Nairametrics| On Friday, the Naira closed at N390/$ down from N520/$ in January. The development follows a change of heart by the Central Bank of Nigeria (CBN), in February 2017, to ramp up Dollar sales towards the retail segment. The Naira appreciation at the parallel market took a lot of people by surprise, and while the CBN appears to be winning plaudits by the wider populace, the sentiment is not universal. Among the financial analysts’ community, the sense is one of cynicism that as long as it is not a market determined 100% Floating Exchange Rate System, the current moves by the apex bank would ultimately fail. In several debates with friends on the issue, many are now tugging at whether to float or not.

However, following the over 46% depreciation in the value of the Naira, relative to the 55-60% collapse in crude oil prices since 2014, I think the righteous indignation over what FX regime Nigeria adopts appears misplaced. Clearly, the NGN has more than adjusted for the tectonic shifts in Nigeria’s current account and its transmitted shock to CBN reserve inflows, which are down roughly 55% from 2014 levels. In my view, it appears as if we seem focused on the means and not the end.

What it takes to have a free-flowing FX Market

Anyway, to the question: can Nigeria transition to a purely market driven exchange rate system as demanded? To ensure we are all on the same page, a fully flexible FX market is one with an equilibrium price where demand and supply are clear, and is highly liquid. This liquidity qualifier helps keep the theoretical ideal of equilibrium to reality as of what use is an equilibrium price in sync with the current account when no one can get Dollars.

A liquid FX market is one with narrow bid-offer spreads, low transaction costs and sufficiently broad trading activity and turnover, such that the impact of individual trades on prices is negligible. By this definition, today’s parallel market is a poor barometer of the Nigerian FX market as the action of the CBN in recent days proves that one single party acting in another market can influence developments in the market. Indeed, in hindsight the Naira appreciation at the segment appears unsurprising when one examines what happened in 2016. Since the announcement, the CBN has sold close to $2 billion and specifically targeted the retail segment, which was forced to rely on the black market for supply. Thus, after the depressed levels of 2016, when the apex bank sold $58 million Dollars to BDCs vs. $5billion on average previously, it took only a small improvement in CBN sales for the market to re-adjust. The way I see it 2016 is like a year of no rainfall, so with only a few showers in 2017, the whole place greens up.

Having defined our goal, I would now attempt to chart a response. But first I would like to borrow a leaf from accountants and qualify my opinion. What are these qualifiers? A free market system pre-supposes the existence of many buyers and sellers, with the proviso that one agent is unable to dominate or influence the action of other agents in the market system. There are certain markets where a pure play market outcome is thought desirable but yields sub-optimal allocation outcomes. One such instance is the case of a natural monopoly where by legal fiat or economies of scale, one agent (seller) is allowed to dominate the supply side. As I will illustrate, Nigerian FX markets more closely resemble a monopoly outcome and trying to impose a pure-play market system is impracticable unless certain institutional adjustments are made.

Demand and supply

First, let us talk about demand. There are many reasons why people demand Dollars in every country; two reasons of prime importance are – for payments for imports of goods and services. In Nigeria, in the decade between 2005 and 2015, imports of goods and services accounted for, on average, 18% of nominal GDP, with imports of goods clearly the larger share as in the chart below. In terms of services imports, which curiously receive lesser attention for demand management policies, the key imports are transportation (freight and travel), education and professional services. Of note is that demand side is fragmented i.e. no single individual or company places an inordinate demand on our FX; rather the demand side is highly fragmented though we can group individuals into several classes, but none sufficiently wields undue influence on the overall market. On this alone, Nigeria ticks the box of many buyers.

Figure 1: Imports of Goods and Services

Source: CBN

How are imports of goods and services financed in Nigeria? The answer provides an illustration of how the supply side of Nigeria’s FX market looks like. Looking at data between 2007 and 2015, one agent, the CBN, accounts for roughly 60% of imports of goods and services, if you look at its sales to the FX market. In addition, you have capital flows (defined as FPI, FDI and other capital), which jointly accounts for 16% of total imports, if you look at inflows. With over three quarters of import supply spoken for, the CBN is the 800-pound gorilla in FX room. Importantly, as a single agent, the apex bank singularly accounts for over half of Dollar supply to the Nigerian FX market while other agents are fragmented. The flaw in evolving to a pure play free float appears obvious as one singular agent accounts for more than half and other agents are minuscule relative to this agent.

