- Three banks are being probed by the presidency for short-changing the Federal Government in the management of the N50 billion escrow accounts interest yield for seven Electric Power Generation Companies (EPGC).

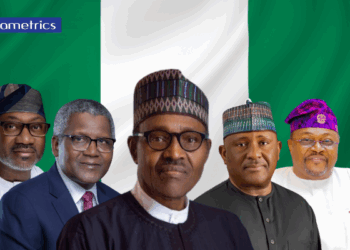

- The row over the escrow accounts was referred to President Muhammadu Buhari following the loss of over N10 billion interest yielded in the last two years.

- The companies are: Afam Power Plc; Egbin Power Plc; Geregu Power Plc; Kainji Hydro-Electric Plc; Sapele Power Plc; Shiroro Hydro-Electric Plc; and Ughelli Power Plc.

- Each of the generation companies (sellers), pursuant to the provisions of the Electric Power Sector Reform Act No. 6 of 2005, were mandated to take over generation and related businesses of the Power Holding Company of Nigeria (PHCN).

- Safety escrow accounts were established to protect the stake of private investors in the seven generation firms.

- The Bureau of Public Enterprises (BPE) and the Nigerian Bulk Electricity Trading Plc (NBET) in 2013 entered into an agreement with three banks to manage the N50 billion.

- The said N50 billion was sourced from the proceeds of the privatisation of Egbin Power Plc. But, contrary to the guidelines of the Central Bank of Nigeria (CBN), the banks have not been paying “the required interest on the escrow accounts”.

- It was gathered that instead of paying 10 per cent interest on the N50billion as applicable to other funds being managed by NBET, the banks had been remitting only 0.02 per cent interest per annum.

- It was also gathered that Clause 7.1 (Compensation) of the agreement that the interest on the escrow accounts be compounded monthly together with the balances in the Escrow Accounts”

- Source: The Nation

Find Out Why PMB Has Three Banks Under His Microscopic Watch

Related Posts