Nigeria’s external debt service obligations surged to $1.08 billion in Q4 2024, representing a significant rise from the previous quarter.

This is according to the latest data released by the Debt Management Office (DMO).

Nairametrics had earlier reported that Nigeria’s total debt service costs climbed to N3.57 trillion in the third quarter of 2024, up by N60 billion or 1.71% from N3.51 trillion in Q2.

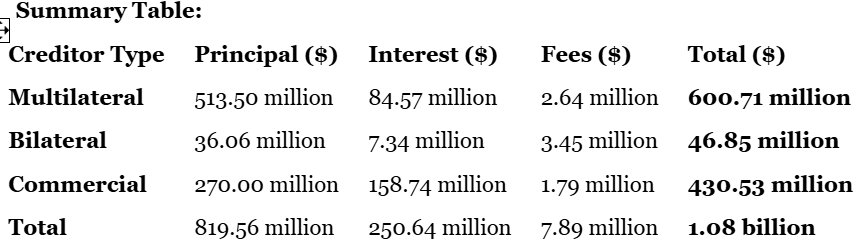

The report, which covers the breakdown of external debt service payments by creditor category, revealed that multilateral loans accounted for the largest share of debt service, followed by commercial and bilateral loans.

Key Highlights (Q4 2024):

- Total External Debt Service:

$1.08 billion

- Multilateral Creditors:

Nigeria paid a total of $600.71 million to multilateral lenders, representing 55.7% of total debt service in the period. - The International Monetary Fund (IMF) led this group, receiving $407.97 million, the highest payment to any creditor.

Other key payments include:

- International Development Association (IDA): $116.48 million

- African Development Bank (AfDB): $43.89 million

- International Bank for Reconstruction and Development (IBRD): $14.48 million

- Islamic Development Bank (IsDB): $5.83 million

- Commercial Creditors:

Commercial loans absorbed $430.53 million, or 39.9% of total external debt service. - The Eurobond debt alone accounted for $148.57 million.

- A further $280.16 million was paid on Syndicated Loans, which made up the bulk of commercial debt repayments.

- Smaller payments were made to UniCredit S.P.A ($1.54 million), Standard Chartered Bank ($144k), and Deutsche Bank AG ($108k).

- Bilateral Creditors:

Debt service to bilateral lenders stood at $46.85 million, or 4.3% of the total. - The majority of these payments were made to France’s Agence Française de Développement (AFD), which received $33.13 million.

- Germany (KfW) followed with $11.84 million, while China Development Bank received $1.88 million.

- Notably, no debt service payments were recorded to Japan, China Exim Bank, or India Exim Bank during the quarter.

Nigeria’s rising external debt service obligations come amid increasing concerns over the country’s debt sustainability, exchange rate volatility, and foreign reserve pressures.

The significant payments to multilateral and commercial lenders—particularly the IMF and Eurobond holders—highlight the weight of non-concessional financing on the country’s external obligations.