Nigeria’s pension fund industry maintained its upward trajectory in June 2025, with total assets under management rising to N24.63 trillion, marking a 2.17% growth from N24.11 trillion in May 2025, and a robust 20.24% year-on-year increase.

This growth reflects sustained investor confidence, strategic asset reallocation, and improved market performance, particularly in domestic equities and government securities.

This analysis is based on data released by the National Pension Commission (PenCom), offering insight into how Nigeria’s pension funds are navigating the investment landscape amid economic shifts.

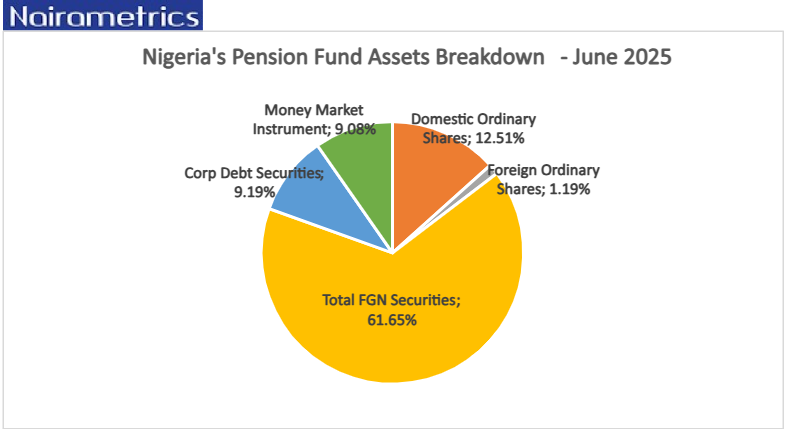

Breakdown of pension fund assets by investment type

Domestic ordinary shares saw a significant boost, rising by N333.05 billion or 12.12% month-on-month to N3.08 trillion, CONTRIBUTING 12.5% to the total asset under management.

This marks one of the strongest monthly performances in equities this year, likely buoyed by bullish sentiments in the Nigerian Exchange (NGX), improved corporate earnings, and increased risk appetite among Pension Fund Administrators (PFAs).

Foreign ordinary shares also edged up slightly by 0.95%, reaching N292.78 billion, indicating cautious optimism in global markets amid persistent macroeconomic uncertainties.

Notably, the Federal Government of Nigeria (FGN) securities maintained their dominance, accounting for over 61% of total pension assets. The asset class grew by N232.96 billion or 1.56%, reaching N15.19 trillion in June.

- FGN Bonds (HTM) rose moderately by 0.91% to N12.79 trillion, contributing a significant 51.9% to the total asset portfolio.

- Treasury Bills increased by 3.24% to N624.15 billion.

- Green Bonds saw a notable surge of 361.15% to N10.71 billion, up from N2.32 billion in the previous month.

- Sukuk Bonds also recorded a modest 3.21% increase to N89.64 billion.

Despite the decline of Agency Bonds by 5.50%, the broad FGN securities category remains the most trusted and liquid investment channel for pension funds.

Corporate debt securities experienced a broad-based decline of 1.26%, dropping to N2.26 trillion. Likewise, all subcategories of the corporate debt securities posted negative returns, with declines of 1.02% in Corporate Bonds (HTM), 1.48% in Corporate Infrastructure Bonds, and Corporate Bonds (AFS) dropping the most by 1.86%.

Regardless of the declines, corporate debt represents 9.19% of pension assets, showing moderate but cautious allocation to the private sector.

The pension industry’s money market investments dipped by 3.16% to N2.24 trillion, as PFAs reallocated funds toward higher-yielding assets.

- Fixed deposits also recorded a decline of 7.10%.

- Commercial Papers increased by 32.98% to N342.65 billion, signaling a shift towards short-term debt securities, while foreign money market instruments plummeted by 24.69%, the sharpest decline in the portfolio.

Alternative assets performance

Mutual Funds dipped slightly by 0.10% to N183.82 billion. Indicating a cautious stance by PFAs in these categories.

- Open/Close-End funds went down by 1.83%, while Supra-national Bonds inched up by 0.09%.

- Real Estate investments declined 6.83% to N255.94 billion, due to asset revaluation.

- Notably, Infrastructure Funds increased 5.62%, indicating renewed appetite for long-term developmental assets, while REITs saw modest increase of 2.23%.

The analysis reveals a sharp rise of 21.35% in cash and other assets to N394.18 billion in June, from N324.84 billion in May 2025.

Performance by fund category

Among RSA funds and legacy schemes:

Fund II, the most popular fund for active contributors, surged by 2.57%, rising from N10.04 trillion to N10.3 trillion. This fund contributed over 41% to the total assets, highlighting strong inflows and solid investment returns.

Fund III (for older contributors) also saw a modest 1.17% rise to N6.4 trillion, contributing 25.98% to the asset portfolio.

Fund I grew by 3.21% to N329.6 billion, while Fund IV increased by 2.14%, reflecting the conservative nature of its portfolio.

Fund V and Fund VI (for micro-pensions) recorded moderate growths of 3.86% and 2.90% respectively.

Existing Schemes and CPFAs contributed by 12.08% and 10.7% to the total asset funds, respectively, reinforcing the growth trajectory across legacy and institutional schemes.

RSA registration trends

The number of Retirement Savings Account (RSA) holders rose marginally from 10.76 million in May to 10.80 million in June 2025, and a 4.01% increase from 10.38 million in June 2025.

This increase signals continued onboarding of workers into the Contributory Pension Scheme despite macroeconomic headwinds.

What this means for you

The June 2025 data underscore the resilience and adaptability of Nigeria’s pension fund industry. With total assets nearing the N25 trillion mark, PFAs are increasingly diversifying portfolios while capitalizing on equity market rallies and stable government securities. However, the decline in corporate and money market instruments signals a cautious stance amid evolving macroeconomic dynamics.

As the second half of the year unfolds, market watchers will be keenly observing how PFAs navigate interest rate trends, inflationary pressures, and regulatory shifts to sustain asset growth and ensure long-term value for contributors.