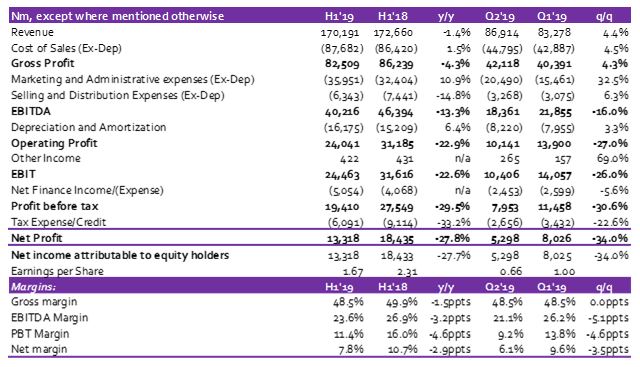

Nigerian Breweries (NB) in its recently released H1 2019 financials reported a marginal 1.4% decline in Revenue to N170.2 billion from N172.7 billion in H1 2018. While the company did not report Gross Revenue and excise duty payments, we believe the decline in Net Revenue must have been impacted by higher excise duties payment with the second phase of advalorem excise duty system implemented in June.

On a q/q basis, Net Revenue improved by 4.4% to N86.9 billion in Q2 2019 from N83.2 billion in Q1 2019. On an annualised basis, reported Revenue of N340.4 billion beat our 2019e of N332.0 billion, although we expect seasonality effect for beer business in Q3 to bring down Revenue in line with our estimates.

Cost of Sales adjusted for depreciation, however, climbed marginally by 1.5% y/y to N87.7 billion in H1 2019 from N86.4 billion in H1 2018. Higher Cost of Sales was driven by a 1.1% y/y uptick in raw materials cost. Consequently, Gross Profit declined by 4.3% y/y to N82.5 billion in H1 2019 from N86.2 billion in H1 2018. On a q/q basis, Gross Profit climbed higher by 4.3% to N42.1 billion in Q2 2019 from N40.4 billion in Q1 2019.

Operating Expenses (adjusted for depreciation) climbed higher by 6.1% y/y to N42.3 billion in H1 2019 from N39.8 billion in H1 2018. The rise in Operating Expenses came as a result of a 10.9% y/y rise in Marketing & Distribution (adjusted for depreciation) Expenses to N32.9 billion in H1 2019. We believe the increase in Marketing & Distribution costs was largely due to NB’s drive to reclaim lost market share. Meanwhile, Administrative Expenses (adjusted for depreciation) recorded a double-digit decline of 14.8% y/y to N6.3 billion in H1 2019 from N7.4 billion in H1 2018 due to a reduction in staff headcount following the right-sizing exercise done last year.

Against the backdrop of higher Operating Expenses and a declining Gross Profit, EBITDA dipped by 13.3% y/y to N40.2 billion in H1 2019 from N46.4 billion in H1 2018. Operating Expenses were significantly higher in Q2 (up 28.2% q/q), thus, EBITDA for Q2 2019 slumped 16.0% q/q to N18.4 billion from N21.9 billion in Q1 2019. EBITDA margin slipped lower by 3.2ppts y/y to 23.6% in H1 2019 from 26.9% in H1 2018. The spike in Q2 2019 Operating Expenses significantly impacted EBITDA margin in Q2 2019 which declined by 5.1ppts to 21.1%. A 6.4% rise in Depreciation & Amortisation Charge accelerated the decline in Operating Profit, falling 22.9% y/y to N24.0 billion for H1 2019 from N31.2 billion in H1 2018.

Net Finance Cost increased 24.2% y/y to N5.1 billion in H1 2019 from N4.1 billion in H1 2018 on the back of lower Interest Income (down 9.6% y/y to N198.5m) and higher Interest Expense (up 22.5% y/y to N5.3bn). NB’s higher Interest Expense was driven by higher Interest-Bearing Liabilities (up 57.5% y/y to N43.8bn) due to the recent Commercial Paper issuances done by the company to finance working capital. While Tax Expense declined 33.2% y/y N6.1 billion, Net income slumped 27.8% y/y to N13.3 billion in H1 2019 from N18.4 billion in H1 2018. EPS stood at N1.67/s in H1 2019 as against N2.31/s in H1 2018. On an annualised basis, EPS is on track to beat our estimate (Annualised actual – N3.34 vs CSL Estimate – N2.60), however, we note that seasonal factors which would see Q3 record weaker Earnings would align EPS with our 2019 estimate.

We have a target price of N87.90 for Nigerian breweries with a HOLD recommendation on the stock.

About CSL Stockbrokers Limited: CSLS is regulated by the Securities and Exchange Commission, Nigeria. It is a member of the Nigerian Stock Exchange.

As regards their stance in the stock market, how soon will they bounce back?!