The share price of Oando Plc has tanked in the wake of the recent allegation that Jams Ibori has a majority stake in the company. Even before the allegation, the company’s share price has by some quarters remained cheap relative to its earnings per share as it’s P.E ratio is one of the lowest in the industry. Even its price to book ratio is heavily discounted trading below 50. To put this into perspective the likes of Total, Mobil and Conoil all trade at Price to Book ratios that are 11x, 13.7x, 27.9x respectively. And so, with all the negative publicity is the current price of N9 a bargain?? Lets find out.

Assumptions

Revenue

Revenue has consistently grown over the last 5 years except for 2009 when they had a blip. The CAGR for revenue for the last 5 years is strong at 15% beating industry average. The company has also acquired some upstream assets which is expected to contribute significantly to top line revenue growth in the near future even though the haphazard price of oil may have one or two things to say about that. In the downstream sector the company has also embarked on a massive expansion of its retail presence by adding hundreds of Mega Stations to its fleet. This is also expected to add significantIy to revenue. Based on this, I am am assuming revenue will indeed continue to grow at this pace in the next 5 years.

Expenses

Oando hasn’t been very good with margins over the previous 5 years. The best in terms of profitability margin that it has posted was 3.8% and that was in 2010. Profit margins at the end of December 2012 was just 1.5%On a CAGR basis, Oando has posted a negative profit margin of -10%. In fact, in 2013 Q2 revenue grew at a rate of 32% over Q1 2013, yet pre-tax profit for Q2 lagged that of Q1. Reason is that expenses and finance cost grew at a rate much higher than revenue. In the first half of 2013 the figure has remained mostly the same at 1.4%. I am assuming expenses will increase at least for the next five years as they start to take it depreciation cost and write down assets with no significant goodwill value in the wake of their acquisitions.

Debt

Oando as at 2013 was owing N243billion 1.4x its Net Assets. I doubt if this debt will rise in the next five years like it did the preceding five years. Even though it has been able to capitalise most of its interests expenses and generate the cash flows to repay these debts (to an extent) it certainly bodes bad for the company if it does not begin to reduce the debt. Basically, I do not see interest cost rising by any significant margin yet.

Earnings Per Share

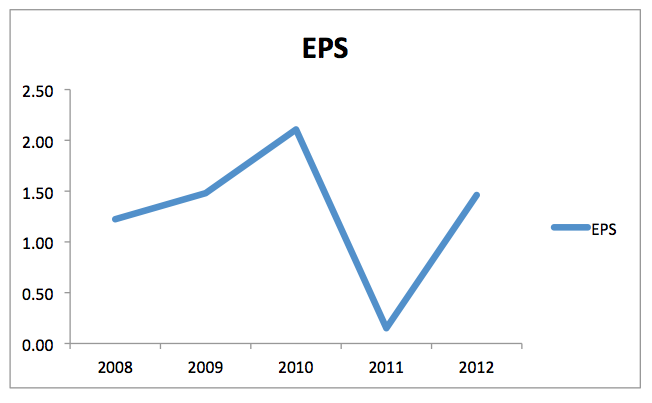

Oando Plc has an EPS graph that looks like this;

This N shaped graph is typically a red flag for Value Investors as it indicates a lack of steady growth in EPS. On a flip side you might look at 2011 as the year of turbulence and 2012 the beginning of a resurgence. The only problem is that EPS is currently down 40% after their release of 2013 H1 results. Despite this, I will use the current EPS growth rate based on its trailing CAGR

Other Assumptions

- Valuation is done based on DCF of future retained earnings per share. This is added to the terminal value and the current Book Value per share.

- Expected Average Dividend Payout of 50% annually

- Buyer of the share is only a minor shareholder with no influence that can be liken to any form of control

- In view of the high debt to equity ratio I assumed an expected yield is 20%

- Projected dividend is deducted from earnings to arrive at projected retained earnings

- Inflation rate is projected at 9% average for the next 5 years

- A premium of 10% is added to the DCF derived Projected Book Value per share to arrive at a higher valuation figure

- Shares bought will be held for a minimum of 5years

5 Year Historicals

Valuation

Using Earnings Per Share method as a valuation metric it appears the Oando current Value is between N20-N22. That is a N12.7 discount on the current share price and is a assumed price earnings ratio of 15x. To make matters worse for my valuation the PEG ratio (price to earnings growth ratio) is 1.76 (a price below 1x is typically an indication of a bargain) presumes the current price may even be expensive as the price earnings ratio is well above the companies EPS CAGR. No need to panic, as this is where it gets interesting. The reason for this anomaly is in the company’s current Book value. Oando has a book value per share of N15.44 which the market prices at less than 50% showing the market has little faith on the ability of the book value to deliver improved earnings. That is why even after my projections, the cumulative present value of all future earnings per share is just N4.61 just 30% its current book value.

In addition, the current EPS only generates a ROE of just 9.5% a figure that has been in decline from 18% in 2008. ROE in 2009, 2010, 2011 was 19%, 15%, 1.1% respectively. So basically, the company’s equity is not been adequately compensated for by its current and projected earnings.

Summary

For those looking for a long term view on this stock, the intrinsic value I have basically estimated may not be enough to create an attractive proposition. I won’t buy for the long terms based on this because the company fundamentals and business model lack the desired qualities I like to see. It’s finance structure makes it uncompetitive, the company appears to be overtrading and growing too fast to generate consistent returns. The company’s management and operations also appears convoluted to me with many unanswered questions as per who owns what. Despite this, the current share price is a very attractive proposition for those seeking for very short term gains. The market cannot continue to gloss over the “heavily discounted” PB ratio for too long. Their appetite cannot just be ruined for too long with the currently negativity hoovering over. In fact, the share price may probably close in the region of N12 by year end which is potential gain of 29%.

NB: At the time I wrote this article, Oando was trading for 9.32, it was trading for N11 as at 20th September 2013.