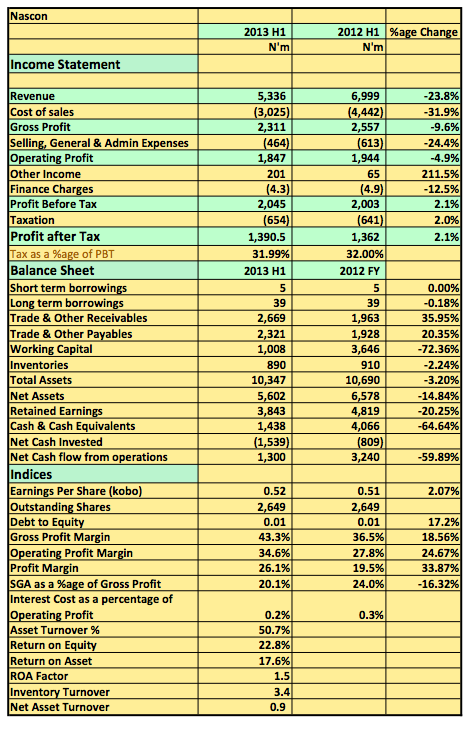

[upme_private]National Salt Company of Nigeria (NASCON) released its 2013 H1 results with revenue dropping 23.8% to N5.3billion compared to same period 2012 (N6.9billion). Gross profit dropped 9.6% to N2.3billion (2012 H1: N2.5billion). Operating profit was N1.8billion compared to N1.9billion a 4.9% drop. Pre-tax profits at the end of the period was N2.04billion (2012 H1: N2billion).

Key Highlights

- It appears the slide in revenue the company witnessed in the first quarter continued into the second half of the year. The drop in revenue in the first half of the year was also witnessed in Q2 2013. Revenue between March and June was N2.5billion compared to N3.3billion in 2012.

- Independent reports from news sources indicate the unrest in the North is affecting the company’s operations and as such revenues.

- Despite this though, margins improved significantly as Gross Profit margin and Operating Profit margin increased 18.5% and 24.6% respectively.

- It appears though that the improved margin may be as a result of a massive scale down in operations rather than an improvement in efficiency. I believe a detailed report from the company will shed more light in the coming weeks.

- Other income also rose 211% to N201million during the period.

- This helped keep pre-tax profits (N2.045billion) abreast or even higher than the 2012 figure (N2.0billion)

- The company still retains a very low debt profile.

NASCON Plc released its 2013 H1 results in the website of the NSE[/upme_private]