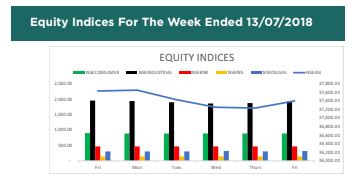

The performance of the Nigerian Equity Market remained bearish last week with the index (NSE ASI) down by 0.62% WTD to close at an index level of 37,392.77 and market capitalisation of N13.55 trillion.

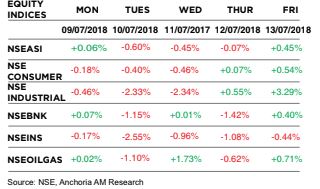

The sectoral performance was negative as bearish sentiments were witnessed in all sectors with the exception of Oil & Gas index that rose by 0.71%. The Insurance sector recorded the highest decline amongst NSE indices with the NSE Insurance index down by 5.10% WTD, owing to significant price depreciation in MBENEFIT (-24.44%) and SOVRENINS (-14.81%).

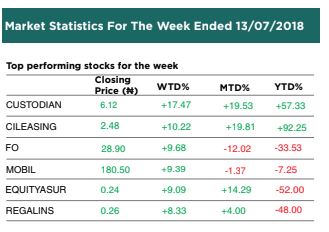

The market activities were characterised by profit taking on 3 out of 5 trading sessions last week as foreign investors continued to dump Nigerian equities. According to Foreign Portfolio Investment (FPI) report released by the NSE, foreign investors’ outflow from the equities market increased by 124.7% to N131 billion in May as against N58.25 billion recorded in April.

In the global space, equities market witnessed a changed sentiment last week as investors ignored the trade war between US and China to close all the selected indices in the green last week with the US Dow Jones up by 2.30% to close at 25,019.41 while China CSI 300 was up by 3.79% to close at 3,492.69.

Stock Watch

Over the last five trading sessions:

ZENITHBNK (Zenith Bank) fell by 1.23% to close atN24.00.

Recommendation: We maintain a buy rating on this stock.

UBA (United Bank of Africa) fell by 3.38% to close atN10.00.

Recommendation: We maintain a buy rating on this stock.

ACCESS (Access Bank) fell by 1.92% to close at N10.20.

Recommendation: We maintain a buy rating on this stock.

Contact Anchoria Asset Management Limited for more information

Email: research@anchoriaam.com

www.anchoriaam.com