Nairametrics| Last weekend, the Access-Lagos Marathon took place with Kenyan runner Abraham Kiptum winning the 41km dash round the streets of Lagos for the second year running, shaving one minute of his 2016 time to finish the race in 2hours 15minutes.

As with the Kenyan, chances appear bright that Access looks set for a stellar FY 16 results announcement with a fresh burst of pace from the sale of the SIPML investment announced on Friday. We have a positive view on Access with an OVERWEIGHT rating (FVE: N7.96).

[read more=”Continue Reading” less=”Read Less”]

Access Bank Disposes its stake in SIPML: Access filed a notice on the NSE that it had obtained regulatory approval for the disposal of its 17.6% stake in Stanbic IBTC Pensions Managers Limited (SIPML) – the pension subsidiary of Stanbic IBTC Holdings Plc—the largest pension fund administrator in Nigeria with 1.4million RSA contributors and AUM of N1.6 trillion using its most recent audited accounts (2015).

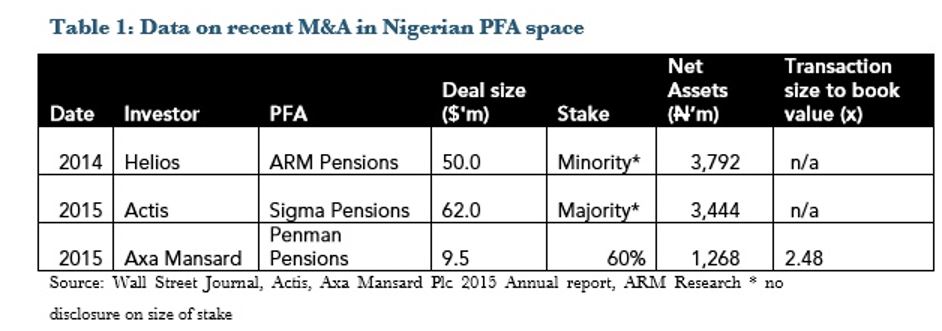

Transaction raises prospect for sizeable gain: Access acquired the SIPML stake in 2007 for N75 million and as at 9M 2016 using a P/B multiple, the bank fair valued its stake at N957 million. Though the notice did not include information regarding the deal size, we look at data on precedent transactions in the sector over the last three years. Transaction raises prospect for sizeable gain.

In its most recent audited report, SIPML net assets stood at N17.8 billion implying Access share on book value basis of N3.1billion. Using multiples from AXA Mansard’s 60% acquisition of Penman Pensions at 2.5x net assets, we estimate that Access should have sold its stake by at least N7 billion which should generate a profit on its income statement.

That said, Penman Pensions was a relatively small pension fund with AUM of circa 1% of SIPML. A naïve scaling for AUM size suggests potential valuation north of N12 billion. Overall, we see higher prospects for Access to report significant gains on this transaction in its income statement. In keeping with trends in the Nigerian environment where announcement of special dividends accompany disposals of investments, there exists higher prospects for a special dividend announcement. Nevertheless, given the current soft macro environment, one could argue that Access could retain some of the profits from the transaction to bolster capital buffers.

We remain positive on Access ahead of FY 16E release: We have been bullish on Access over the last one year as the bank positioned itself to be a beneficiary from naira weakness in 2016 via several cross-currency swaps ($900 million outstanding as 9M 16). Furthermore, its low exposure to upstream O&G (5% of loan book) and no exposure to troubled power sector loans implied limited exposure to sectors facing macro headwinds. We think the announcement implies fresh upside to our earnings estimates (2016E: +21% YoY) and prospects for the announcement of a special dividend could spur share price rally. The stock closed 5% higher on Friday following the announcement.

On a related note, in the typical merger arbitrage move, Stanbic IBTC could succumb to negative sentiment as investors fret over the likely source of funding for the purchase of Access’ minority stake in SIPML. Given its failed attempt at raising capital, worry over a potential cut in dividend payout ratio or fresh gearing to fund the purchase could spur bearish sentiments against the stock.

This article was written by ARM Research. Visit ARM research portal to get research reports on the Nigerian economy.

[/read]