Can foreign capital flows dismantle the CBN if Nigeria adopts policies which bolster appetite for Naira assets? While this story appears seducing and a lot of people are quick to compare Nigeria to Egypt, Nigeria will need capital flows of more than $20billion – the highest amount of capital flows ever, which occurred in 2012-13 when global central banks were providing stimulus measures to jump-start their economies, to ensure a floating market. Even in the event that we assume QE was in full force, Nigerian capital markets (debt and equity) are simply not deep enough to absorb capital flows to the extent that they dislodge the CBN. In any case they would still not go anywhere towards meeting import Dollar requirements.

Figure 2: Dollar supply

Source: CBN

Can Nigeria float?

The idea behind full currency flexibility is to allow Dollars flow into an economy by optimizing agents transacting in Dollars in their natural setting vs. a central bank which does not need to pursue a profit motive in FX trading. Under this scenario which would permit 2-way trading i.e. possibility of loss/gain, economic agents would be governed by the invisible hand. Having examined supply and demand, the picture which emanates in the event of a float is likely a monopoly. It is this institutional framework which negates the progression to a fully-fledged FX regime. In the process of researching for this column, I stumbled on this IMF paper, where I picked up two key institutional requirements, out of several, critical for a transition to a flexible exchange rate regime:

- A country must phase out or eliminate existing regulations that require agents to surrender foreign exchange receipts to the central bank.

- A country exiting a peg must replace it with another nominal anchor and redesign its monetary policy framework around the new anchor.

Requirement one is necessary as in any market, you need agents acting without benevolence, as Adam Smith put it, in a natural setting demanding and supplying Dollars purely on a needs basis with a profit motive. Put simply, only exporters and importers of goods and services, and the odd arbitrageur should exist in the currency markets, with futures markets to allow for speculative betting.

In Nigeria, the first requirement is perhaps the biggest hurdle in the path of a transition to full Naira floatation, as it requires a change to our legal code, specifically, laws which currently mandate that Nigeria’s oil proceeds be surrendered to the CBN. By default, this would transform the Nigerian National Petroleum Corporation (NNPC) to the new behemoth in the FX market. Therein lies the challenge, NNPC’s very sleazy history with the organization run like a black box, means that it is less likely anyone will agree to give NNPC near monopoly over Dollar proceeds. Some Economists, like Henry Boyo, have argued in favour of letting the state governments to receive their FAAC allocations in Dollars and then disperse proceeds to the interbank market. This view has been dismissed to the fringes, as the idea fails when one considers the lurid corruption tales of Dollar cash real estate transactions and money laundering by certain governors in times past in foreign countries. Clearly, the current institutional setting implies that the CBN is likely to remain the elephant in the room for some time.

Requirement two is largely theoretical and is a distinct feature of advanced economies with liquid futures and forwards market which provide an institutional feature for hedging FX risk. With this institutional framework, currency volatility is less of an issue as everyone can insure themselves for currency risk leaving pass-through to inflation from FX less of an issue. This allows monetary policy focus on its core mandate of price stability.

To those who understand actual Nigerian monetary policy, where the key policy anchor of the CBN is currency stability not price stability. Now in shifting to a flexible regime, the shift implies a total adoption of new anchor in totality, with no subtle attempts to influence the currency via interest rates, especially when inflation rates are within target levels. Between 2013 and January 2016, Nigeria’s inflation rate declined to single digit levels, which did not draw any response from the CBN that kept interest rates at a record level in pursuit of currency stability.

What point two implies is that policy makers must consistently stick to price and not FX stability despite political influence or other pressures. However, as history shows, Nigerian policy makers (fiscal and monetary) are not mature enough to accept currency volatility. This is because there is no mechanism for panicky agents to insure themselves against volatility, which results in demand front-loading during periods of crises. This fear is largely what forces policy makers to consistently prioritise FX stability. Before we float, we must develop a fully liquid futures market.

Long and short in the absence of any modification in the underlying institutional make-up, the claim for imposition of a floating exchange rate regime looks like theoretical utopian drivel with no context of the Nigerian setting.

