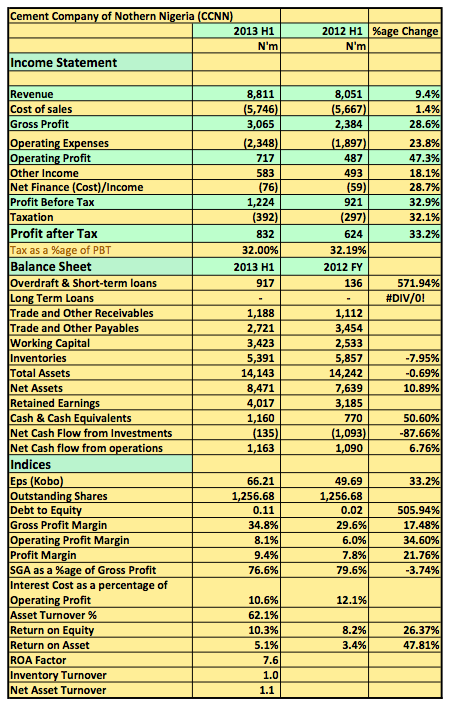

[upme_private]Cement Company of Northern Nigeria (CCNN:NL) released its 2013 H1 results increasing 9% to N8.8billion (2012: N8billion). Gross Profit also rose 29% to N3billion (2012 H1: N2.3billion). Pre-tax profits at the end of the period was N1.2billion representing a 33% growth from N921million posted same period last year.

key Highlights

- CCNN has the BUA Group as its core investors. They acquired 50.7% shares in the company in 2009

- The company’s factory is located in the North with plants in Sokoto

- They were able to keep cost of sales relatively flat during the period helping boost Gross Profit by 28% to N3billion. This is evident in the 35% gross profit margin.

- Operating expenses as a percentage of Gross Profit was 76.6% an improvement from 79.6% same period last year

- The company has very little debt. Interest cost as a percentage of operating profit was just 11%..lower than 15% which I like to recommend.

- The company also has a strong working capital of N3.4billion most of which is cash of N1billion

- Its return on equity of 10% is only better than Ashaka Cement (2.3%). Wapco and Dangote Cement all produced above 20% ROE for the period.

- CCNN has a P.E ratio of 10x as at blog time and a Price to book ratio of 1.5x.

- The stock is now in my radar

CCNN Released its 2013 H1 results in the website of the NSEhere[/upme_private]