Cautious trading as market rates adjust

IMF Staff Concludes Visit to Nigeria

The outlook for 2018 remains challenging, as private sector lending remains low and foreign exchange inflows are mostly short-term. – IMF

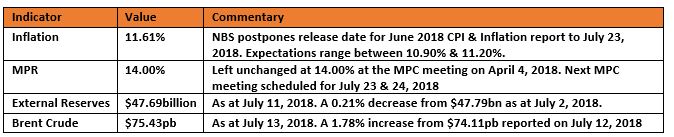

KEY INDICATORS

Bonds

A relatively quiet trading session saw yields compress by c.2bps on the average across the curve. Investors however appeared to be slightly risk-off bonds on the longer end of the curve, as demand slowed down causing yields on the longer dated securities to expand by c.3bps on the average.

We retain a cautious outlook on bonds in the interim, as current yields provide profitable exit opportunities for local and foreign bond holders.

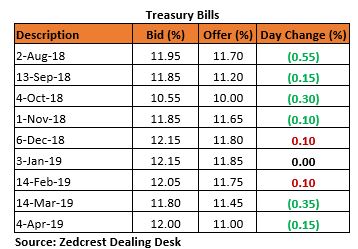

Treasury Bills

Yields in the T-bills market trended slightly lower due to the relatively buoyant level of liquidity which spurred some demand by market players on the shorter end of the curve. We also witnessed slight demand from clients on the medium to long end of the curve. Yields consequently compressed by c.15bps on average. We expect yields to remain relatively stable in the coming week due to the relatively buoyant level of liquidity in the system and expectations of some client demand ahead of the OMO and PMA maturities on Thursday.

The CBN will conduct a Primary Market Auction in the coming week (Wednesday), with N5.85bn, N26.60bn and N145.96bn of the 91-, 182- and 364-day bills expected to be rolled over. We do not expect any significant change in the PMA stop rates from the previous auction which cleared at 10%, 10.30% and 11.50% respectively

Money Market

Rates in the Money Market opened and closed on a calm note as a result of the robust liquidity in the interbank market which is estimated at N303bn closing today, coupled with the absence of an OMO Auction by the Central Bank. Funding rates are expected to trend northward next week as we expect the CBN to conduct wholesale FX sales which will further put pressure on systemic liquidity. The CBN is also expected to conduct an OMO later next week

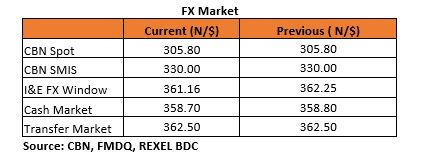

FX Market

The Naira regained prior losses at the I&E FX Window, with the NAFEX rate appreciating by 0.30% to close at N361.16 from N362.25/$ previously. The Interbank rate however remained flat, closing at N305.80/$.

Rates in the parallel market closed the week on a flat note as USD cash and transfer rates closed at N358.70/$ and N362.50/$ respectively.

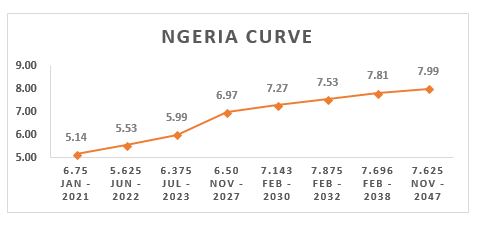

Eurobonds:

In line with the theme for the week, NGERIA Sovereigns continued to witness demand interest during today’s trading session, as yield compressed by an average of c. 0.08bps across the curve.

We also saw some decent demand in the NGERIA Corps in today’s session, with yields compressing further by c.11bps across board. Market participants continue to position against possible reinvestment risks as a result of anticipated liquidity coming from the $300million FBNNL 2020s early redemption.