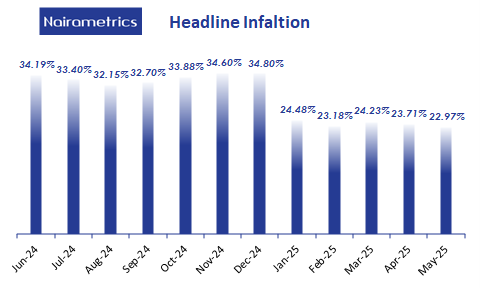

Ahead of the official release of the Consumer Price Index (CPI) by the National Bureau of Statistics (NBS), financial analysts expect Nigeria’s headline inflation to post a marginal decline in June 2025, following a print of 22.97% in May.

Most projections place June inflation between 22.0% and 22.8%, driven by base effects, relative foreign exchange (FX) stability, and seasonal food supply adjustments.

However, the outlook is tempered by sticky food inflation, persistent insecurity, and demand pressures.

What experts are saying

According to the Managing Director of Optimus by Afrinvest, Ebo Ayodeji, June inflation is likely to ease further on the back of a stable naira and relatively contained energy prices.

“We anticipate a further decline in headline inflation in June 2025, largely due to continued FX stability and minimal volatility in energy prices,” he noted. “However, food inflation remains a concern due to heightened insecurity in key food-producing areas like Benue State.”

Managing Director of Rostrum Investment & Securities Ltd, Olaitan Sunday, projects inflation to ease slightly to 22.4%–22.8%, citing a mix of statistical and policy-driven factors.

- Base Effects – With prices already elevated in June 2024, the year-on-year comparison appears milder, even if prices rose month-on-month.

- Rainy Season Adjustments – While ongoing rains are disrupting food logistics and driving localized spikes in perishable items, early harvests in some regions and rising imports are beginning to offer some relief.

- FX Stability – The naira held firm around N1,524/$ during the month, narrowing the spread between official and parallel market rates. This has helped moderate imported inflation, especially on processed goods.

“Although structural challenges like insecurity and high transport costs remain, we believe inflation will decline modestly due to FX gains, seasonal harvests, and reduced consumer spending,” Sunday concluded.

An executive banker, Onche Samuel, shares a more optimistic projection, expecting headline inflation to drop to approximately 22.0% in June. He attributes this to tighter monetary conditions and improvements in core inflation indicators.

“The Central Bank’s sustained tight monetary policy, evident in elevated yields on treasury instruments, and the marginal appreciation of the naira at the NAFEM window helped suppress core inflation, especially in pharmaceuticals and logistics,” Samuel said.

Still, he warns that the decline from May to June may be less pronounced than that seen between April and May, largely because of stubborn food inflation.

However, Idris Adeniyi, Head of Investment at Norrenberger Pension Limited, suggests the possibility of a slight uptick above 23% due to the Eid-el-Kabir (Sallah) festivities, which led to a 35% surge in the prices of livestock and select commodities earlier in the month.

“The NBS typically captures CPI data early in the month, so the brief increase in fuel prices towards the end of June may not be reflected. But the festive-driven spike in food prices likely was,” Adeniyi said.

Factors that could influence June figures

- Logistics Challenges: Ongoing rains and poor road infrastructure limited food distribution, putting upward pressure on prices in some regions.

- Currency Movement: FX stability helped slow imported inflation, especially for non-perishable goods.

- Policy Interventions: The CBN’s tight stance and regulatory oversight on FX may have helped ease core inflation.

- Festive Spending: Sallah celebration in the month of June spurred higher demand and price hikes, particularly in the food and livestock categories.

Outlook for July 2025

While analysts are cautiously optimistic about a mild drop in June 2025 inflation to between 22.0% and 22.8%, the outlook remains mixed. Food inflation, insecurity, and festive demand remain key pressure points, while currency stability, policy measures, and seasonal supply patterns offer room for short-term relief. July’s inflation trajectory will largely depend on how these opposing forces evolve.

If current FX stability holds and early harvests continue, July inflation could remain within similar bounds as June. However, any sharp depreciation of the naira or increase in fuel prices could push inflation back toward or above 23%.

Looking ahead, inflation may come under renewed pressure in July.

- Fuel price increases: if sustained, increased food prices could start showing up in inflation numbers.

- Logistical disruptions: The peak of the rainy season could further strain food supply chains.

- Consumer spending fatigue: Continued monetary tightening may help cap inflation upside.