17 months, 18 days, 6 lawyers, 4 issuing houses, countless meetings, meticulous checks, and a rock- solid balance sheet was all it took for FMDQ Securities Exchange Limited to issue a vote of strong confidence in the approval of a N20 billion commercial paper (CP) for Sujimoto Holdings.

This approval, supported by Sujimoto’s Triple BBB+ investment rating and strong corporate governance, reinforces the company’s financial stability and reliability.

The funding is designed to fuel a series of ambitious projects, with a significant portion directed towards the iconic LeonardoBySujimoto— Nigeria’s tallest residential building, deemed to stand as a beacon of architectural and economic prosperity for the Nigerian nation.

According to Dr. Sijibomi Ogundele, the Group Managing Director of Sujimoto Holdings, the journey to securing the commercial paper has been a rigorous test of resilience and integrity, with success hinging on the company’s ability to demonstrate not only the viability of its projects but also its commitment to upholding high standards of corporate governance.

Despite Nigeria’s persistent turbulent economic environment, marked by a fluctuating forex market and inflationary pressures, this has not been enough to stop Sujimoto’s vision and gigantic projects. Against all odds, Sujimoto has consistently proven its resilience over the years.

From the successful Medici Residences in Ikoyi to the soon-to-be-completed LucreziaBySujimoto—a breathtaking 15- storey luxurious property in Banana Island—Sujimoto has consistently demonstrated its resilience over the years. Over the past decade, Sujimoto has demonstrated an unwavering consistency in delivering exceptional real estate projects that have become benchmarks in Nigerian and African markets.

The approval of the N20 billion Commercial Paper from the FMDQ Security Exchange is not just an endorsement of Sujimoto’s capacity to access capital but an acknowledgement of the trust the brand has earned. This trust, forged through a rigorous corporate restructuring process and reinforced by a strong balance sheet, positions us as more than just another construction company. Sujimoto has earned the trust and bond of the Nigerian public and global financial institutions alike, and for the first time in history, an indigenous company at that level obtained a foothold in the Nigerian capital market, solidifying its reputation in the construction of vertical cities.

