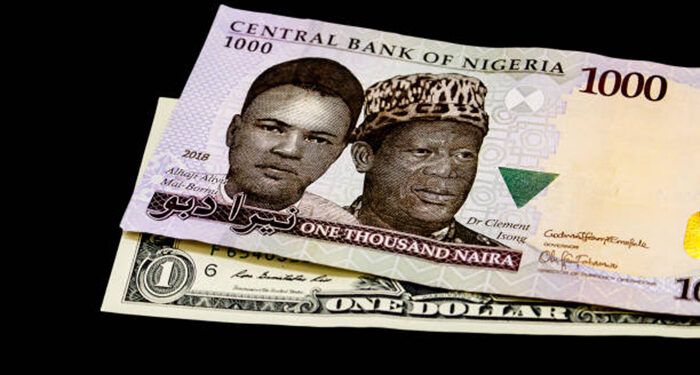

The naira has weakened further against the US Dollar, falling to N1,500.79/$1 on the official market on June 25, 2024.

This marks the lowest exchange rate since May 16, 2024, when it was recorded at N1,533.99/$1.

According to the FMDQ data for the NAFEM window, the naira’s depreciation on June 25 represents a 0.71% decline from the previous day’s rate of N1,490.2/$1.

This crash occurred amid the claim by the Governor of the Central Bank, Yemi Cardoso, that the country has already experienced the worst of naira volatility regarding foreign exchange.

The naira traded at a high of N1,507/$1 and a low of N1,426/$1, indicating significant volatility in the foreign exchange market. The significant difference between the high and low exchange rates indicates considerable volatility in the foreign exchange market.

FX turnover falls by 10.03%

The FX turnover for the day stood at $136.75 million, a significant drop of 10.03% compared to the previous day’s $152 million.

The latest figures indicate a troubling trend for the Nigerian currency, which has been under continuous pressure.

This decline comes amid efforts by the Central Bank of Nigeria (CBN) to stabilize the currency through various interventions.

The CBN earlier permitted eligible International Money Transfer Operators (IMTOs) to sell foreign exchange (FX) on Nigeria’s official window. This directive, effective immediately, is part of CBN’s plan to ensure greater remittance flows through formal channels and improve the liquidity of the foreign exchange market.

This move by the CBN comes at a time when the official market is struggling with FX liquidity. For about a month, the value of FX turnover on the NAFEM window has been between the range of $83 million and $390 million.

A similar move was made last month as the CBN allowed International Oil Companies (IOCs) to sell 50% balance of their repatriated export proceeds to authorized forex dealers.

What you should know

The naira had hovered below a N1,500 ceiling for over a month. This ceiling was breached today, which may signal a new wave of depreciation following over a month of stability in the official market.

Nairametrics earlier projected that currency weakness could be imminent due to the summer holidays when Nigerians mostly fly out of the country for vacations.

During an interview on Tuesday in London with Bloomberg TV, Cardoso said he is satisfied with how far they have been able to manage the currency crisis in the past few months.

Regarding whether the naira has reached its peak value or if further appreciation is expected, the CBN chief stated that it depends on “a host of different issues,” implying that the fiscal side plays a significant role in determining the value of the currency.

Cardoso, however, added that it is a work in progress as they will continue to implement certain macroeconomic fundamentals that will positively impact the market.