Total 2013 9 Months Results ↓

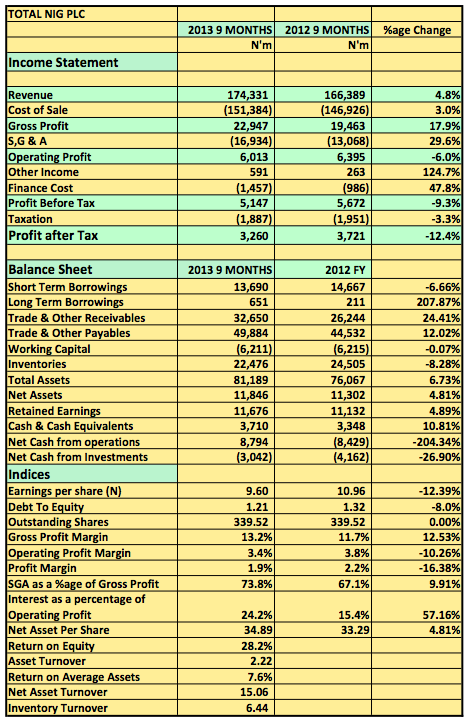

Total Nigeria Plc released its 2013 unaudited results showing a YoY 4.8% rise in revenue to N174billion (2012 9 Months: N166billion). Gross profit also rose 18% to N23billion pushing gross margins slightly higher by 12.5%. However, rising operating expenses pushed operating profit down by 6% to N6billion (2012 9months: N6.4billion).[upme_private]

2013 Q1-Q3

Key Highlights

- Total is still a dominant player in the downstream sector, however, it is increasingly facing competition from the likes of Oando, FO, MRS and Conoil who have all increased their presence by expanding gas station and introducing new products.

- Though revenue was higher YoY, it struggled to hit the N61billion mark set in the first quarter this year in the following two quarters. Its 5% growth rate is also not enough to cover the nearly 30% rise in opex

- If not for the strong Q1 Growth posted this year (20% YoY) the result may have been a little worse as growth dropped off in subsequent quarters.

- Operating expenses on the other hand remained on the increase averaging N5.6billion a quarter this year compared to N4.3billion last year. The third quarter (July-Sept) recorded the highest increase of 16% over Q2 at N6.1billion. It was also 84% of Gross Profit. The results did not reveal the reason for this rise.

- Total also had a weak liquidity position at the end of the period with working capital negative at N6.2billion. This may affect its ability to meet its short-term indebtedness. In fact it owes its trade and other creditors about N17billion more than its Trade and other debtors owe it.

- Its N3.7billion in cash is good but doesn’t cover its average open of N5.6billion a quarter. Total owes N14.2billion in both short and long term debt

- Interest of N597million suggest an average debt cost of under 5% but I suspect the rest of the interest may have been capitalised somewhere

- Total Plc is a a strong player in the downstream sector and has the resources and experience to face the competition. A lot of this will depend on a two pronged approach of increasing revenue and/or reducing cost. It may already be already be doing this ( having spent over N7billion on investments in the last 18months), however, this year’s result indicate a lot still needs to be done

- Total closed the week at N160 and has risen 37.35% YTD. It has a P.E ratio of 11.6x and a PB ratio of 4.8x. I doubt the share price will suffer much on account of this result. Total shares are scare and only about 71million is traded on a 30day average (thats about 2,130 a day). They proposed a dividend of N2 per share a yield of 1.25%. This will cost the company about just N680million.

Total Plc released its 2013 9 Months results in the website of the NSE[/upme_private]