The Federal Government has announced plans to review the 2020 budget as oil revenue comes under severe pressure following the rampaging impact of the coronavirus on oil price.

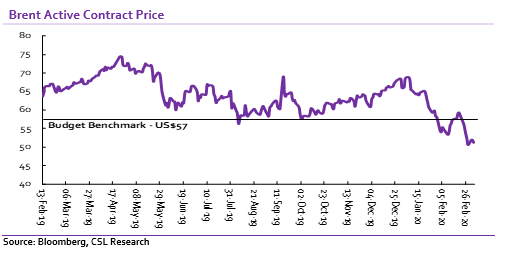

Brent crude price which is the benchmark for Nigeria’s crude price is down 22.5% YTD. We recall the 2020 budget was benchmarked on an oil price assumption of US$57/bbl and oil production of 2.18mb/d.

According to the 2020 budget document, Nigeria’s crude oil sales were expected to contribute c.35% of the Federal government’s total revenue. In the 2019 budget performance, we note that despite oil price remaining in line with budget benchmark, Nigeria’s oil revenue still underperformed significantly with a performance of 52% as at 9M 2019 due to lower than budgeted production levels.

Media reports state that oil traders are struggling to sell oil from West Africa (Nigeria & Angola) as European and Chinese refiners are cutting demand due to tight margins and lower economic activity. According to these reports, c.70% of April futures cargoes from Angola and Nigeria are yet to find buyers. This is as millions of barrels slated for export in March remain unsold.

Thus, we think a mix of lower demand and lower price may be forcing the finance ministry to rethink its revenue strategy for the year. A Punch report says the Finance ministry plans a midterm review to make necessary adjustments to the country’s revenue forecasts and sources.

[READ MORE: Insecurity: On the rise again)

We think the Federal Government has very limited alternatives to cover any shortfall from oil revenue. It recently implemented aggressive tax policies via the Finance Act as well as introducing stamp duties (which the FG budgets would raise N200.0bn in revenue in the 2020 budget). The easiest alternative would be to increase the planned debt finance raise via Eurobonds.

We think the low-interest rate environment would help the Federal government raise cheap debt. However, we note credit spread on Nigeria’s foreign debt instruments may be widening given all 3 major rating agencies have downgraded Nigeria to a negative outlook based on elevated FX earnings concerns.

______________________________________________________________________

CSL STOCKBROKERS LIMITED CSL Stockbrokers,

Member of the Nigerian Stock Exchange,

First City Plaza, 44 Marina,

PO Box 9117,

Lagos State,

NIGERIA.