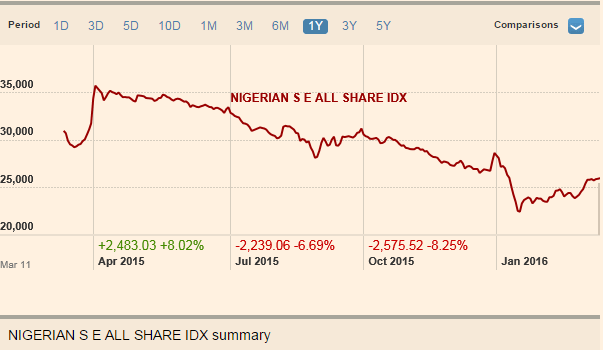

The market opened on a bullish note, extending its most recent bull run to 8-consecutive sessions of gains. This however broke on Tuesday. But the market shrugged off that brief interruption, continuing northward for the rest of the week. The positive sentiment was driven by markets expectations of earnings and corporate action announcement from the Banks. The week ended with a smallish week-on-week gain of 0.65% to close the All-Share Index at 25,988.40pts.

The Oils were the principal drivers of market performance, jumping 4.41% on the back of a recovery in OANDO (+53.30%) & TOTAL (+8.89%). The Financials were also supportive with week-on-week gains of 2.35% and 1.78% in the Banking and Insurance Index respectively. This was driven by gains in the likes of FCMB, UBA & FIDELITY. In the same vein, the consumers closed the week higher following a recovery in the flour millers – HONYFLOUR (+25.00%) & FLOURMILLS (+18.03%). The weakness came in from the Industrials

Market activity remained tepid with a turnover of 1.11bn shares valued at N7.45bn in line with the 1.47bn shares valued at N7.99bn that traded in the previous week. As in the previous week, turnover was driven by trades in ZENITHBANK, NB & GUARANTY – activity in these names accounted for about half of total market turnover. While in terms of volumes, the activity was mainly in the shares of FIDELITYBK, FCMB & ZENITHBANK. The action in these names was largely due to block trades by offshore investors. Our sense is that active participation came in from index types, perhaps on the back of a fresh subscription funds.

Market Snapshot

- All-Share Index: 25,988.40pts

- Market Cap (NGN): 94tn

- Market Cap (USD): 38bn

- Total Volumes Traded: 11bn

- Total Value Traded (NGN): 45bn

- Daily Average Value Traded – WtD (NGN): 49bn

- Daily Average Value Traded – YtD (NGN): 28bn

- Advance/Decline Ratio: 77

Sector Performance:

Market Screeners:

- Top Risers: TIGERBRANDS (+59.30%; N2.74); OANDO (+53.30%; N5.35) & HONYFLOUR (+25.00%; N1.80)

- Top Decliners: BETAGLASS (-9.00%; N45.50); AGLEVENT (-5.00%; N0.76) & CAVERTON (-5.00%; N1.52)

- Top by Volumes Traded: FIDELITYBK (202.93mn); FCMB (117.85mn) & ZENITHBANK (106. 66mn)

- Top by Value Traded: ZENITHBANK (N1.311bn); NB (N1.19bn) & GUARANTY (N0.99bn)

- New 52-Week High: Nil

- New 52-Week Low: CAVERTON (N1.52); IKEJAHOTEL (N2.60); NIG GERMAN (N4.67) & UNIONDICON (N11.25

Whats your take on the banks? do u think GTB’s result is a fluke and we should be weary or to u advice buys to take advantage of the earnings season?