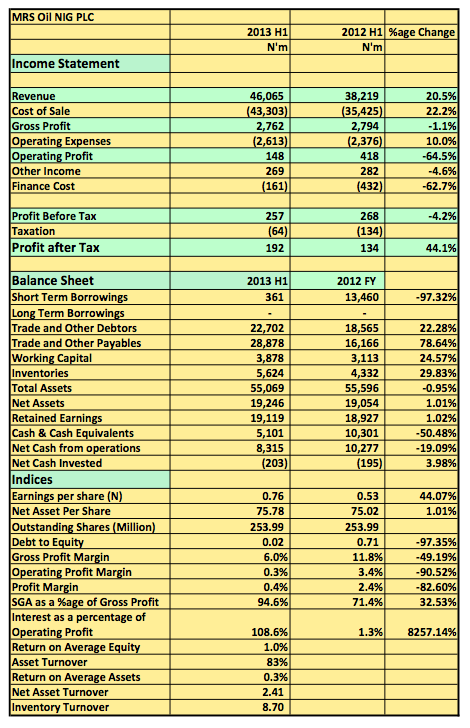

[upme_private]MRS Oil Plc (MRSOIL:NL) released its 2013 H1 earnings with revenue rising 20.5% to N46billion (2012 H1: N38.2billion). Gross Profit margin however remained flat at N2.7billion dropping 1.1% to N2.79billion. Operating profit dropped 65% to N148million (2012 H1: N418million). Pre-tax profits however dropped just 4.2% to N257million compared to N268million in the prior period.

Key Highlights

- Despite the rise in revenue (20.5%) the company was unable to reign in on cost of sales. Direct cost rose 22.2% compared to the same period last year resulting in a 50% drop in margins.

- On a Quarter on Quarter (QoQ) revenue actually grew 95% (Q1: N15.6billion) showing a renewed effort to improve top line growth. QoQ Growth in the corresponding 2012 results was -1% showing just how remarkable the growth was.

- Unfortunately though, the growth in revenue did also come at a huge rise in cost of sales. It similarly almost doubled at 90% this quarter compared to Q1 2013 (N14.9billion).

- Operating expenses also rose 10% compared to the same period last year. This dropped operating profit by 64% when compared to the same period last year. In fact operating expenses sliced off N95 of every N100 in Gross Profit generated.

- On a flip side, Operating profit did show remarkable improvement when you compare this quarter to the last. Last quarter the company posted an operating loss of N276million compared to N425million this quarter. And this is even after operating expenses rose 68% QoQ.

- The company astonishingly reduced its entire debt by a whopping 97%. It has paid off about N13billion in debt in the last 6months alone with this quarter accounting for another N5.9billion.

- Its debt repayment spree has helped more than halved finance cost to N161million, a figure that might only slightly increase by year end if the company decides to remain debt free.

- Working capital is also positive at N3.8billion with the company boasting of a large cash pile of over N5billion. By the way Net Cash from operations was also an impressive N8.3billion

- It is a bit of an irony that a company like MRS Oil will be posting Profit margins of 0.4% when the likes of Total and Mobil post 2.5% and 4.3% respectively. In fact, MRS Oil posted a higher turnover than Mobil (N38billion) this period with mobil dropping in revenue by 9%. However, Mobil still post an ROE of 25% compared to MRS 1%!!!

- A lot of this point to MRS high operating cost which the company has since identified as a problem. Its new MD, I understand started cost cutting turnaround starting with the lay off of employees.

- MRS also high huge Net Assets of about N19billion which is higher than that of Mobil and Total and only just next to Oando and perhaps Oando. However, despite its huge net assets it only just 2.41x compared to 9.3 for Mobil and over 5x for Total

- A lot of this point to under trading and failure to maximise shareholders value.

- MRS Oil currently trades at N36.14 and an industry high P.E ratio of 44.75x. Ironically the share price is only just 48% of Net Assets per share of N76. Is this cheap or costly one might ask

- MRS Oil has been added to my Watch list

MRS Oil Plc released its 2013 H1 results in the website of the NSE[/upme_private]