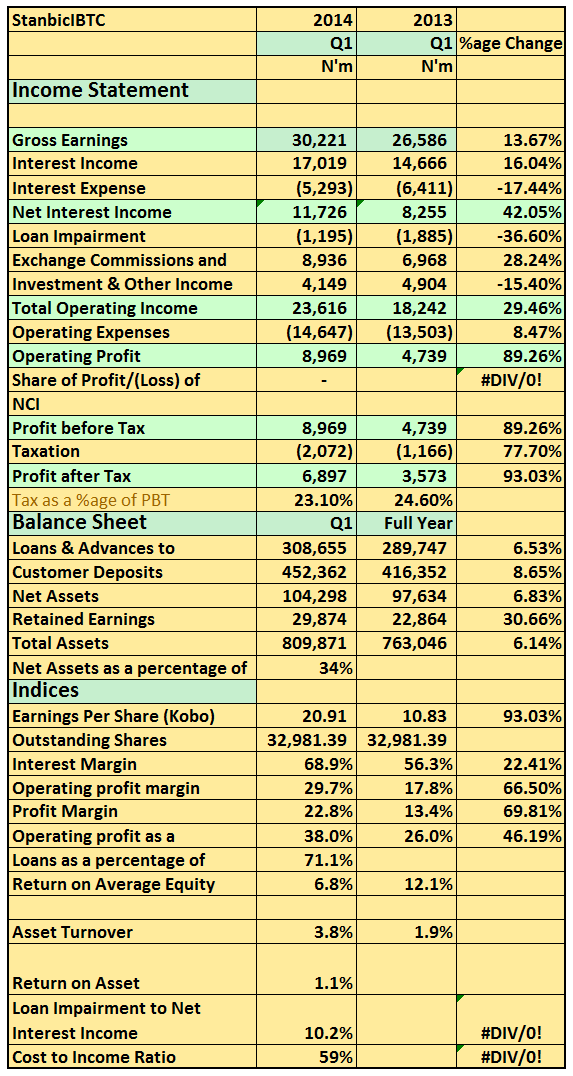

Stanbic IBTC released its 2014 Q1 results showing a gross revenue growth of 13% to N30billion. Other details of the results are as follows;

- Net Interest income rose 42% to N11.7billion (2013 Q1: N8.2billion)

- Interest expense dropped a massive 17% which led to the strong rise Net Interest income and ultimately profits

- Income from commission and fees rose 28% to N8.9billion (2013 Q1: N6.9billion)

- Pre-tax profits rose a whopping 89% to N8.9billion (2013 Q1: N4.7billion)

- This result follows with a strong 2013 where the bank posted a 104% rise in profits

- It also a remarkable trend considering stringent policies by the CBN which has adversely affected results of banks like GTB and Diamond Bank.

- It appears earnings growth was across board for the quarter.

- Stanbic IBTC has been added to our watch list….

Stanbic put out this statement on the back of this result;

Net interest income increased by 42%, benefiting from sustained growth in loans to customers and banks, good yields in investment securities and improved funding cost. Interest income grew by 16%, while interest expense declined by 17%. The reduction in interest expense is supported by the improvement in our deposit mix, as the ratio of low cost deposits to total deposits improved to 55% from 46% achieved in 1Q 2013 and 52% recorded at the end of 2013. Non-interest revenue, which comprise revenue from commissions, fees, trading and other non-interest bearing revenue, grew by 10% to N13.1 billion (1Q 2013: N11.9 billion).

The growth in non-interest revenue is primarily attributable to a 29% increase in net fee and commission revenue to N8.9 billion from N7.0 billion in 1Q 2013, although muted by the regulatory induced reduction in transaction fees and the bearish performance of the stock market.

The growth in net fee and commission revenue is driven by increased transactional volumes and activities aided by increased in number of customers, increased card related fees, a function of the high ATM uptime, steady growth within our wealth business and good advisory mandates in investment banking. Credit impairment charges declined by 37% to N1.2 billion (1Q 2013: N1.9 billion), benefitting from recoveries on loans and advances previously written off. We continued to maintain prudent approach to credit impairments in line with the realities of the operating environment.

Operating expenses grew by 9%, keeping with inflation. Staff cost was up 9% as a result of by inflation related salary increases in latter part of the quarter, while the 8% increase in other operating expenses was supported by growth in insurance cost including NDIC and AMCON expenses and increases in information technology expenses for securing competitive advantage in business efficiency and marketing and advertising expenses to increase brand awareness. The cost-to-income ratio improved to 59.0% from 67.1% recorded in 1Q 2013. We are committed to ensuring that revenues continue to grow at a faster rate than cost growth.

Overall, the group recorded an 89% growth in profit before tax to N9.0 billion, while profit after tax increased by 93% to N6.9 billion.

Group