The Bank of America has projected that the official exchange rate could likely be devalued to N520/$ in 2023 because it is well above fair value.

This was disclosed by Bank of America Economist Tatonga Rusike, in a note to clients seen by Bloomberg.

As you may know, the Central Bank of Nigeria’s (CBN) foreign exchange strategy has resulted in a significant premium between official and parallel market rates. As a result, the apex bank’s major move next year may be a devaluation to bridge the deficit, Rusike explained.

What Bank of America is saying

According to Tatonga Rusike, the naira is 20% overpriced. And this is based on three indicators:

- the popular black-market rate

- the central bank’s real effective exchange rate

- And the Bank of America’s “currency fair value research”

Rusike said, “We see scope for it to weaken by an equivalent amount over the next six-nine months, taking it to as high as N520 per USD.”

In the meantime, devaluation of the naira is unlikely to happen until after the February 2023 presidential elections, the bank said. This is despite the fact that the naira will likely come under increasing pressure “due to limited government external borrowing”.

The bank also warned that “the greater the disparity with the official market, the higher the likelihood of increasing excess demand for foreign currency on the parallel market”.

What you should know

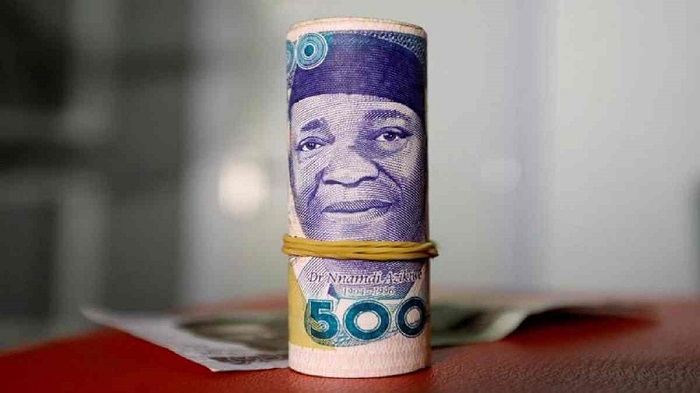

- The exchange rate between the naira and the US dollar at the I&E official window has been fluctuating around N440 to $1, while it trades around N742 to $1 on the black market.

- Nigeria’s foreign reserves have been declining due to the CBN’s ongoing intervention in the official market trying to maintain the stability of the local currency.

- The Association of Bureau De Change Operators of Nigeria (ABCON) had earlier blamed the apex bank for the significant difference between official and secondary market rates.

- According to ABCON, the naira has lost significant value against the dollar since the CBN stopped selling currency to Bureau De Change (BDCs) operators in July 2021.