The Nigeria Inter-Bank Settlement System (NIBSS) has unveiled significant upgrades to its Nigeria Quick Response (NQR) payment system, designed to streamline and enhance digital transactions for businesses and individuals across Nigeria.

Premier Oiwoh, MD/CEO of NIBSS, emphasized the evolving capabilities of NQR and how it is poised to revolutionize payments, transactions are processed instantly, ensuring immediate settlement.

“This account is the only QR in the world that is instant for the beneficiary,” he said.

He noted that the system is also far more robust, offering smoother and more secure transactions. It now supports both Person-to-Person (P2P) and Entity-to-Person (E2P) payments, significantly expanding its use cases.

“Beyond the P2P, there is also E2P on the MQR, and most of the bank apps have it today.

My dream is to have hawkers on the streets being able to present their QR in the form of an ID card and then make payment. Cash cannot be everywhere, what we are all looking for is payment” he said.

“You can also send your personal QR code to anybody to pay you rather than send an account number,” he said

Oiwoh announced that a new pricing structure for NQR payment will take effect on March 1, 2025

What is NQR?

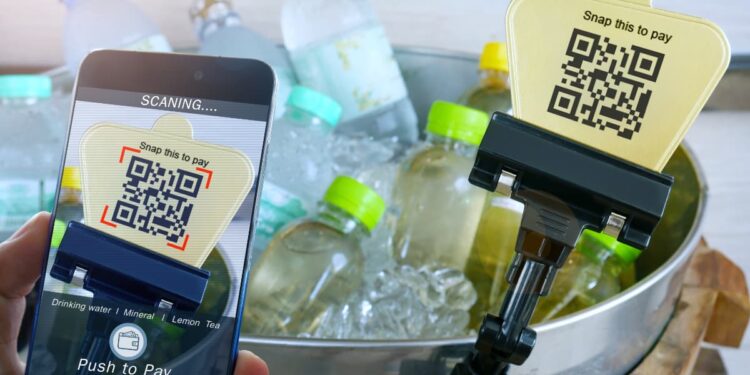

The NQR payment system is part of Nigeria’s broader push to promote cashless transactions across the country. Launched in March 2021, in collaboration with the Nigerian financial industry, the system allows customers to make payments by scanning a QR code, which redirects them to their bank or mobile wallet to complete the payment.

The use of QR codes is expected to significantly reduce the reliance on cash, thereby contributing to the financial inclusion agenda of the Central Bank of Nigeria (CBN).

Key improvements

The architectural upgrade addresses several issues that previously affected the efficiency of the NQR system.

- Ensure instant reversals – Transaction failures will now trigger immediate reversals without delays. Previously, reversals could take minutes or require follow-ups with banks.

- Enhance reconciliation – A new system ensuring a single session ID from transaction initiation to completion will eliminate discrepancies in payment references and simplify reconciliation.

- Improve transaction speed – By reducing the number of calls between banks and NIP (NIBSS Instant Payment), transactions will be processed faster, lowering latency.

- Strengthen security – The upgraded system includes a secure gateway with enhanced authentication and authorization measures to prevent fraud.

- Simplify fee processing – The new framework integrates fee queries into the prepayment process, eliminating the need for separate fee assessments, and thereby improving merchant experience.

Lagos State embraces NQR payments

The NIBSS boss highlighted the increasing adoption of the Nigeria Quick Response(NQR) payment system, particularly within the public sector.

He revealed that the Lagos State Government has successfully generated over 750,000 QR codes to facilitate payments for essential services such as water bills and land duties.

With this system, users can conveniently scan the QR code from the comfort of their homes and complete transactions without visiting a bank or logging into a mobile app.

“You will receive your bill—whether for water or land duty—and simply scan to pay from the comfort of your house.

Just yesterday, a Lagos State Commissioner reached out, requesting the same solution. The demand is growing because it’s all about convenience,” Oiwoh said.

Oiwoh also spoke about how churches and religious institutions could benefit from NQR, stating that digital donations offer transparency and ease of payment. He humorously pointed out that digital transactions encourage higher donations.

“If you go to some churches today, you scan and make payments. When people are making offerings, it is easy for you to dip your hand in your pocket and bring out N20.

One thing I have noticed is that when people scan the QR code in the church, on rare cases its nothing less than N5,000,” he said

What this means for users

These upgrades will make digital payments faster, more secure, and more convenient for both merchants and customers. Transactions will be processed seamlessly, with instant reversals in case of failed payments.

- Customers can now enjoy a smoother checkout experience, whether shopping in stores, paying bills, or using transport services. The introduction of dynamic QR codes ensures secure, error-free payments by generating unique transaction identifiers for each purchase.

- For merchants, real-time payment notifications and improved reconciliation tools will reduce delays and disputes, making it easier to track and manage sales. Additionally, features like “payment playlists” allow businesses to offer personalized promotions, enhancing customer engagement.

With all banks operating within the same framework, users can expect a more consistent and reliable digital payment experience across different platforms.