Nigerian equities posted strong gains driven by impressive numbers and corporate action announcements from DANGCEM and to a lesser extent AFRIPRUD as well as improved market sentiments, as local investors positioned ahead of earnings release by other corporates.

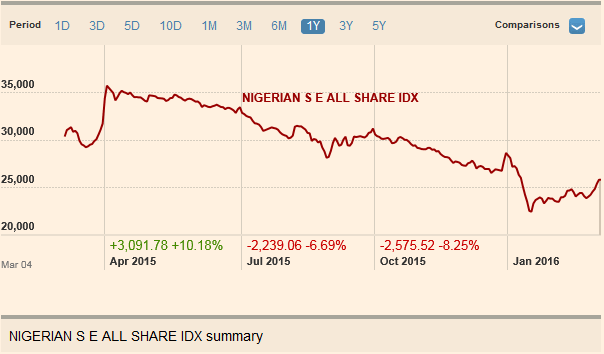

These saw the All Share Index surge 6.57% to close at 25,820.10pt, following 5-consecutive session of gains. At current levels, the YtD market decline has been trimmed to single digit (-9.85%).

A drill down into the market’s performance shows that the gains came in from the NSE Premium Index (DANGCEM, ZENITHBA & FBNH) which was up 20.7% while the NSE Main Board Index made up of other listed companies declined 0.54% w/w. Sector wise, the Industrials saw the steepest gains, jumping 11.38% on the back of gains in DANGCEM.

On its heels, were the Financials, with the Banking and Insurance Index up 5.45% and 1.42% respectively. The weakness came in from the Oils which declined 6.10% on sustained selling pressure in FO and CONOIL which is trading at a 3 year low as well as profit taking which got underway in SEPLAT. The Consumers also came in lower, down by 1.36% w/w.

Market activity levels dipped sharply, with a turnover of 1.47bn shares valued at N7.99bn, down by over a third from the N11.74bn traded in the previous week. The week saw a daily average value of N1.60bn which was also down by about a third compared to the daily average value in 2016 (N2.31bn). The action was mainly in 3 names – GUARANTY, ZENITH & NB – these names accounted for over half of total market turnover. Volume wise, WAPIC, FCMB & ACCESS moved the most number of shares. In terms of participation, it was mixed with foreigners still largely on the sell side and locals on the buy side of transaction.

Market Snapshot

- All-Share Index: 24,820.10pts

- Market Cap (NGN): 88tn

- Market Cap (USD): 09bn

- Total Volumes Traded: 48bn

- Total Value Traded (NGN): 99bn

- Daily Average Value Traded – WtD (NGN): 60bn

- Daily Average Value Traded – YtD (NGN): 37bn

- Advance/Decline Ratio: 46

Sector Performance:

Market Screeners:

- Top Risers:

TIGERBRANDS (+30.30%; N1.72); UCAP (+29.55%; N1.71) & AFRIPRUD (+27.73%; N3.27)

- Top Decliners:

FO (-14.26%; N293.23); FCMB (-10.13%; N0.71) & CONOIL (-9.71%; N1.5)

- Top by Volumes Traded:

WAPIC (214.78mn); FCMB (194. 66mn) & ACCESS (168.79mn)

- Top by Value Traded:

GUARANTY (N1.78bn); ZENITHBANK (N1.56bn) & NB (N0.88bn)

- New 52-Week High:

Nil

- New 52-Week Low:

FIDSON (N2.30); FCMB (N0.68); FIDELITYBK (N1.08); TOTAL (N137.75); CONOIL (N16.56); HONYFLOUR (N1.29); MANSARD (N1.80) & OANDO (N2.90)