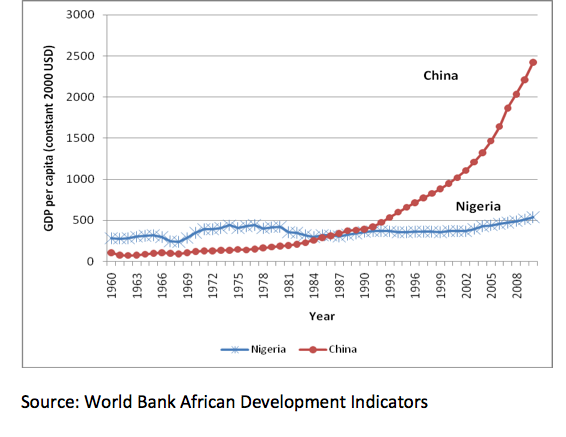

Its no news Nigeria’s decline began in the mid eighties when the military took over. What is interesting however is when you realize that about 22yrs ago (1990) Nigeria and China had the same GDP Per Capita. At that point, China had basically caught up with Nigeria and of course never looked back. As the graph below also shows, the decline started at about 1984 when the Buhari, Babangida and their cohorts took over.

This is perhaps one more proof of the damage Babangida and the military brought upon Nigeria.

the graph actually shows growth fo Naija na.

Dre, unless it wasnt you that posted the graph, or we are not reading from the same graph, your assertions are wrong. If you look closely, between ’78 and ’84, we were in a deccline. Again looking closer, ’84 to ’90 we were on an ascent, albeit modest. The climb is even in tandem with that of China. It flattens out between that time and 2002. While I don not believe most of these economic indices, and that is because I really don’t understand how they work much, I can see from this graph that the military actually halted what was a steep descent somewhere around ’78/79.

Guys, Nigeria is blue here ohhh…What growth are you talking about. Its been flat and never went above 500 until 2007-2008. And the point really is when you compare it to Naija.

Guys, Nigeria is blue here ohhh…What growth are you talking about. Its been flat and never went above 500 until 2007-2008. And the point really is when you compare it to Naija.

It’s not really as a result of one leader or another. Reading from your graph, it looks like the economy started to grow after the civil war ended, was flat until 1979, and subsequently entered a decline. Looks like the economy is just beginning to take off around 2003.

I would read it like, we grew with the surge in the world economy (70s oil boom), and declined with the recessions of the 80s and early 90s. Since our only forex earner has been oil since the 70s, it’s a no-brainer to deduce the real reason for our non-growth.

It’s not really as a result of one leader or another. Reading from your graph, it looks like the economy started to grow after the civil war ended, was flat until 1979, and subsequently entered a decline. Looks like the economy is just beginning to take off around 2003.

I would read it like, we grew with the surge in the world economy (70s oil boom), and declined with the recessions of the 80s and early 90s. Since our only forex earner has been oil since the 70s, it’s a no-brainer to deduce the real reason for our non-growth.

It’s not really as a result of one leader or another. Reading from your graph, it looks like the economy started to grow after the civil war ended, was flat until 1979, and subsequently entered a decline. Looks like the economy is just beginning to take off around 2003.

I would read it like, we grew with the surge in the world economy (70s oil boom), and declined with the recessions of the 80s and early 90s. Since our only forex earner has been oil since the 70s, it’s a no-brainer to deduce the real reason for our non-growth.