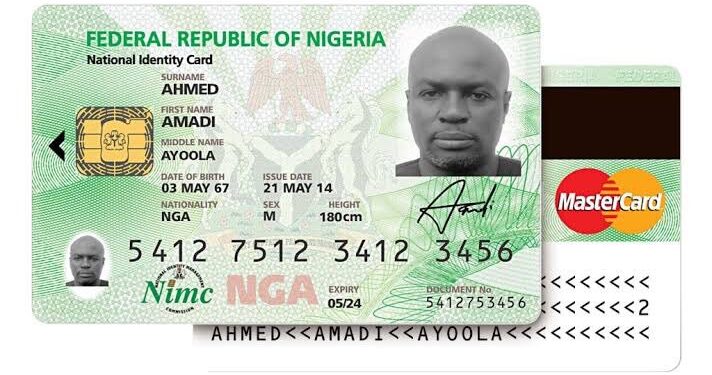

The National Orientation Agency of Nigeria has outlined important details about the country’s new General Multipurpose National Identity Card (GMPC), which is set to replace multiple existing cards.

The new card is designed to serve a variety of functions, from financial transactions to government services, and aims to simplify the identification process for Nigerian citizens.

The update was shared through the National Orientation Agency’s official social media page on X yesterday, detailing the features and benefits of the GMPC.

According to the agency, the card will simplify several identification needs for citizens and provide easier access to essential services.

Single card for multiple functions

The GMPC will serve multiple purposes, combining several existing cards into one. This new card will eliminate the need for citizens to carry multiple forms of identification, making it more convenient for everyday use. Among its various functions, the GMPC will cover payment services, government interventions, and travel-related services.

Collaboration with key financial institutions

The National Identity Management Commission (NIMC) has partnered with the Central Bank of Nigeria (CBN) and the Nigeria Inter-bank Settlement System (NIBSS) to ensure the card’s ability to perform financial transactions. These collaborations are set to ensure that the GMPC will be fully integrated with Nigeria’s financial systems, allowing for smoother payments and other related services.

Powered by Indigenous scheme

The GMPC will be powered by the AFRIGO card scheme, a domestic payment system supported by NIBSS. This initiative aims to enhance the use of locally developed financial infrastructure further and reduce reliance on foreign payment systems. The collaboration is seen as a step toward strengthening Nigeria’s financial independence.

How to apply for the GMPC

Citizens interested in obtaining the GMPC will need to request it through the self-service online portal, NIMC offices, or their respective banks.

Applicants will be required to provide their National Identification Number (NIN) as part of the process.

Once an application is submitted, the card will be issued by the applicant’s bank, following the same protocols used for debit and credit card issuance.

Card delivery options

Once the GMPC has been issued, cardholders can either pick it up at a designated center or request home delivery. If home delivery is chosen, applicants will be required to pay an additional fee to cover the delivery cost.

With these guidelines, the National Orientation Agency’s announcement of the new GMPC seeks to provide citizens with a more efficient and versatile means of identification while improving access to financial and government services.