I find the recent top ten Banking Stock Review by StanbicIBTC Stock Brokers quite instructive. They highlight the risk the banks face if the Naira continues to depreciate as most will loose revenue due to their exposure to loans given to import oriented industries. They also highlight how a depreciated Naira negatively affects foreign inflows which they estimate accounts for “80% of daily trades”.

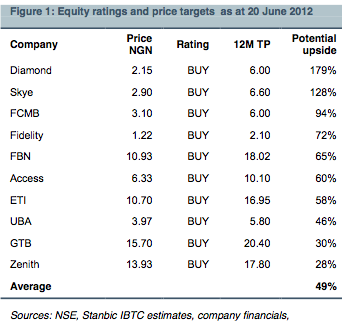

Despite all this they still recommend a buy for all the top ten banking stocks attributing an average upside of 49% for a portfolio holding of the top ten banks. That is if you invest N1m in a portfolio of this stocks, you may see your money increase in value to N490k at the end of the year.

Interestingly Diamond Bank, which they claim will be most affected if exchange rate continues to depreciate, is projected to earn the most returns in share price. A whopping 179% returns!! But remember high returns means high risk. So if you invest in Diamond Bank today, have you at the back of your mind that whilst you stand to make major money, it is also likely to be the one to loose.