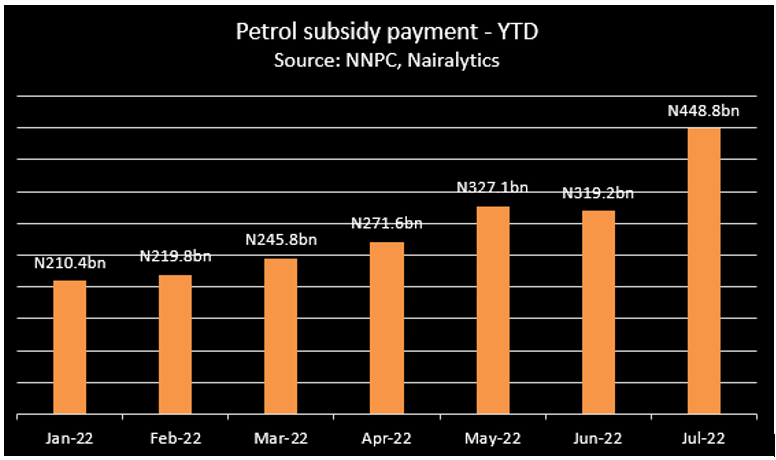

Nigeria’s petrol subsidy payments which gulped a whooping sum of N2.04 trillion between January and July 2022 to cushion the price effect on Nigerians is set to rise further to a little over N4 trillion. Removal of this welfare package will hit hard on Nigerians unless there is adequate investment in transportation and power, which Nigerians spend heavily on.

The N2.04 trillion subsidy payments in the review period, represents a N1.78 trillion variance from the prorated N258.25 billion budgeted by the federal government. This is contained in the NNPC presentation to the Federation Account Allocation Committee (FAAC) for the month of August 2022.

As a result of the huge subsidy payment, stated under-recovery of PMS or value shortfall, which is the cost of under-priced sales of petrol, Nigeria is now set for its biggest ever fiscal imbalance in history. Recall that the federal government recorded a fiscal deficit of N7.3 trillion in 2021, the biggest of its kind as of then.

However, with petrol subsidy payment expected to quaff at least N4 trillion, increased debt servicing cost, and oil revenue still underperforming as a result of oil theft and under-production, the difference between revenue and expenditure in 2022 could just overshoot the previous year’s record.

Why the need for subsidy

- Energy subsidies are essentially government actions towards price control, which serve a purpose of either lowering the cost of production for producers, or the cost of retail for consumers, with the government subsidizing the bill by covering part of the cost.

- This subsidy could come in form of direct payments, tax preferences, or trade restrictions. The Nigerian federal government’s petroleum subsidy reported as the “Under-Recovery of PMS/Value Shortfall”, is the cost of under-priced sales of premium motor spirit (PMS), more commonly referred to as petrol.

- While subsidies may have major benefits for the average citizen in the form of supply security or increasing disposable income, they tend to be detrimental to the government. Subsidies are an inefficient way for governments to use resources, with subsidy spending often coming directly from government revenue or in dire cases, government reserves.

- There have been calls to remove the fuel subsidy, however it is feared to cause inflationary pressure in the economy, especially at a time when the world is experiencing increased level of inflation.

The Minister of Finance, Budget and National Planning, Zainab Ahmed has revealed that the government plans to stop subsidy payments in 2023, stating that the subsidy regime was not sustainable and might force the government to borrow more in 2021.

However, Nigerians could be buying petrol at N482 per litre when the subsidy payment is discontinued, according to the managing director of the Nigeria National Petroleum Corporation Limited, Mele Kyari.

Meanwhile, the Customs comptroller-general, Hameed Ali, in a session with the House of Representatives’ Committee on Finance last week refuted the claim by the NNPC that Nigeria’s daily consumption of petrol is 60 million litres.

According to him, “I remember that last year we spoke about this. Unfortunately, this year, we are talking about subsidies again. The over N11 trillion we are going to take as debt, more than half of it is going to subsidy payments. The issue is not about the smuggling of petroleum products. I have always argued this with NNPC.

“If we are consuming 60 million litres of PMS per day, by their own computation, why would you allow the release of 98 million litres per day? If you know this is our consumption, why would you allow that release?” he argued.

