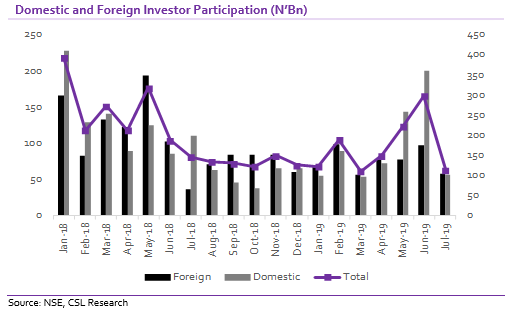

According to data released by the Nigerian Stock Exchange (NSE) on domestic and foreign investor participation in the equities market for July 2019, total value traded plunged 62% m/m to N113.5 billion (US$315.3 million) – the lowest level since March 2019 – N110.1 billion (US$305.6 million). The steep decline in the month of July was due to the significant decline in value of transactions by foreign investors (down 40% m/m) who accounted for 51% of total transactions and domestic investors (down 72% m/m) who accounted for 49% of total transactions.

In our view, the steep decline in the value of transactions traded in the month of July may be related to unimpressive corporate earnings from many consumer goods companies/industrials such as Unilever Nigeria, Dangote Sugar, and Dangote Cement, etc and weak appetite for risky assets, owing to trade tensions between China and U.S which continues to create the fears of an impending global recession.

[READ ALSO: Nigeria received capital inflows worth of $33.27 billion in 17 months]

Although the net outflows by foreign investors declined to N1.1 billion (US$3.1 million) in July, lower than N8.1 billion (US$22.5 million) recorded in June, it marked the eleventh consecutive month that net outflows have been recorded, making foreign investors net sellers of Nigerian equities.

In the short to medium term, our outlook for the equities market remains subdued as we believe that the ongoing trade spat between U.S and China which has raised concerns of a slowdown in the global economy will continue to inhibit foreign investors appetite for risky assets in emerging economies. Specifically for Nigeria, the positive correlation between oil prices and stability in the exchange rate makes the country extremely vulnerable to external shocks.

[READ ALSO: Investors should take advantage of over $48bn opportunities in oil sector]

CSL STOCKBROKERS LIMITED CSL Stockbrokers,

Member of the Nigerian Stock Exchange,

First City Plaza, 44 Marina,

PO Box 9117,

Lagos State,

NIGERIA.