Yesterday’s news reports said the United Arab Emirates and Saudi Arabia reached a compromise on oil production quota. Earlier in the month at the 18th meeting of the Organisation of Petroleum Exporting Countries and its Allies (OPEC+), the decision of members to increase daily production by an additional 0.4mbpd received stiff opposition from the UAE, as it sought to make the group increase its production from the current 3.17mbpd.

Based on the report, an agreement has been reached to increase UAE’s production, but it is subject to approval of members at an extra-ordinary meeting soon to be convened. Price has since reacted, dropping 0.64% to US$74.28.

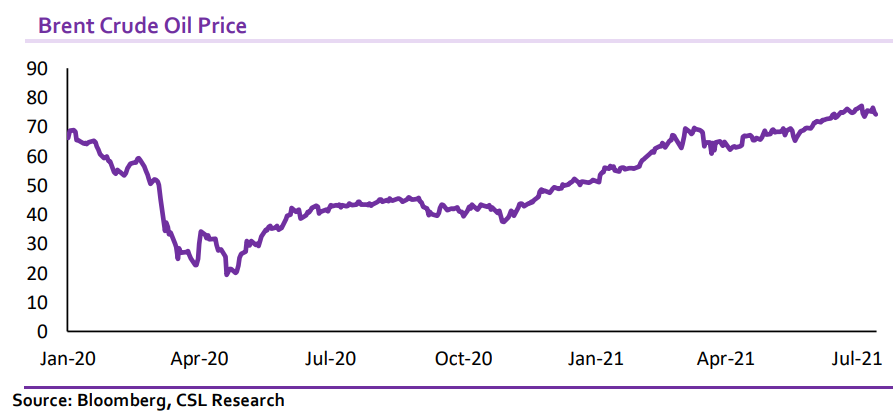

The onset of the coronavirus pandemic in 2020 resulted in a slump in global demand for energy, which caused a significant decline in oil prices (BRENT and the West Texas Intermediate) to an all-time low. This prompted the institution of production cuts by OPEC+ to support prices. Initially, the Cartel had settled for a 9.7mbpd production cut to match supply with demand. This has been gradually eased to 5.8mbpd by July. Since then, the global economy has continued to show signs of recovery. OPEC expects that global demand for crude-oil will grow by an average of 6.6%, reaching close to the pre-pandemic levels by the end of the year.

Rising oil price bodes well for the Nigerian budget, given its benchmark price for crude oil for the 2021 fiscal year is pegged at US$40/bbl. Any decision to increase output by the cartel, would also result in increased production for Nigeria. On the flip side, an increase in oil prices implies an increase in the price of petrol which currently implies an increase in subsidy reported as under-recovery losses in the books of the NNPC.

Despite the rising oil prices, however, the impact is yet to be seen in the level of the country’s reserves. This reflects the increased CBN’s FX interventions and low impetus for foreign inflows. Nigeria’s external reserves stood at US$32.85bn as of 12 July 2021, with oil portion of export receipts at 66.4% as of Q1 2021.

CSL Stockbrokers Limited, Lagos (CSLS) is a wholly owned subsidiary of FCMB Group Plc and is regulated by the Securities and Exchange Commission, Nigeria. CSLS is a member of the Nigerian Stock Exchange.