In the feverish luxury property market of Lagos, few developers have matched the consistency of Foreshore Waters Limited in delivering eye-popping capital gains for investors.

A subsidiary of the Lekki Gardens group, Foreshore Waters has quietly built a reputation for launching projects at what now look like laughably low entry prices in Ikoyi, and Banana Island and Ikeja, GRA, only for values to explode 400–700% within 3–5 years.

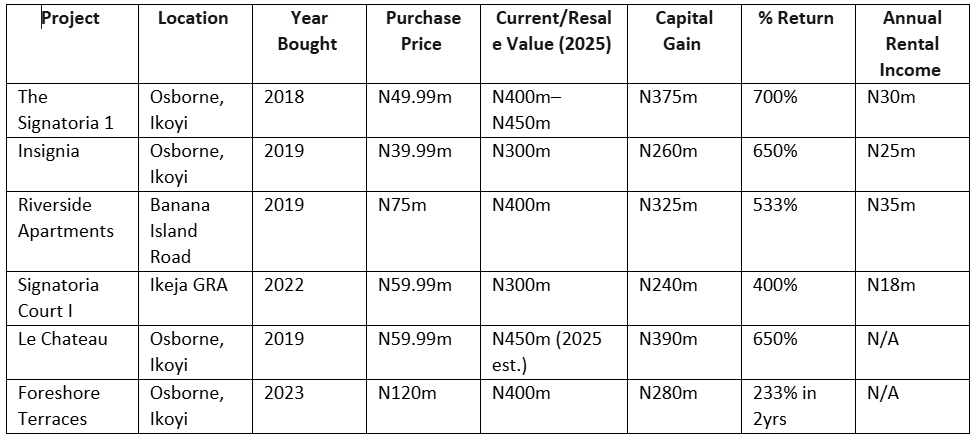

Data obtained by Nairametrics from verified sales and resale transactions show that buyers who entered some of the company’s flagship schemes between 2018 and 2023 have already booked gains ranging from N250m to over N650m per unit, with annual rental yields in prime projects now hovering between N18m and N35m.

Foreshore Waters investor outcomes

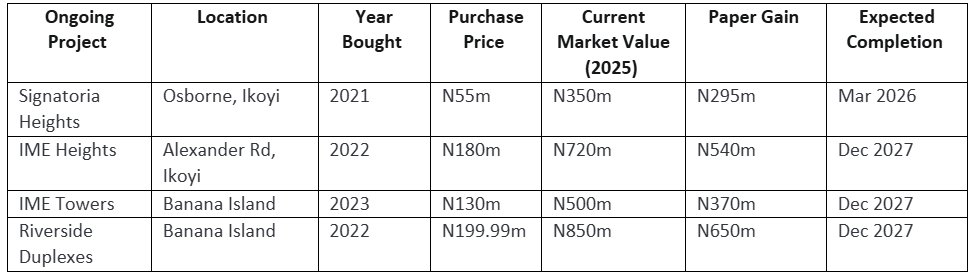

Even ongoing projects are already deep in profit territory for off-plan buyers:

These are not isolated cases. Multiple property agents on the Island confirmed to Nairametrics that virtually every completed Foreshore Waters unit in Osborne and Banana Island that has changed hands in the last 18 months has transacted at or above the figures above.

Why the gains are so high

Scarcity

Banana Island and Osborne Foreshore remain the most land-constrained luxury enclaves in Lagos. Virtually no new developable plots are coming to market.

First-mover pricing

Foreshore Waters has consistently launched at 40–60% below the eventual stabilised pricing of comparable buildings, effectively subsidising early buyers, thereby blowing up their profit margins.

Quality & positioning

Foreshore Waters projects are widely regarded as best-in-class in finishing and design, commanding premium rents and resale values.

Dollar-linked demand

Most high-net-worth buyers in these areas price in dollars, and with naira depreciation running at 25–40% annually in recent years, nominal naira gains have been turbo-charged.

A senior Ikoyi estate agent who has closed over 15 resale transactions in Foreshore Waters projects told Nairametrics on condition of anonymity:

“Once a Foreshore building is delivered, the price almost immediately jumps to the prevailing market rate for that exact location and specification. The early buyers basically get the property at pre-construction pricing while taking zero completion risk because they have always delivered.”

Even investors who choose to hold rather than sell are smiling. In Ikoyi, current gross rental yields on Foreshore Waters’ delivered projects range between 6–8% per annum (N18m–N35m on N300m–N450m assets), which is exceptionally high for prime Ikoyi, where yields on comparable older buildings have compressed to around 4–5%.

With new projects still being launched at what appear to be “old money” pricing relative to today’s market reality (N180m–N200m for soon-to-be N700m–N850m assets), the question for prospective buyers is simple: how many more cycles of this magnitude are left before the market finally prices in the full scarcity value upfront?

With new projects still being launched at what appear to be “old money” pricing relative to today’s market reality (N180m–N200m for soon-to-be N700m–N850m assets), the question for prospective buyers is simple: how many more cycles of this magnitude are left before the market finally prices in the full scarcity value upfront?

For now, the data is clear. If you bought Foreshore Waters in Ikoyi or Banana Island in the last five years, you are very likely sitting on one of the best-performing private investments in Nigeria today.

This pattern is not unique to Foreshore Waters. Across other companies under the Lekki Gardens banner, including Horizon Estates (with assets in Lekki and Victoria Island), Meridian (Ajah), Villas De Paradis (Abuja), and Villas De Riverie (Port Harcourt).

Nairametrics’ checks show a similar playbook at work: relatively affordable off‑plan entry prices followed by sharp capital appreciation once projects are completed and fully tenanted.