In its bid to safeguard the value of the naira, the Central Bank of Nigeria sold a total of $4.04bn to companies or dealers at the foreign exchange markets in January.

Despite this effort, the value of the naira fell in all the segments of the foreign exchange markets, namely Wholesale Dutch Auction System, Interbank and Bureau-de-change.

This was contained in the CBN’s monthly report for January released at the weekend.

The CBN report read, “Foreign exchange sales by the CBN to the authorised dealers amounted to $4.04bn, showing an increase of 42.9 per cent above the level in the preceding month.”

“Relative to the level in the preceding month, the average naira exchange rate vis-à-vis the dollar depreciated in all the segments (WDAS, interbank and bureau -de-change segments) of the foreign exchange market.”

To save the naira from devaluation last year, the CBN sold approximately $26.6bn from the nation’s external reserves to currency dealers in a total of 94 regulated auctions between January and December.

The central bank sold the highest amount of dollar in the month of July, offering $3.3bn; while it sold $833,501,279 in January, the least for the year.

The CBN had in October last year replaced the WDAS with the RDAS because of the ineffectiveness of the former in order to address hitches in the foreign exchange market.

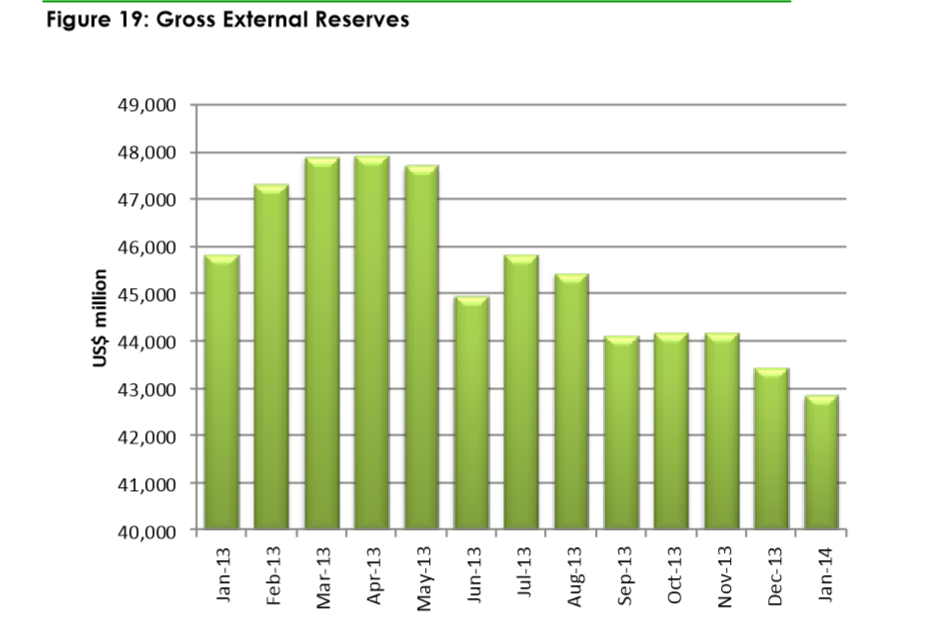

The reserves started last year at a little above $44bn and rose to $48bn in May. They, however, closed the year at $43.6bn on December 31.

This year, the reserves have lost over $5bn, and are currently at $37.9bn.

Experts and industry stakeholders have said the CBN may not be able to sustain the defence of the naira from the external reserves.

Some analysts have suggested that devaluing the naira is necessary.

However, the acting CBN Governor, Dr. Sarah Alade, had said devaluation was not the immediate plan of the central bank. She said the CBN would not renege on its stand to keep defending the naira

![[The Nigerian Economy Daily] FG has approved the closure of five foreign missions and embassies](https://nairametrics.com/wp-content/uploads/2017/05/nigerian-economy-today-1.jpg)