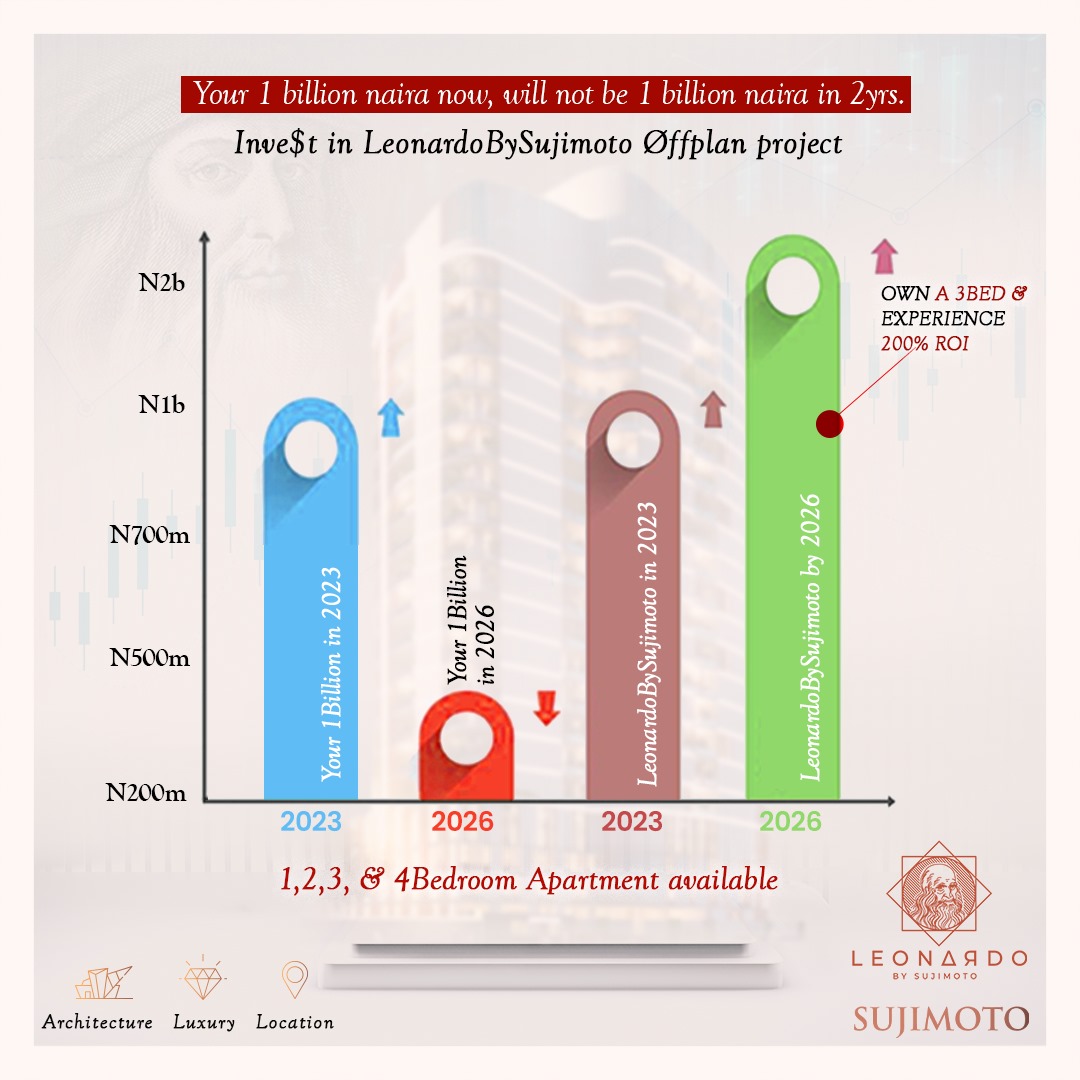

“Selling off-plan properties is one of the assets for young developers who rely on the Other People’s Money (OPM) system to raise capital. However, for us, this approach is one of our biggest detriment. More often than not, we find ourselves selling at prices far below their true value. A prime example is our Giuliano project, which we began selling at N280 million in 2020. In just 4 years, the same units sold for N2.2 billion in December 2024—eight times the original price— yielding an extraordinary 800% return on investment. And units we should have sold for $500k, we can now sell at $1.5 million,” Dr. Ogundele explained.

The funding from this commercial paper will enable us to make substantial upfront investments into our projects, allowing us to hold onto our units until they achieve their full market potential. By doing so, we can then release them at the optimal time to prospective buyers or renters, maximizing revenue from both sales and rental income.

As other developing countries of the world raise capital in real estate, Nigeria is crisscrossed with its own challenges—particularly the approximately ₦21 trillion housing deficit gap. Despite these obstacles, Sujimoto has not only filled the gaps but also created numerous opportunities. The success of our past projects has positioned us to create more jobs for over 800 staff members, and with the Leonardo project alongside other projects in our pipeline, we are positioned to double our workforce to 1,900 people by 2026.

After more than two years of meticulous planning and with the full approval of the Lagos State Government, Sujimoto is set to embark on the groundbreaking LeonardoBySujimoto project— Nigeria’s tallest and most iconic residential skyscraper. With a significant number of units already sold, the project has garnered immense market confidence, underscoring its potential for exceptional returns. We have secured committed off takers who have made substantial advance payments, eagerly awaiting the project’s commencement so they can finalize their balances. To date, we have over N22 billion that our committed off-takers shall pay us, and we have over N200 billion in off-plan assets.

The monumental 36-story LeonardoBySujimoto project stands as a beacon of innovation and luxury, drawing investors with its seamless fusion of futuristic design and world-class amenities. At the heart of this iconic development is Nigeria’s first-ever Krion façade system from renowned Spanish brand Porcelanosa, a bold collaboration with global luxury brands like Fendi to introduce a first-of-its-kind 5-star interactive lobby. Adding to its allure are standout features such as a helipad for swift convenience, a 48-seater IMAX cinema, and two distinguished international restaurants. A state-of-the-art Technogym and six temperature-regulated Olympic-sized swimming pools, a mini- mart, a clinic, hair salons, a crèche, and a cutting-edge home automation system that empowers you to control everything from your door to your music and lights from anywhere in the world, no detail has been overlooked.

The LeonardoBySujimoto offers an unparalleled living experience at a highly competitive price point, distinguishing itself from other high-end developments in Ikoyi and Eko developers. This remarkable waterfront high-rise will not only surpass the Necom Tower in scale but will also redefine the benchmarks of luxury, innovation, and architectural excellence, setting a new standard not only in Nigeria but across the African continent.

Our success in securing this funding and approvals has been accompanied by our upgraded credit rating—from Triple BBB to BBB+ from respected rating agencies DataPro, the referees of the business world. This, alongside our clear balance sheet and impeccable corporate governance, strengthens the trust we have built with our investors and the public.

