The Central Bank of Nigeria (CBN) has finally initiated moves to implement the ban of foreign exchange (FOREX) access to milk importers.

According to a document reportedly sighted on Tuesday, the apex bank has now directed Deposit Money Banks (DMBs) in the country to stop the processing of milk and its related products on “Bills for Collection basis,” which allowed the importer to buy on credit.

The details: In a circular addressed to DMBs, the apex bank also announced that henceforth, the mode of payment with regard to the importation of milk and its related products must be on the basis of Letters of Credit (LC) only.

According to a letter sighted by NewTelegraph, an email a Tier 1 lender sent to its customers included the directive as part of CBN’s efforts aimed at streamlining payment modes for food imports.

The letter dated 26th August 2019 and titled ‘LETTERS OF CREDIT AS MODE OF PAYMENT FOR THE IMPORTATION OF MILK AND ITS RELATED PRODUCTS’ read:

“As part of efforts aimed at streamlining payment modes for imports, the Central Bank of Nigeria (CBN) has directed all Authorised Dealers to discontinue the processing of imports of milk and its related products on Bills for Collection basis.

“For the avoidance of doubt, the mode of payment in respect of milk and its related products shall henceforth be on the basis of Letters of Credit (LC) only.

“Thank you for your continued patronage.”

[READ MORE: Buhari’s food importation ban could drag the Nigerian economy into misery]

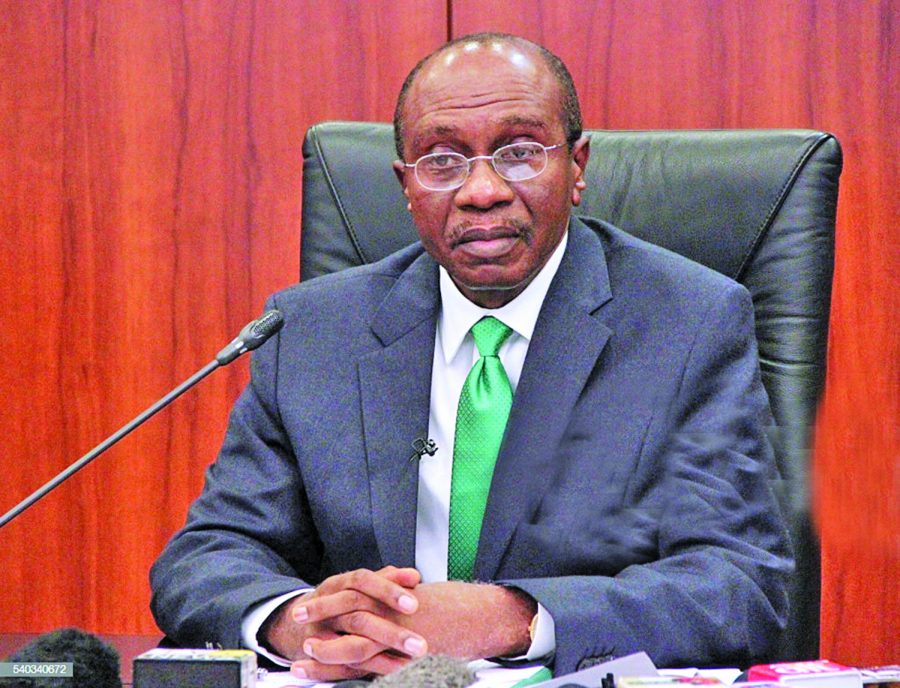

The backstory: The move by the CBN followed a recent circular it released, where Godwin Emefiele, the apex bank’s governor, reiterated the bank’s plan to restrict FOREX for the importation of milk and other dairy products.

- According to Emefiele, Nigeria spends between $1.2 billion to $1.5 billion annually on importation of milk and other dairy products. The CBN governor noted that although there were some successful attempts at producing milk locally, the vast majority of the importers still treat this national aspiration with imperial contempt.

- While Nigerians were reeling the CBN’s policy move and various stakeholders reacted, the CBN disclosed that all food items would be restricted FOREX.

- Following the new policies, milk and all food import may now officially be ineligible for FOREX, and importers will no longer have access to the Investors & Exporters Window (I&E) for foreign currencies required to carry out transactions.

What it means: The latest action by the CBN should not come as a surprise, and the bank had reiterated that it had already commenced the implementation to restrict FOREX for food and milk importers, stressing that, there is no going back.

The new CBN directive to banks means the apex bank has officially tightened the noose on milk importation. Milk importers should, therefore, brace up to prepare sourcing their own FOREX by patronising bureau de change or other sources.

As early stated, this will come at a higher cost and the implication is that consumers will be made to bear the brunt of the extra costs incurred by the investors.

[READ ALSO: CBN issues disclaimer: Warns public to beware of false loan empowerment scheme]