This brings us to the question of petrol smuggling to other neighbouring countries where petrol is sold at a lower rate. The fact the fuel is cheaper in Nigerian encourages arbitrage, which could be taken advantage of by smugglers. This means that the Nigerian government could be subsidizing the consumption of a few rather than the Nigerian minority.

Scenarios like this will inevitably lead to calls for the government to scrap petroleum subsidy payments. Revenues from the energy industry should be deployed towards sectors like health, or education, or even put back into the NNPC’s downstream sector.

After all, the country presently hardly refines its own crude and has to rely on imports. The reliance on petrol imports inevitably drives retail prices upward, given the supply failures and inflation the global oil and gas industry has been a victim of. This also means the government has to spend more on subsidies to maintain retail prices favourable to end users. A cycle ensues and subsequently becomes entrenched.

Global and internal issues spurring subsidy spending

- Nigeria’s subsidy spending has increased progressively this year, with the month of July’s spending of N448.8 billion, representing a 40.6% increase from the previous month, and 113.3% higher than the N210.4 billion recorded in January 2022.

- July was notable for the petrol scarcity and ensuing fuel queues which occurred in major cities around the country. At the time, the NNPC Group Chief Executive Officer, Mele Kyari, attributed the scarcity to supply disruptions, particularly in the marine sector.

- The Independent Petroleum Marketers Association of Nigeria (IPMAN) were vocal about its inability to turn a profit at the then-pump price of N165, leading to the negotiation of a N10 per litre increase.

- Recall that the price of crude oil has remained elevated at the global market, hence leading to an increase in the landing cost of petrol. Also, considering that Nigeria is a net importer of petrol and would be affected by the volatility recorded in the crude oil market as a result of the Russia-Ukraine war.

- Notably, 72% of all revenue collected by the corporation in 2022 has been used to service subsidy payments, with the rest going into infrastructure projects. NNPC has not made any remittances to the Federation Account Allocation Committee (FAAC) this year.

- This also means that state and local governments will also see their allocation drop significantly and have to look inwardly to fund their operations.

What needs to be done

- The July spike is important because it is supposed to be the exact scenario subsidies should be able to protect Nigerians against. Negative market shocks such as supply disruptions generally cause price hikes, which should be tempered by subsidy payments. In this case, it did not, with the marketers demanding, and getting, the price increase.

- If subsidy payments continue to play such a huge role in the nation’s fiscal imbalance and are now failing to protect the citizens from price hikes, it defeats the essence of the subsidy in the first place. Although, subsidy removal comes at cost too.

- According to the Transmission Company of Nigeria, the country has an installed generation capacity of 13.01GW, with 7.65GW available for actual generation. By comparison, South Africa generates about 58.09GW.

- Nigeria’s electricity generation underperformance, along with a 57% electricity access rate for a population of over 210 million, means that most households and businesses have to generate their own electricity.

- For these people, the removal of the subsidies will lead to a situation like that of Yemen in 2014, where subsidy removal produced such negative outcomes that the government reversed its decision.

- It could serve the country well to act more towards the long-term, with an eye on subsidy phase-out plans being implemented by countries such as Saudi Arabia and Egypt. The former country has a plan to phase out subsidies completely by 2030, with gradual increases to energy retail prices. Starting the phase-out in 2016. the Middle East giant has a plan to attain total price deregulation by 2025.

- Egypt has committed to massive development of energy and transportation infrastructure, with the idea of cushioning energy price increases by reducing individual and household energy demands.

Nigeria can pick pointers from these countries. Public transportation in most major cities is often inadequate and cannot meet the demand from huge populations. Hence, an increasing number of people opt for private transport, driving primary demand.

Unless the country invests in transport and power infrastructure, primary demand for fuel will remain high. While that continues to happen, any abrupt subsidy removal could prompt a reaction such as the nationwide protest and strike actions in 2012.

The subsidy payments are undoubtedly a strain on the country’s finances, and the nation’s president has set June 2023 as the deadline for removal of the subsidy. This deregulation will lead to a dramatic increase in the retail price of PMS in the country. However, it remains to be seen how the government plans to cushion the economic heat Nigerians will face.