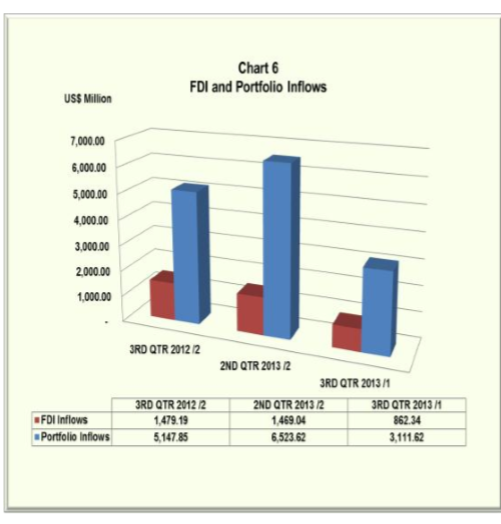

The CBN released its 2013 Q3 external sector development showing huge declines in Foreign Portfolio Inflows as well as Foreign Direct Investments. This confirmed analyst fears that a decline in forex inflows contributed to the exchange rate pressures we are witnessing.

At US$4.91 billion in Q3 2013, aggregate foreign capital inflow declined by 42.8 per cent from US$8.58 billion in Q2 2013 due to the decline in both direct investment and portfolio investment inflows. Direct investment inflow declined from US$1.47 billion in Q2 2013 to US$0.86 billion in the review period. Similarly, portfolio investment inflow declined by 52.3 per cent from US$6.52 billion in Q2 2013 to US$3.11 billion in the review period. Other investment inflows increased by 59.5 per cent from US$0.58 billion in Q2 2013 to US$0.93 in Q3 2013. Portfolio investment inflow remained dominant and accounted for 63.4 per cent of total for- eign inflows while direct investment inflows accounted for 17.6 per cent of total. Other investment inflows accounted for the balance.

Available data revealed that foreign exchange inflows to the economy in Q3 2013 stood at US$38.49 billion as against US$38.17 billion recorded in Q2 2013 indicating a marginal increase of 0.9 per cent. Inflows through the Central Bank increased by 25.6 per cent from US$9.44 billion in Q2 2013 to US$11.86 billion in the review period while in- flows through autonomous sources declined by 7.3 per cent to US$26.64 billion. Outflows in the Q3 2013 increased by 5.6 per cent to US$13.36 billion as against US$12.65 billion in Q2 2013. Consequently, a net inflow of US$25.14 billion was recorded in Q3 2013 as against US$25.51 billion in Q2 2013 indicating a decline of 1.5 per cent. The CBN component of foreign exchange flows recorded a net outflow of US$0.81 billion during the review period in contrast to a net inflow of US$3.1 billion in Q2 2013.

One expects 4th quarter report to actually show a grimmer reality explaining the reason why the CBN embarked on one of the most stringent monetary policy measures in the recent times.