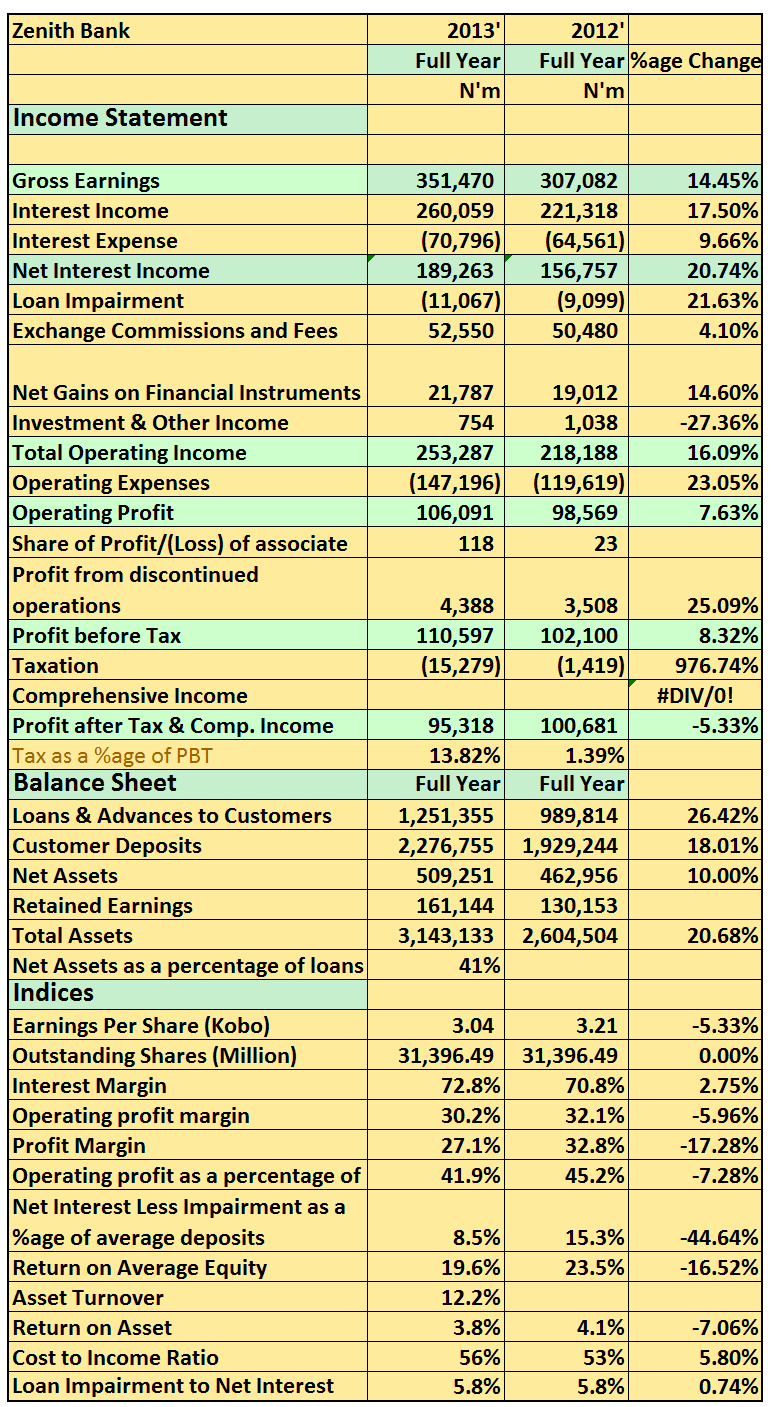

Zenith Bank Plc released its 2013 FY results showing a 21% increase in Net Interest Income of N189.2billion (2012: N156.7billion). Profit after tax at the end of the year was N95.3billion 5% drop from the record N100.5billion it posted in 2012. Considering the drop in profits and head winds that blew on the banking sector can this be considered a great result? Let is delve..[upme_private]

Key Highlights

- Net Interest income averaged N47billion in 2013 compared to N40billion posted in 2012. In fact the lowest Net Interest income recorded in Q1 was N45billion and still more than average than the highest of any quarter in 2012.

- 54% of interest income was loans and advances whilst a comfortable 40% was from bonds and treasury bills.

- Interest expense on savings deposits doubled to N3.8billion as CBN regulations continue to bite. During the year the CBN increased the minimum amount bank can pay for Savings deposits

- Commission and fees could have been better despite a 4% growth. C.O.T fees dropped by N900m to N27million during the year. C.O.T fees is a reliable contributor to revenue and with the CBN reducing C.O.T fees payable by customers a major source of revenue have been essentially reduced.

- Operating expenses is an area where Zenith Bank has hardly had joy. They have found it considerably difficult to achieve a cost to income ratio lower than 50%

- This year operating expenses rose 23% to N147billion. A major contributor to operating expense was the amcon charge which rose from 0.3% to o.5%. This increase cost Zenith Bank an extra from N6.5billion to N17.5billion during the year wiping out N11billion from operating income.

- The high operating cost therefore helped pull down profit margin by 18% during the year compared to last.

- Nothing indicates this trend is about to change soon even though one might argue some of the cost incurred this year will be better mitigated against next year. Zenith bank is basically built on a high operating cost model.

Other Issues to Note

- Zenith bank had a total loan balance of N1.25trillion representing a 26% net increase from 2012 balance. While this increase was more than double that of 2012/2011 you observe it still represents about 55% of total customer deposits. To put this into proper perspective, GTB’s loan to deposit ratio was about 71% suggesting a heavy reliance on Public sector deposit for Zenith as against GTB which relies more on retail deposits as well as raising cheap debt capital.

- Zenith Bank may probably have lent out more but with the CRR squeeze in the banking sector loan creation probably slowed more than they may have expected

- The extra N270billion in loans created this year were predominantly from the following Manufacturing (N43b), Government (N31billion), Power (N45billion), Communication (N45billion), Oil and Gas (N23billion), Transportation (N43billion).

- These areas represent major bets and arguably the some of the major drivers of economy. Agriculture didn’t represent any major increase but they had over N64.6billion in loans there this year

- Now these represents immense risk considering the fragile nature of the Nigerian economy. It is basically a make or mar and surely one would measure the quality of these loans a year or two from now from the progress of the Nigerian economy. This is no more the era of banks posting profits and the economy fairing badly.

- By the way N31billion of their loans are non-performing with “Finance and Insurance” taking the larger share of N7.9billion. Their real estate bets are also not faring well with about N6.3billion already in jeopardy. Power sector also had N1.6billion as non performing.

- Zenith Bank did increase its deposits to N2.4trillion a step closer to First Bank as the bank with the highest deposits. Admittedly much of the deposits are short term deposits, a sizeable public sector contribution and expensive to maintain. However, it is a clear evidence that Zenith Bank is more than any other time closer to being the largest bank by customer deposits in Nigeria.

Finally

For the outright skeptic who is not too sure about the future of Nigerian banks but still have appetite for investing in the sector, tier one banks such as Zenith Bank will always be a viable option. Yes there are challenges facing the banking system out of which regulatory requirement is probably the highest. I’d accept regulatory requirements aimed at sanitizing and protecting the sector cost them more on the short term but improve operation and reduce risk on the long term.

Zenith Bank released its 2013 results in the website of the NSE[/upme_private]