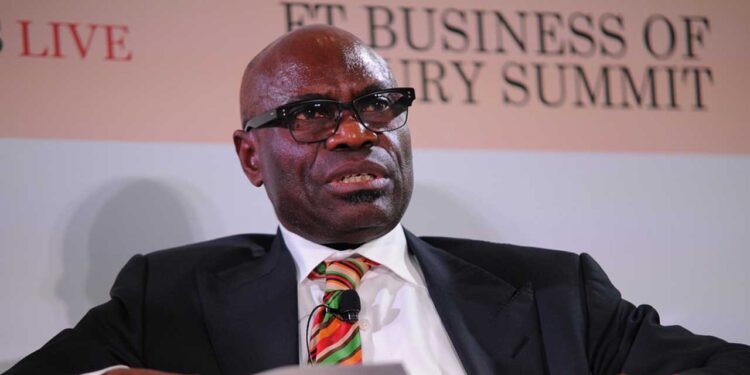

The Managing Director of Polo Luxury, John Obayuwana, has acknowledged the impact of soaring gold and silver prices on the luxury retail sector, describing the trend as a global economic shift that is reshaping product pricing and consumer strategy.

Obayuwana said the surge in precious metal prices has forced luxury brands to rethink how they deliver value to customers.

“You see, we’re in a global market,” Obayuwana said. “And the price of gold, the price of silver—all of these that you have named—it’s a global phenomenon. So it affects everything,” he told Nairametrics.

Gold hits historic highs, outpaces equities

Spot gold recently crossed the $4,000-per-ounce threshold for the first time in history, marking a more than 50% increase in 2025 alone. The rally has delivered returns that now outpace equities this century, with bullion trading below $2,000 just two years ago.

Silver has also surged, reaching $51.235 per ounce, its highest level in over four decades—amid growing investor concerns over inflation, fiscal instability, and waning confidence in traditional financial systems.

The metal has climbed nearly 70% year-to-date, outpacing gold’s performance.

Cushioning the impact without sacrificing value

Obayuwana likened the situation to oil price volatility, noting that such macroeconomic shifts inevitably influence costs across industries.

“It’s like when the price of oil goes up, it affects everything,” he said.

Despite the upward pressure on input costs, he said focus should be on preserving customer satisfaction through strategic value additions rather than direct price hikes.

“We are here, trying to find ways to cushion the impact as much as possible for our customers,” Obayuwana explained. “We don’t say the prices, but we try to find other value-added that we can pass on to our customers to impact some of the harsh effects of these prices.”

Luxury market resilience and Nigerian opportunity

Obayuwana expressed confidence in the resilience of the luxury market, emphasizing that the brand’s core clientele remains committed to quality and exclusivity.

“But don’t forget, though,” he added with a smile, “the rich will always get richer. They are not crying.”

Benjamin Comar, CEO of Piaget, echoed optimism about Nigeria’s potential as a strategic luxury market.

“Nigeria has so much to give. I mean, the oil, as well as the tech, and the Nollywood. It’s a leading country in Africa,” Comar said.

He added that Nigerians are discerning consumers who appreciate premium experiences: “Nigerians enjoy good things. And I think that Piaget is a company for people who enjoy life. So I think there’s a big market for us to be here.”

What you should know

- Recently, Nigeria reaffirmed its commitment to strengthening its foreign reserves through a creative gold acquisition program that eliminates the need for dollar sourcing.

- According to the Minister of Solid Minerals Development, Dele Alake, the Solid Minerals Development Fund (SMDF) is leading this initiative, which began in August.

- The goal is to boost Nigeria’s foreign reserves by utilizing locally extracted yellow metal, thereby reducing pressure on the naira and minimizing the demand for foreign exchange.