The Nigerian equities market consolidated on the gains recorded in the previous week as it posted a 1.83% growth in the all-share index in the week ended 13th August, 2021 to close at 39,522.34 points.

Investors in the local bourse gained N371 billion during the week as the market capitalisation recorded a growth of 1.83% to close at N20.59 trillion compared to N20.22 trillion recorded at the end of the previous week.

This is contained in the weekly market report released by the Nigerian Exchange group (NGX).

Equity Market Performance

During the week, a total of 1.61 billion shares valued at N12.59 billion was traded in 18,622 deals compared to 989.59 million shares at N8.18 billion, which exchanged hands in 19,617 deals in the previous week.

- The financial service industry led the activity chart at the bourse with trades in 584.79 million shares worth N3.728 billion across 8,658 deals.

- The financial services sector contributed 36.32% and 29.62% to the total equity turnover volume and value respectively.

- The consumer goods industry followed with 525.860 million shares worth N3.655 billion in 3,553 deals. The third place was the natural resources industry, with a turnover of 250.928 million shares worth N1.376 billion in 72 deals.

- The top three traded equities during the week were Honeywell Flour Mill Plc, B.O.C. Gases Plc, and Flour Mills Nig Plc, which traded an aggregate of 724.07 million shares worth N3.91 billion in 1,061 deals, contributing 44.97% and 31.06% to the total equity turnover volume and value respectively.

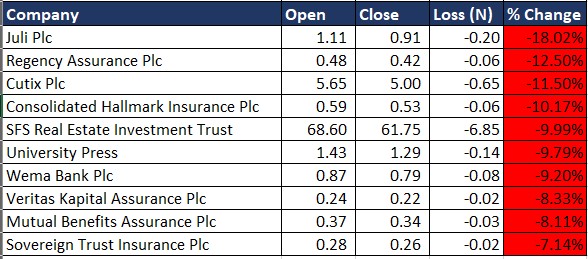

- Twenty-nine (29) equities appreciated in price during the week, the same number of equities depreciated in price, while ninety-eight (98) equities remained unchanged.

Notably, all other indices finished higher with the exception of NGX Premium, NGX Insurance, NGX ASem, NGX AFR Div Yield, and NGX Industrial Goods Indices which depreciated by 0.17%, 2.37%, 2.82%, 0.24%, and 1.35% respectively, while the NGX Growth Index closed flat.

Top gainers

Top losers

Exchange-Traded Products (ETPs)

Trading activities in exchange-traded products dropped during the week, compared to the previous week as a total of 28,938 units valued at N949,074.38 were traded across 3 deals.

This represents an uptick in volume compared to 17,550 units traded last week. It, however, dipped significantly in terms of value compared to N34.01 million recorded in 36 deals in the comparable period.

The 4 ETFs traded during the week were; MERGROWTH, STANBICETF30, LOTUSHAL15, and NEWGOLD.

Fixed Income Securities Market

In the same vein, the fixed income market recorded a significant drop in the volume and value traded during the week as against the previous week.

A total of 139,062 units valued at N139.702 million were traded this week in 19 deals compared with a total of 702,021 units valued at N709.343 million transacted last week in 17 deals.

Specifically, the 6 bonds traded in the week were FG152023S3, FGSUK2027S3, FG112034S2, FG112024S1, FGS202489, and FGS202143.

During the week, Dangote Cement listed 3 tranches of Bonds, valued at N150 billion under its N300 Billion Debt Issuance Programme. The three tranches have coupon rates of 11.25%, 12.5%, and 13.5%, with a maturity date of 30 May 2024, 30 May 2025, and 30 May 2028 respectively.