Nigerians continue to grapple with high costs of goods and services, leading to a whopping household expenditure of N57.1 trillion in the first six months of the year, representing a monthly average spend of N9.51 trillion on living expenses.

This is according to data on Nigeria’s GDP, by the expenditure and income approach, released by the National Bureau of Statistics (NBS).

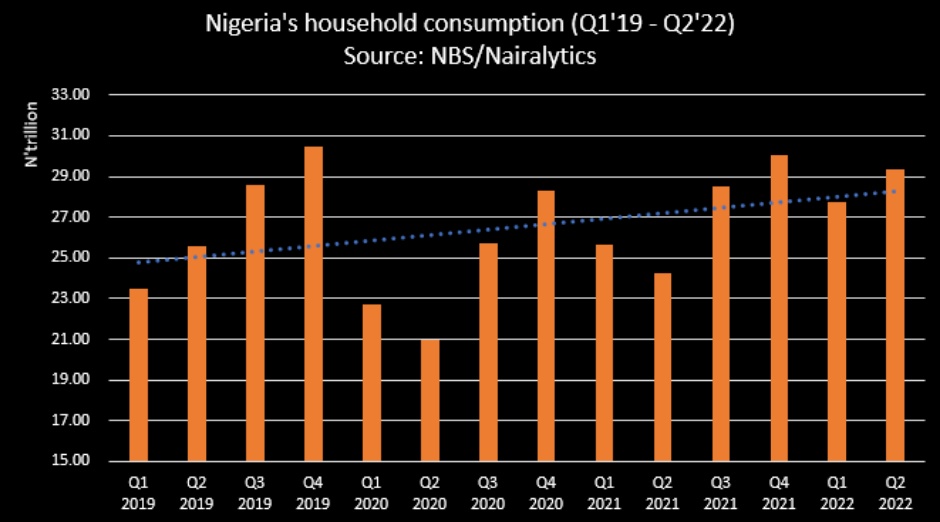

Nigeria’s household consumption expenditure in H1 2022 increased by 14.4% compared to N49.89 trillion recorded in the corresponding period of 2021.

Compared to the first half of 2020, which was affected by the covid-19 pandemic and movement restrictions, household consumption expenses surged by 30.6%, while it increased by 16.4% in contrast to N49.06 trillion recorded in the same period of 2019.

More data insight: Household expenditure in the first half of the year accounted for 62.4% of the total expenditure by the populace (gross domestic product by expenditure – N91.41 trillion). Consumption expenditure of non-profit organizations stood at N496.47 billion, accounting for 0.5% of the total.

Government consumption expenditure declined by 3.97% on a year-on-year basis to stand at N4.06 trillion, which accounts for 4.4% of the total GDP expenditure.

Meanwhile, the gross fixed capital formation, which is represented as fixed asset acquisitions minus disposals stood at N28.5 trillion, representing 31.2% of the total expenses.

A breakdown showed that N27.71 trillion was spent on household consumption in the first quarter of the year, while N29.37 trillion was spent in Q2 2022.

In terms of real value, which excludes the effect of inflation, Nigerians spent a sum of N27.29 trillion on household consumption, which is 12.1% higher than the corresponding period of 2021 (N24.35 trillion). Compared to the nominal increase of 14.4%, there is an inflation effect of 2.29%.

High costs impact household expenses: Rising cost of goods and services generally known as inflation has been a major bane of the Nigerian economy. However, in recent times, owing to a chain of global and domestic events, Nigeria’s inflation rate has surged to a tsunami level.

- In September 2022, headline inflation rose to its highest level since September 2005 at 20.77%, caused by a combination of increases in food prices and the core sub-index of the inflation basket.

- Further breakdown showed that Nigeria’s food inflation in September, which stood at 23.34% also accelerated to its highest since October 2005, while the core index which excludes volatile agricultural produce quickened to a 5-year of 17.6% in September 2022.

- Data from the NBS shows that Nigerians spend over 50% of their household expenditure on food, which indicates Nigeria’s low level of disposable income amongst most of the populace as prices continue to soar high while income remains relatively the same.

- Despite the huge amount spent by Nigerians on household consumption, the country still ranks 103 out of 121 countries in the world in terms of the global hunger index.

Household spending per capita: Based on the Bureau’s assumption that Nigerians spend about half of their household expenses on food, we could estimate Nigerians’ food expenses at N28.54 trillion for the first six months of the year and a population size of 211.4 million people.

- Further calculations showed that an average Nigerian spends less than N750 on food daily while reports suggest that a pot of Jollof rice costs an average of almost N10,000 for a family of five. This is significantly larger than the amount spent daily by average Nigerians.

- Nigeria’s food supply is currently being threatened by the raging flood ravaging the food-producing areas of the country, causing an astronomic increase in the price of food items, especially in the southern region of the country.

- Also, the cost of transportation has surged significantly, caused by the sudden increase in the cost of petrol, diesel, and jet fuels. Petrol price per litre rose from an average of N165 earlier in the year to over N200 per litre depending on the location. The price of diesel has also tripled year-to-date.

Higher poverty rate predicted: According to the World Bank, over 90 million Nigerians are estimated to be living in poverty, with projections hitting 95.1 million by the end of the year, largely due to the ripple effect of the covid-19 pandemic and the economic consequences from the Russia-Ukraine war.

The gap between the rich and poor is widening at a rapid pace, forcing more Nigerians to live below the poverty line. Nigeria’s unemployment rate according to the most recent data released by the NBS is over 33% (Q4 2022), while several companies have laid off workers this year in a bid to minimise its rising operating cost, which had been driven by the high cost of raw materials and energy.

The World Bank in a report titled, “A Better Future for All Nigerians: Nigeria Poverty Assessment 2022” noted that about 17% of Nigerian workers hold the wage jobs best able to lift people out of poverty, leaving a staggering 83% at the expense of poverty.

“Nigeria is currently facing sluggish growth, low human capital, labour market weaknesses, and exposure to shocks, which is holding Nigeria’s poverty reduction back,” the bank stated.

The bottom line: Poverty is arguably the most daunting issue affecting Nigeria. The rising cost of goods and services continues to impact the purchasing power of average citizens, forcing more people below the poverty line.

High spending on food items systematically means that citizens will struggle to spend on non-food items and savings. This will, in turn, affect the economy negatively.