The N20 billion commercial paper approval from FMDQ is a powerful reflection of this trust, as Sujimoto has demonstrated that it is far more than a construction company. The company’s approach to capital markets and its investment philosophy is grounded in creating real, tangible value. While N20 billion is undeniably a significant sum, the magnitude of our vision is even greater, with our future projects valued at over 2 trillion naira in the pipeline. We fully recognize the immense responsibility entrusted to us, and we are resolute in our promise to utilize these funds judiciously, ensuring they are deployed effectively and efficiently.

Thanks to the collaborative efforts and involvement of top-tier investment banking partners such as Cowry Asset Management Limited, Investment One Financial Services Ltd, Cordros Capital Limited, PAC Capital Ltd, and ICMG Securities Limited. This strategic collaboration reinforces the company’s standing in Nigeria’s capital markets and positions Sujimoto as a leader in the real estate and financial sectors. But most importantly, we are committed to repaying the money as and when due, ensuring that we meet all financial obligations before the expiry date. Our dedication to returning this investment with the highest level of accountability and integrity remains our foremost priority.

Investor’s takeaways:

Sujimoto’s wireframe of a stable investment outlook, strong liquidity metrics, robust enterprise risk management, best corporate governance, project vision, and a strong board of directors ranging from manufacturing to highly skilled marketing professors, as well as engineers with over 30 years of experience in growing unicorns, have all collectively contributed in unison, making a key part of the company’s growth and diversification.

“To understand the future dynamic of any company, you would need to measure its past glory, present achievements, and the expected trajectory of its future projects. Despite the constraints in the macroeconomic environment, Sujimoto Holdings continues to thrive. Today, we are fulfilling our ultimate intention of being a part of the Nigerian capital market and giving Nigerians the opportunity to be a part of this transformative growth.” Dr. Sijibomi Ogundele

Built on a firm reputation of successfully scaled projects, based on solid brand identity and a philosophy of keeping stakeholders and customers at heart, Sujimoto has, for the last decade, demonstrated a forceful balance sheet and investor-grade opportunity for customers looking for projects with strong intrinsic value, cash cow projects that have seen over 200% ROI for current investors as well as stakeholders.

“Sujimoto owns the market. In fact, Sujimoto is the market! When you acquire any of our projects, you’re buying into the highest value money can buy.” This statement reflects Sujimoto’s dedication to delivering projects that not only meet but exceed investor expectations, consistently yielding returns of over 200% for early investors. Dr. Ogundele asserted.

While real estate remains at the core of Sujimoto’s operations, the company has also made bold strides into hospitality. With the success of Sujimoto Residences, a collection of high-end short-let apartments, and the unveiling of Euphoria Pool and Restaurant, along with the exclusive Silencio Nightclub strictly reserved as a meeting ground for the dignifying few, Sujimoto is diversifying its portfolio to cater to the luxury lifestyle market. These ventures further underscore the company’s commitment to creating holistic, luxurious living experiences for its discerning clientele—the true 1% of the 1%.

Sujimoto’s ambitious projects include the Sujimoto Twin Tower (STT), Africa’s tallest twin tower, a 44-storey megaproject that uniquely combines residences, hospitality, and retail in one audacious structure. The Queen Amina mixed-use development in Abuja offers luxury apartments, Maisonettes, and penthouses with world-class facilities that set a new benchmark in the luxury real estate market. AdebukolabySujimoto expands the horizon for investors seeking townhouses in Ikoyi, one of Nigeria’s most prestigious neighborhoods.

Additionally, Sujimoto Cement highlights the company’s expanding reach with superior cement strength, durability, and performance, while Motopay, its cutting-edge digital payment platform, offers seamless and secure transaction solutions, further venturing into fintech. Sujimoto Farm Estate represents another ambitious leap—an agro-tourism and food security project with plans to scale from 30,000 hectares to 2 million hectares before 2030. This initiative among several others are part of our broader commitment as a group to sustainable development and aim to significantly contribute to food security, agricultural innovation, and job creation across Nigeria.

Dr. Sijibomi Ogundele is the Group Managing Director of Sujimoto Holdings, the Czar of Luxury Real Estate Development, and the mastermind developer behind the renowned Giuliano. Our other audacious projects, such as the most sophisticated building in Banana Island, LucreziaBySujimoto; the grandiose Sujimoto Twin Tower, the tallest twin towers in Africa; the regal Queen Amina by Sujimoto, a monument to royal affluence; the magnificent LeonardoBySujimoto high-rise, Nigeria’s tallest residential building; the Sujimoto Farm, an advanced farm estate system that incorporates housing, farm hospitals, hotels, and markets within an ecosystem, creating opportunities for agro- tourism and affordable housing; among other projects that have etched an indelible imprint on Nigeria’s skylines, are a testament to Sujimoto’s unrivalled mastery of modern-day engineering.