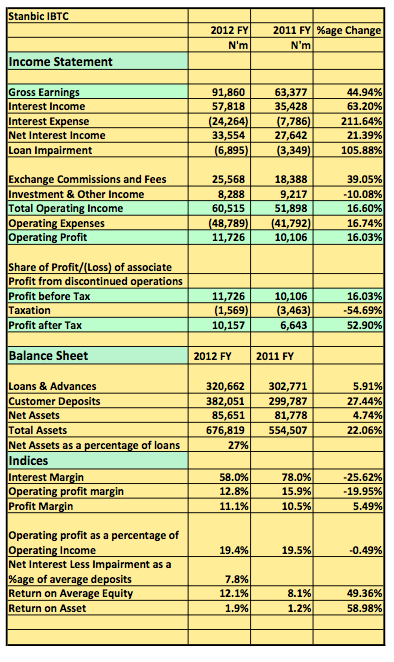

Stanbic IBTC released its 2012 audited accounts with Gross Earnings rising 45% to N91.8billion. Net Interest income rose 21% to N33.5billion and income from commission and fees adding another N25.5billion about 42% of total Operating Income. The bank will go on to declare a profit after tax of N10.1billion, 53% higher than the N6.6billion posted in 2011.

Result Overview

Stanbic IBTC is a well known respectable bank boasting quality employees who have over the years prided themselves as sound investment bankers. In 2011 the bank made N18.3billion in commission and feed following in that up with an impressive N25.5billion in 2012. That’s not surprising as most M&A deals involving foreign corporations will often list the bank as a financial adviser. What is surprising however is the huge loan loss write off of about N6.89billion in the year under review. That amount was about 20.5% Net Interest Income, way higher than the industry average of 11.5%. This huge drop affected profitability ratios helped only by taxes which helped pushed PAT higher in comparative terms to N10.1billion.

Market Price

The bank’s share price took a beating today, dropping 5.69% to N12.26 about 24.5x its earnings per share of 50kobo. They also propose dividend of 1o kobo per share yielding just 0.8%. The bank helps investors derive the intrinsic value of equities and investments. It will be a great surprise if they dim the current share price worthy of its value considering the price multiples placed on its better performing peers.

Stanbic IBTC posted its 2012 Audited Accounts on the website of the NSE