The National Bureau of Statistics released its 2016 First Quarter Balance of Trade report revealing Nigeria had a negative trade balance of N184.1 billion. This will be the first time the country will be recording a negative trade balance since data collection began in 2008 and another string of “firsts” for the Buhari presidency.

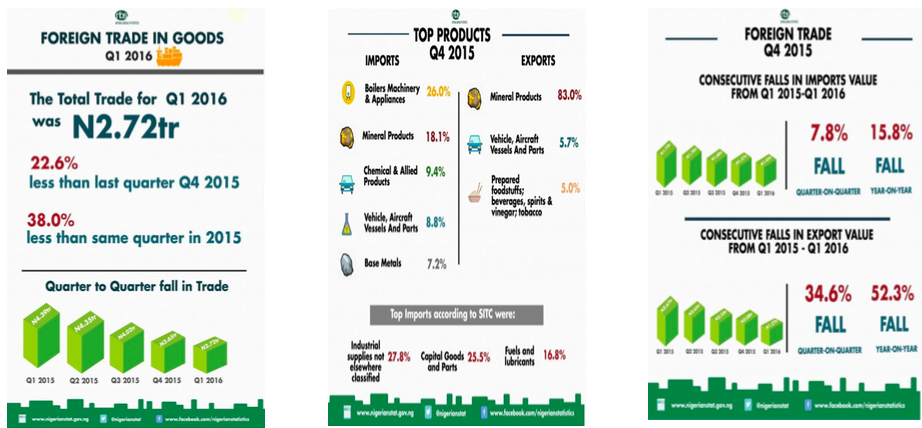

According to the report, the total value of Nigeria’s merchandise trade at the end of Q1, 2016 stood at ₦2,723.9 billion. From the preceding quarter value of ₦3,517.4 billion, this was ₦793.5billion or 22.6% less. This development arose due to a sharp decline in both imports and exports. Exports saw a decline of ₦671.1 billion or 34.6%, while imports declined by ₦122.4 billion or 7.8%. The steep decline in exports brought the country’s trade balance down to – ₦184.1 billion, or ₦548.7bilIion less than in the preceding quarter. The crude oil component of total trade decreased by ₦716.7 billion or 46.6% against the level recorded in Q4,2015 .

Here are other key highlights

- Nigeria’s import trade stood at ₦1,454.0 billion, at the end of Q1, 2016. This was 7.8% less than the value recorded in the preceding quarter ₦1,576.4 billion.

- Further comparison with the corresponding quarter of last year, showed a decrease of ₦273.7 billion or 15.8%. The structure of Nigeria’s import trade according to SITC was dominated by the imports of “Machinery and transport equipments”, “Mineral Fuel”, and “Chemicals and related products”, which accounted for 34.7%, 17.4%, and 14.7% respectively in 2016.

- These commodities contributed the most to the value of import trade in Q1, 2016, whereas commodities such as “Crude inedible materials”, “Oils, fats & waxes”, and “Beverages & tobacco”, contributed the least, accounting for 1.5%, 0.8%, and 0.6% respectively

- The value of the export trade, totaled ₦1,269.9 billion in Q1, 2016 showing a decrease of ₦671.1 billion or 34.6%, over the value recorded in the preceding quarter.

- Year-on-Year analysis shows that the country’s exports dropped by ₦1,395.2 billion or 52.3% against the export value recorded in the corresponding quarter of 2015. The structure of Nigeria’s export trade is still dominated by crude oil exports, with the contribution of crude oil to the value of total domestic export trade amounting to ₦821.9 billion or 64.7%

Get the report

Please What’s Belgium importing into the country…just curious?