Delve straight into the solutions

Nairametrics should be very concerned about the quality of op-eds they receive. Or at least have editors brush it up.

When I saw this: “On Friday, the Naira closed at N390/$ down from N520/$ in January” I was livid. The rate was not N520/$ in January, it was N520/$ in February (20th of February to be precise). So, I begin to question the intelligence of anyone who claims to have a thing against floating, when such an obvious error is made.

And I can’t even begin to pick out all the fallacies in this report. The 2012-2013 so-called capital inflows increase that was because of global central banks, when in actuality it was because of improving fundamentals in the Nigerian economy (evident by the sharp drop in 2014 when oil price fell and our fundamentals went south).

Anyone that doesn’t know a float guarantees capital inflow to the real sector not simply because of FX sales for imports, but because of spendings in the real sector (that’d push us faster out of recession) is not supposed to have an article up on Nairametrics. You can’t be crying out for FDI investments to develop the real economy and then lock the date because you don’t think they’d be enough for FX sales.

Then I literally spilled my coffee, when he moved into the “Can Nigeria float?” section. Really, how old is the author? Did Nigeria change the legal code and make the NNPC a behemoth in the FX sector when Joseph Sanusi and Soludo and SLS each established a free float at various points in their tenures?

This whole article sounds like a poor excuse from a politician rather than a qualified economist. It’s a disgrace.

And I didn’t want to respond to the other article by the same article. That one is way worse.

Every time Nigeria has imposed restrictions, every time we’ve lost the currency war, and every time we go back to our unhealthy habits, after wasting tens of billions of dollars. Soludo ate up $20b in the space of 8 months and the Naira still fell 25% (only to magically increase in value, after the float, when our fundamentals improved). Emefiele has done better with the reserve considering how long oil stayed under, but the Naira still fell by 50%.

We all know how this story ends. Naira will lose another 25% whenever CBN decides they’re tired of using intervention as a political tool.

And then true to form, when there’s oil price stability, we’ll all move back to high imports (we’ll put the import prohibition list in the trash), disastrous sharing by politicians, and diversification will return to the annals of history (to be reawakened by the political class when another tsunami hits).

The intervention has made the government lazy. Preparing an economic plan in 18 months?! Only in Nigeria. FDI to boost the economy has stayed out. Even the $30b loan they need to “spend our way out of the recession” hit a roadblock. And somehow, an arm-chair, bottom-dweller economist thinks it is for the greater good, when even prices of most goods and services (except fuel) hinges on the parallel rate (fueled by greed of speculators and complicity of the CBN and its FX acolytes), paid with salaries that were fixed when Naira was at N135-150/$.

Oh look, I made a better argument for a float in a comment than an entire article argument against a float.

Per se.i do not see any problem here or there,the floating or not floating the naira.ANYBODY THAT FLOATES THE NAIRA BY ANY MEANS DESERVE DEATH, FOREIGNER OR NIGERIAN.

let us concentrate on the evidence,i was curious,if it.s nairametric opinion,but they said it’s not their opinion,so this article is of no consequences,since godwin took over he have been saying since 2015,there is liquidity of forex.i saw it last week dated sometimes in 2015,my view is that this giving forex to banks or bdc should not be in cash,BUT THEY ARE GIVING CASH FOREX to bank and bde,which is crazy,the cbn do not control the supply of printing of forex currencies.e.g dollar or pound.,THE CBN IS AT THE MERCY OF FOREIGN CENTRAL BANK.now they said the naira is the legal tender in Nigeria,now the question is with what .is it your bum or not ?,when you allows foreign currencies is used as legal tender with the naira.

The naira have been battered by devaluation,deficit,when you allows foreign currencies in circulation,you support the strength and gives some value those foreign,some relevance and importance,God damn this govt and their policiesThe govt should should explode the possibility of nationalizing some bank,ans expel those white foreign parasites in nigeria.

