The Nigerian stock exchange has released its February foreign portfolio report showing foreign inflows into the Nigerian stock market as well as outflows.

According to the report, monthly FPI transactions at the nation’s bourse which was N99.11 billion at the end of January 2015 increased to N133.95 billion (about $0.68 billion) at the end of February 2015, up 35.15% from January 2015.

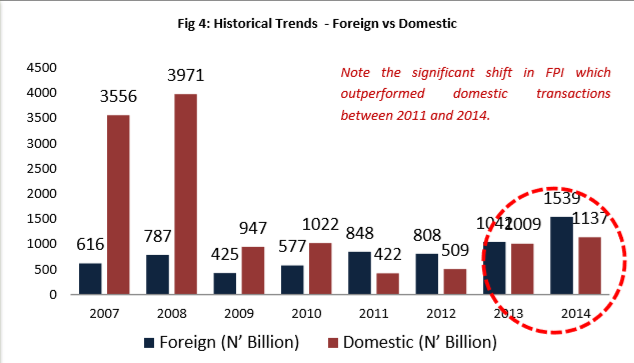

Domestic investors conceded about 45.22% of trading to foreign investors as Domestic transactions decreased from 47.76% to 27.39% while FPI transactions increased from 52.24% to 72.61% over the same period.

In comparison to the same period in 2014, total FPI transactions decreased by 1.71%, whilst the total domestic transactions decreased by 19.03%. FPI outflows outpaced inflows which was consistent with the same period in 2014.

Overall, there was a 7.15% decrease in total transactions in comparison to the same period in 2014.

Total Outflows

The report more importantly also showed that a total of N81.6billion was recorded as outflow for the month of February up 59.7% from the previous month and dropped 22.5% year on year.

Significance

This report helps measure activities of foreign investors in the nation’s bourse considering how much they influence demand and supply for stocks. A higher FPI activity buttresses market liquidity and activity.

![[The Nigerian Economy Daily] FG has approved the closure of five foreign missions and embassies](https://nairametrics.com/wp-content/uploads/2017/05/nigerian-economy-today-1.jpg?resize=350,250)