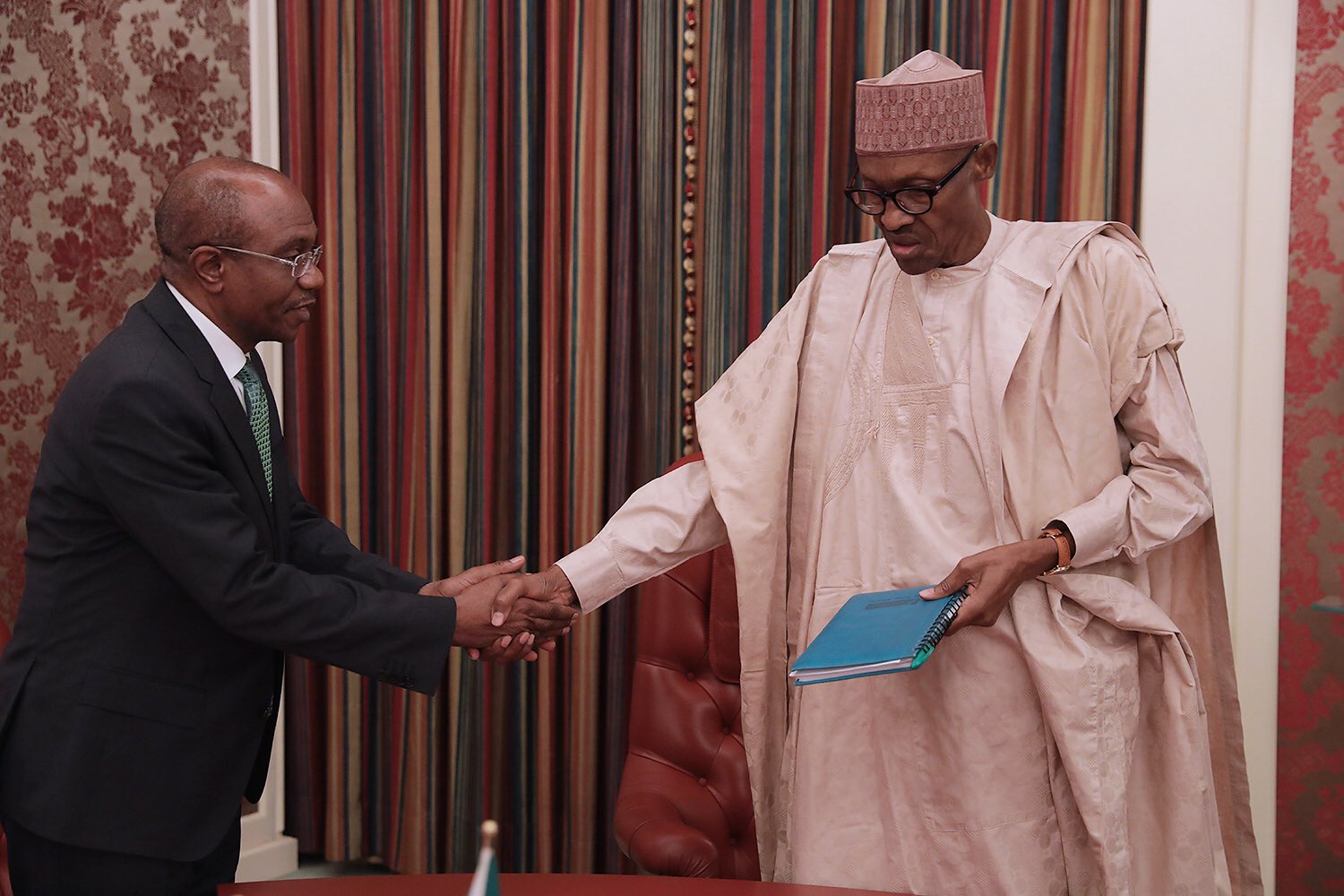

The floating of the naira is A NON-GOING AREA.PRESIDENT BUHARI IS OPPOSED TO THE FLOATING OF THE NAIRA.sometimes when you give somebody bad name to hang it,and this is what happen with the naira.we Nigerians knows those foreigners who conspired with some selfish Nigerians bent on destroying our country.we knows whose Nigerians who betrayed Nigeria,we knows those in the cbn and the ministry of finance who betrayed GEJ.

Now this demented white boy think we are stupid,where he is getting his data,he can resort to insulting nairametric staff,come out and fight like a man not under the clock of anonymous or nevermind, e-mail adress.however the staff of nairametric deserves this insults,they are getting from foreigners in their country